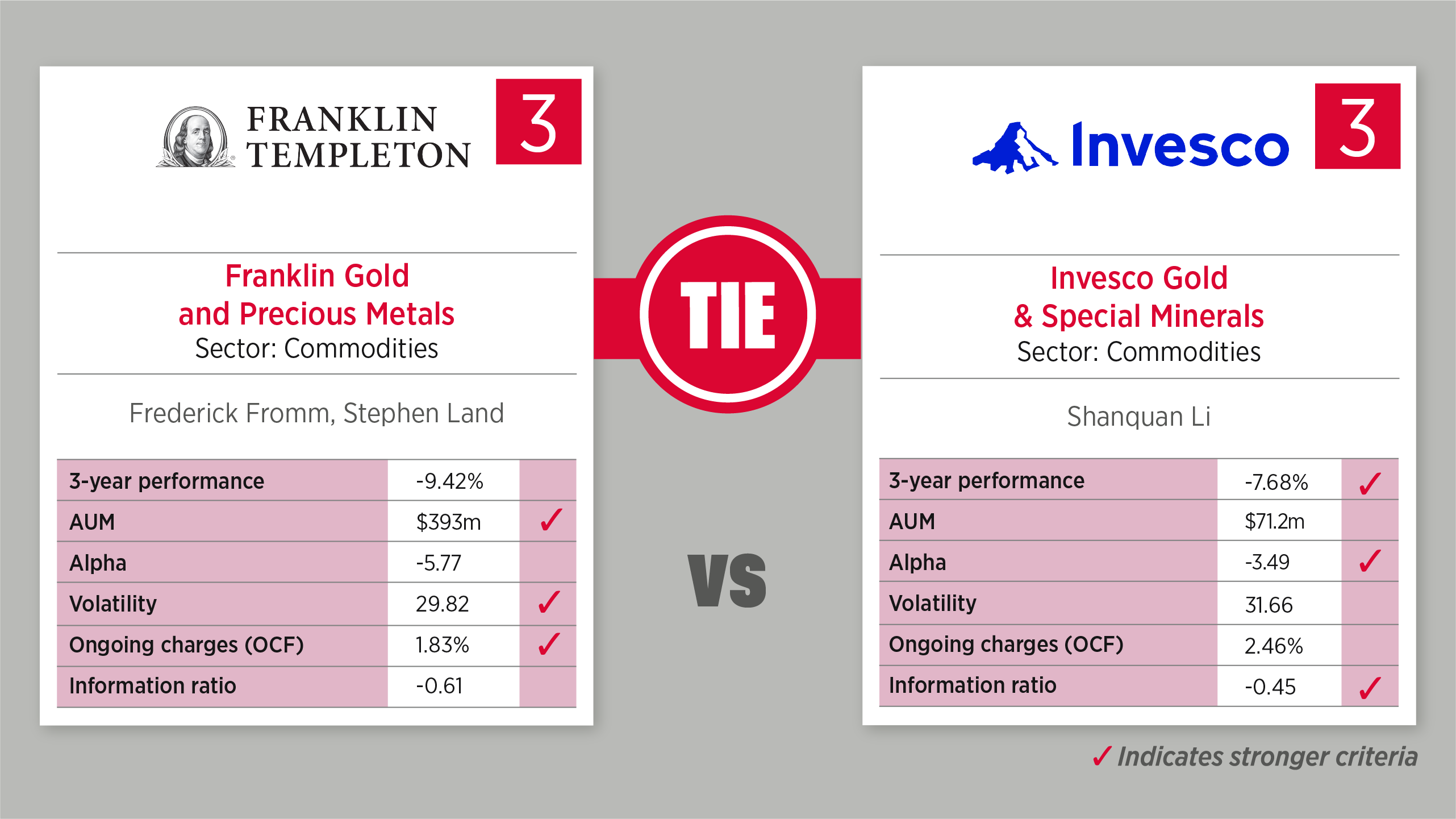

Based on the popular 80s card game, each week we select an asset class and use FE Fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide who is the Top Trump.

This week the Franklin Gold and Precious Metals Fund and the Invesco Gold & Special Minerals Fund tie 3-3.

Franklin Gold and Precious Metals Fund

The fund seeks capital appreciation by investing in the securities of companies around the world that mine, process or deal in gold and other precious metals such as platinum, palladium and silver.

Top 10 Holdings:

- Endeavour Mining (4.96%)

- Barrick Gold Corp (4.89%)

- Alamos Gold (4.88%)

- Newcrest Mining (4.87%

- Agnico Eagle Mines (4.7%)

- Perseus Mining (3.37%

- SSR Mining (2.99%)

- Red 5 (2.72%)

- Newmont Corp (2.67%

- Orla Mining (2.6%)

Geographic Breakdown:

- Canada (54.38%)

- Australia (27.01%)

- South Africa (5.88%)

- Burkina Faso (4.96%)

- United States (3.27%)

- Egypt (1.45%)

- Turkey (1.18%)

- Peru (0.22%)

- Colombia (0.16%)

- Others (0.1%)

Invesco Gold & Special Minerals Fund

The fund invests primarily in the equity and equity related securities of companies engaged predominantly in exploring for, mining, processing, or dealing and investing in gold and other precious metals such as silver, platinum and palladium, as well as diamonds, worldwide.

Top 10 Holdings:

- Barrick Gold (4.8%)

- Northern Star Resources (4.5%)

- Freeport-McMoRan (4.4%)

- Agnico Eagle Mines (4.1%)

- Ivanhoe Mines (3.7%)

- Newmont (3.4%)

- De Grey Mining (3%)

- Evolution Mining (3%)

- Chalice Mining (2.6%)

- Allkem (2.6%)

Geographic Breakdown:

- Canada (44.3%)

- Australia (25.8%)

- United States (13.2%)

- South Africa (3.2%)

- Brazil (2%)

- Burkina Faso (1.9%)

- China (1.9%)

- Turkey (1.4%)

- Others (2%)

- Cash (4.3%)