And so we enter the final quarter of 2021 and head towards the end of the year, Christmas and the whole shooting match. Most investors are probably happy to put September behind them – especially as markets worldwide took a little swoon last month. Will the “buy-anything, buy-the-dip, buy-the-meme” crowd reappear to keep the juggernaut on the road? Spy has been notoriously bad at market predictions, but finally, the excess chickens could be coming home to roost: inflation, rising interest rates, tapering, supply chain woes, tottering property empires, ugly geopolitics and much more, make the beginning of what is usually a good quarter for markets, feel most uncertain. With apologies to Winston Churchill, Spy “has nothing to offer you but volatility, nervousness, risk and worry.”

The foreign asset managers are coming! Well, perhaps not quite with the exclamation mark, but China opened the door a little wider this week, reckons Spy. Neuberger Berman (NB) has become the latest American manager to be granted an operating license in Shanghai by the China Securities Regulatory Commission. The company is starting with a modest capitalisation of RMB150m ($23m), but considering the range of activities approved – publicly offered securities, investment fund management, fund sales and privately offered fund management – the investment will surely grow. The Wall Street firm now has six months to launch its first fund in China. NB, with $433bn in AUM, joins Blackrock and Fidelity in this rarefied group.

Bonds may not exactly be flavour of the month with inflation raging across the world, but that did not stop T Rowe Price rolling out three new bond ETFs last week, which was the first time it has offered fixed income in the format. The giant’s Total Return (TOTR), Ultra Short-Term Bond (TBUX) and QM U.S. Bond (TAGG) are all active strategies that started trading this week on NYSE’s Arca. The funds all have tiny fees with the total return strategy only charging 31 basis points. This brings T Rowe’s range of ETFs up to eight.

Franklin Templeton (FT) is on the acquisition trail again. The firm that merged with Legg Mason two years ago to create a $1.5trn manager, has just snapped up O’Shaugnessy Asset Management. O’ Shaughnessy’s appeal seems to be its custom indexing business, named Canvas, rather than its rather puny (by FT’s standards) $6.4bn in assets, imagines Spy. Canvas has $1.6bn in assets and, no doubt, under Franklin’s huge global reach could grow immensely. The deal, on which Franklin Templeton was coy on the price paid, is expected to close by the end of December.

Is DBS trying to tell us all something rather subtly? As markets have taken a swoon of late and volatility has jumped up again, DBS seems to think there is no such thing as “low risk” anymore. Well, that is the impression the bank gave Spy, anyway. Reviewing the firm’s fund selection available for retail investors, making a selection of “low risk” tells the investor: “There are no results that match your search”, no matter how widely one sets the rest of the criteria.

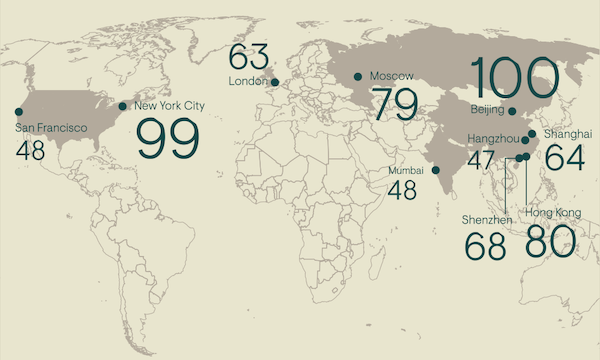

Did you grab a cup of coffee to read Spy? Perhaps grab another one and settle down with this excellent piece on China trade history by Ninety One’s global strategist, Michael Power. Much nonsense gets written about China, but this long read about China’s history of trade is a complete cracker. Among the many interesting snippets, is the fact that more than one in two of the world’s billionaires in the world’s top 10 cities are now ethnically Chinese. Power writes, “An old Chinese proverb states: ‘If you want to get rich, build roads first’ – Spy might add, if you want to understand China today, best have a good read about its past, too. Ninety One gives a nice primer.

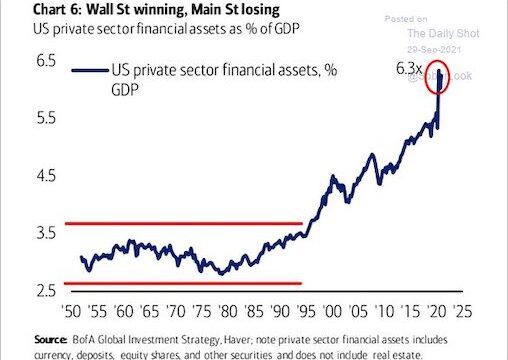

Is financialization of the world a good or a bad thing? Spy could debate all seven sides of that argument until the next time we have Year of the Goat. That we are living in an era of extraordinary private assets, is not in doubt. Between 1950 and 2000, US private sector financial assets as a percentage of GDP fluctuated between 2.5% and 3.5%. In the last 22 years, it has rocketed to 6.3%. It is an exaggeration to say the US does not make anything any longer except money, but if the trend stays this way, that may become more of a reality. Either way, Spy doubts this is good for equality, politics or humanity.

Just on cue, as the US debates its artificial debt ceiling (and kicks the can down the road to December) and central banks keep the money printers whirring, Jupiter Asset Management points out an ugly home truth. Spy loves this image for its utter simplicity. Gold has not had the best of runs of late, but as stagflation appears, perhaps a little nibble is worth it?

Spy’s quote of the week is one that has been said in many ways before, but this time is eloquently expressed by Schwab’s chief investment strategist, Liz Ann Sonders. “The sucker has always tried to get something for nothing…People who look for easy money invariably pay for the privilege of proving conclusively that it cannot be found on this sordid earth.” Nailed it.

Spy’s eagle-eyed photographers have spotted a few new adverts kicking around Singapore. First Sentier is thinking about Asia, its myriad people and its 2,300 languages; so much so, they put it on a billboard.

Until next week…