Sipping a very fine glass of Bordeaux last night, your trusty Spy mused on the fact the world has gone rather bonkers of late. The IMF now wants us all to believe that open-ended funds pose a global, even systemic, risk and is telling anyone who should listen that asset managers need to be reined in. Academic economists sitting in ivory towers with their models and spreadsheets have seldom known what is going on in the real world right now, let alone been able to model future events accurately. Quite rightly, in Spy’s humble opinion, asset management trade bodies have hit back at the “hypothetical and erroneous assumptions” of the IMF. The world faces a great number of systemic risks; mutual funds are not one of them.

Simplify has launched a Bitcoin ETF with a twist. It also offers to give investors some income with your crypto, too. Because that is what you have always wanted! The Simplify Bitcoin Strategy PLUS Income ETF “seeks capital gains and income by providing investors with exposure to bitcoin while simultaneously generating income by selling short-dated put or call spreads on the most liquid global equity indices”. Phew. Spy could not help but imagine he was in a McDonald’s restaurant and heard the server ask, “Would you like to Supersize that?” On this occasion, Simplify may not live up to its name.

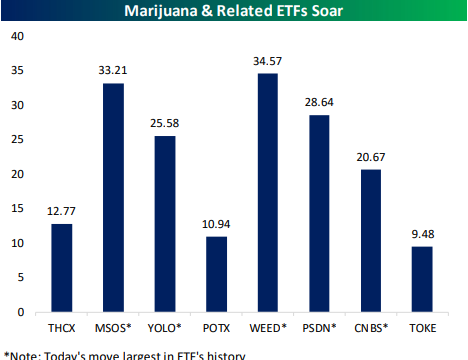

Hey, dude, is the state of the world so bad that people think the only way to get through it, is to smoke some weed? Spy spotted that marijuana ETFs had massive inflows yesterday. $200m suddenly poured into them, in not a very chilled out manner. Upon closer inspection, it may have been something to do with the fact that President Biden promised to review marijuana’s status in the US, making the drug even more widely accessible.

There has been a lot of crazy speculation around Credit Suisse of late. For anyone expecting a Lehman Brothers moment, Spy has cold glass of water and a sit down for you. When Lehmans went down, it was an investment bank with no retail banking operation and the entire world was on fire. With Credit Suisse, it has a sizeable retail business. Governments, especially the Swiss government, are never, under any circumstances, going to let a bank like Credit Suisse fail. Spy will put his modest reputation on the line with this. Credit Suisse will be here long after the name Lehman Brothers has been forgotten.

Here is a new term for you: moralwashing. By now we are all aware of greenwashing and the numerous spurious attempts to turn funds, that are anything but leafy, into a positive forest of green with a tiny lick of paint. Now the same is being applied to firms that have made public claims over exits from countries with tricky moral reputations, such as warmongering Russia, but have in fact, only temporarily exited. In reality, they have kept all their infrastructure mothballed in place and are just waiting for the war to end.

So, Elon Musk has to pay up for Twitter after all. $44bn is a lot of money, even to the world’s richest man. With Musk having debuted his shiny new Optimus robot last week, Spy can’t help but wonder if Musk will be replacing Twitter’s numerous bots, with his far shinier humanoid versions…

There is a fairly popular meme idea, that well-known TV presenter Jim Cramer’s buy and sell predictions should be acted upon. But not in the direction he wants you to. If he says buy, sell and vice versa. Tuttle Capital Management has filed to launch two exchange-traded funds that trade on the stock tips of CNBC’s lively and shouty stock personality: one that goes long and one that goes short. The mooted tickers are LJIM and SJIM. Truly we have entered the age of the trading casino.

Who wants a big number? US national debt has reached $31trn for the first time, an increase of $8trn (35%) over the last three years alone. The US will be paying $1trn per year in interest and that is larger than the amount it spends on social security. Ouch.

There are hundreds of ways we are feeling inflation. Sadly, yesterday, the maker of Cadbury’s chocolate did nothing to assuage Spy’s fears over outrageous price increases for his favourite Fruit and Nut bar. “Our input costs for next year are going to be up as much as they are up this year, which means…there will be more price increases coming in food in my opinion,” says Mondelez International CEO, Dirk van de Put. Tragic.

Pub Quiz: In how many years have both the S&P 500 and 10-Year Treasury Bond been down more than 10%? One, only one: the year 2022. You’re welcome.

Spy’s quote of the week touched a nerve inside. “One of the strongest forces in the world is the urge to keep doing things as you’ve always done them, because people don’t like to be told they’ve been doing things wrong.” ~ Morgan Housel. Nailed it.

Spy’s trusty photographers have been out in Singapore spotting new outdoor campaigns.

First up, First Sentier is pushing its listed infrastructure fund. Pie-shaped cities have a certain appeal to Spy’s whimsical side. Hat tip to their advertising agents.

Allianz Global Investors wants its investors to stay the course and is offering a smorgasbord of strategies to do so.

Until next week…