Aviva Investors’ Sunita Kara makes the contrarian case for high yield currently.

Aviva Investors’ Sunita Kara makes the contrarian case for high yield currently.

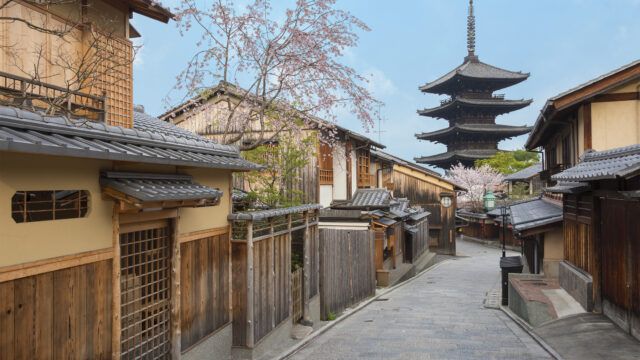

Schroders sees the region’s growth outlook and other tailwinds as key drivers for Asian credit as an attractive asset class.

Different economic growth cycles across geographies globally call for fixed income investors to be selective to find alpha.

Sheldon Chan also details the reasons for the fund’s outperformance so far this year.

High yield managers are looking instead at Macau gaming, Indian renewable energy and Indonesian corporate credits.

The Singapore-based digital wealth platform has onboarded funds from AllianceBernstein, HSBC and Franklin Templeton.

With spreads falling despite the recession risk, do they adequately compensate investors?

Arnaud Brillois, managing director at Lazard Asset Management, discusses why the dislocation in the convertible bond market has lasted so long.

Cardano’s Corne van Zeijl and David Goldberg discuss the global impact of rising inflation in Japan.

There has been a quick shift in investor preference towards safety after a strong run up in global equity markets at the beginning of the year.

Part of the Mark Allen Group.