Spy had a rather amusing lunch with a venture capital investor this week. It was all sparkling water and no Chablis (sadly) – very California. He was full of the joys as his portfolio had performed rather well of late – on paper anyway – but he said with a genuine smile, “We are expecting a bloodbath.” This alarming news, said ever so casually, as the Dim Sum disappeared, was nothing to do with equity or debt markets, but in the AI space. “Large language model businesses – LLMs – are heading for an almighty fall. One competitor of ours has just given a $1bn valuation to an LLM business with less than $1m in revenues. This will not end well. Mark my words.” Duly noted, thought Spy.

It is a rather tragic indictment of our times, reckons Spy. If you believe that defence spending is going to ramp up and the world is on the verge of yet more regional wars, Themes ETFs have a solution for you. The thematic-focused manager has just launched the Themes Transatlantic Defence ETF with the irresistible ticker, NATO. This is a passive play which tracks the Solactive Transatlantic Aerospace and Defence Index – i.e. companies based in countries that are signatories to the North Atlantic Treaty Organisation. More than 70% of the constituent companies are in the US, with the UK and France bringing the total above 90%. Sadly, this seems like a decent idea to Spy. The fund trades on the Nasdaq.

Just before the great financial crisis, Spy was dining in one of those restaurants that fall over themselves to be just a touch too fancy. He was offered a “water list”, as if water was the new wine. Biblical allusions aside, water is back in vogue – and not for good reasons. In a fascinating report worth reading in full out by BNY Mellon Investment Management, the manager highlights the alarming fact that, “By 2050, water use in agriculture is expected to increase by 19% from 2021 levels, with 40% of irrigated agriculture facing extreme water stress.” And it is not just agri where water faces problems, “The technology sector relies heavily on water in its manufacturing process. For example, the production of semi-conductor chips requires billions of litres of ultra-pure water to avoid contamination. Water is also a vital cooling component of many data centres which have an ever-increasing demand profile, not least with the emergence of artificial intelligence related demands. This leaves the tech sector highly vulnerable to localised water shortages in terms of production and operational impacts.” Water might just be the new gold, reckons Spy.

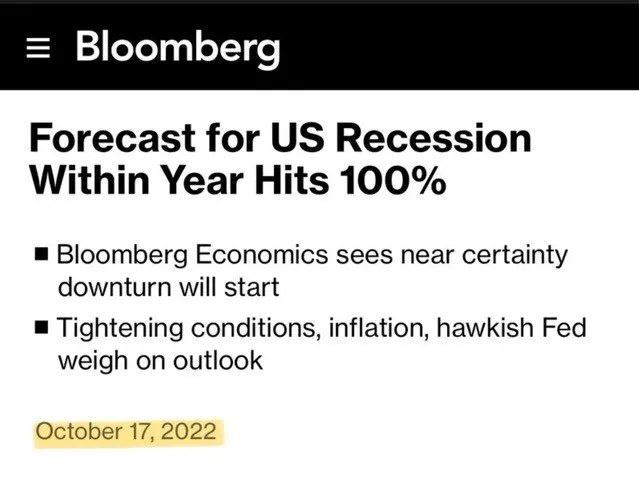

Experts, eh, who needs ‘em? Spy was rather amused to be reminded this week that Bloomberg’s esteemed bunch of economists, in October 2022, forecast a 100% chance of recession. Of course, it never materialised and Spy is reminded that ‘economists make tarot readers look good.’

Hat tip to Pictet Asset Management for summing up the state of play in the US jamboree that is their presidential election between Donald Trump and Kamala Harris. The Swiss manager suggests, “Irrespective of who wins the presidential race between Kamala Harris and Donald Trump, we see the US economy remaining on its path to a soft landing.” And, regardless how one feels about their individual qualities, personal merits and public policies, Pictet is even more reassuring: “Analysing US election cycles since 1972, there’s no evidence to suggest equity markets do better under the presidency of one party or the other.” Perhaps they should save the American people a ton of angst, money and time and just flip a coin, reckons Spy.

With gold hitting all-time highs (again) this week, Spy was not too surprised to see Hong Kong’s chief executive John Lee Ka-chiu, stating that Hong Kong intends to become an “international gold trading centre”. Investments will be made in trading infrastructure, expanding bullion storage warehouses and, the jewel in the crown, integrating with the vast Chinese market. With US government spending out of control, regardless of who controls the White House, it is not terribly likely that gold is going to fall out of favour any time soon.

What are people doing in the evening? Watching Netflix it would seem to Spy. The streaming king, has just reached 283 million paid subscribers. In the last quarter alone, 5.1 million people signed up. The most staggering thing about their results this week was the firm’s operating margin of 29.6%. There is definitely money in couch potatoes.

What goes up must come down? The recent run up in Hong Kong and China shares seems to be losing a little lustre. At the time of writing, the Hang Seng has dropped more than 12% since its recent high. There will no doubt be a bunch of people who jumped in at the last minute licking their wounds. It was ever thus, believes Spy. As the late great Richard Russell used to say, the stock market likes to take the fewest possible people with it on the way up and the greatest number on the way down.

Finance has been a notorious boys club for decades with women gaining prominence and position through grit and determination. A new book, She Wolves, by Paulina Bren pulls back the curtain on the women who came to Wall Street and broke through the glass barriers which were everywhere from the trading floor to the office canteen and even the business schools preparing people for a career in finance. It is lively account of how far we have come but perhaps a pointer of more that needs to be done. Highly recommended.

Until next week…