Christophe Donay, Pictet Wealth Management

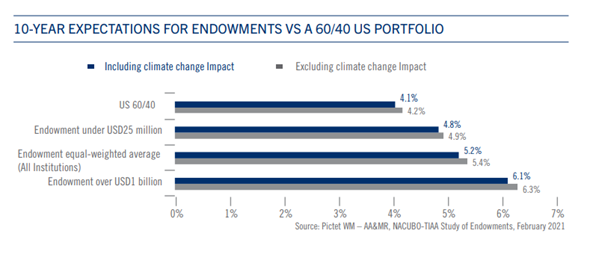

Climate change is set to be one of the most important externalities over the next decade, and investors will have to reassess their asset allocations in an inflationary environment. Indeed, Geneva-based Pictet WM expects that so-called “endowment-style” investing will outperform the conventional 60% equities / 40% bonds US investment portfolio.

“A classic 60/40 portfolio may be suboptimal at times of higher inflation. From a strategic asset allocation perspective, the expected rise in inflationary pressure, in part because of energy-transition policies over the next 10 years, is a further argument in favour of endowment-style investing,” said Christophe Donay, Pictet WM’s head of asset allocation and macro research at a media briefing on Tuesday.

The wealth manager released its 10-year view on global economies, expected investment returns and strategic asset allocation, as well as its analysis on the impact of adjustments to climate change on economic projections and investment performance.

According to the report, a basic US 60/40 portfolio is expected to return 4.1% annually (including climate change impact), while large endowments with AUM of over $1bn should generate an average annual return of 6.1% over the next decade.

Alternative preferences

The multi-asset approach adopted by endowment funds, which includes a range of real assets and alternative investment classes may protect against inflation.

Pictet WM forecasts an average 9.4% return for private equity: “Company control, the ability to time the exit from investments, sector allocation and the proper use of financial leverage are the pillars of superior returns from private equity investments,” said Donay.

He expects an average annual return for venture capital of 10.6% over the next 10 years, with the premium over private equity declining from the 5.5% it has reached during the past three years.

Although real estate has been one of the most embattled sectors during the pandemic, Pictet WM thinks the it will recover and can provide a stable cash flow stream and better returns than sovereign bonds inside a global diversified portfolio. The firm’s analysis shows that both Reits and private-equity real estate will deliver an average annual return of 5.8% over the next decade.

Amid the pandemic, infrastructure has proven resilient to the disruption, and is expected to grow at a healthy, albeit lower, pace of 5.6% for the next 10 years.

“Infrastructure spending has been a way to boost the post-pandemic recovery,” said Donay. The sector is also attractive to ESG-conscious investors because of the tight link to sustainable development goals.

Climate costs

The firm’s forecasts are in part predicated on governments’ measures to tackle climate change, and the their impact on inflation.

“Climate change will be one of the most important externalities hanging over economies and markets. As these are internalised into production processes and consumption patterns to transition to a low carbon economy, they will impose higher costs on third parties, contributing to higher inflation by a projected 10 basis points per year over the next 10 years in major economies,” added Donay.

Pictet WM believes carbon costs in the form of taxes and tariffs are expected to be a drag on developed market equity returns over the next decade, with return expectations well below historic averages. The firm mapped an expected annual average total return of 5.7% for the MSCI World index and US equities, while Nasdaq, which is focused on less carbon intensive sectors, is expected to outperform at 8.5%.

The wealth manager also recommends including Chinese assets in portfolios, with the world’s second largest economy setting a latest target to achieve carbon neutrality by 2060 after hitting a peak in emissions by 2030. Chinese annual GDP growth is expected to reach 4.8% from 2025 to 2030, while Chinese equities should deliver annual average returns of 7.2%, according to the firm.

Pictet WM notes that large US endowment funds have been significantly reducing their exposure to traditional assets, such as public equities and bonds, in favour of alternative assets, which provide diversification and the prospect of higher long-term returns. On average, US endowments invest 30% to 60% of assets in alternatives.