The FSA Spy market buzz – 6 June 2025

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

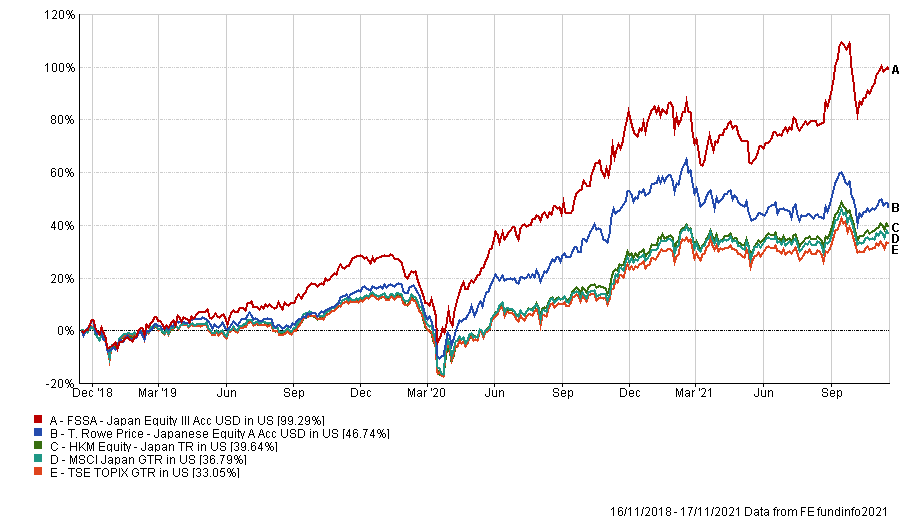

The FSSA fund has performed particularly well this year, and “had a great 2020 too,” said Genderen, “outperforming both its MSCI Japan benchmark and the T Rowe Price fund”.

The FSSA fund has recorded a return of 8.54% year-to-date, in US dollars, outperforming T Rowe Price (-5.54%) and the 4.71% return of its benchmark the MSCI Japan, according to FE Fundinfo.

It has also achieved a 99.29% three-year cumulative return in US dollars, with annualised alpha of 13.79 and volatility of 20.74%, FE Fundinfo data shows.

The T Rowe Price fund has generated a 46.74% three-year cumulative return in US dollars, with annualised alpha of 2.78 and volatility of 18.39%, according to FE Fundinfo, outperforming the sector average of 39.64% and the 33.05% of its benchmark index TOPIX.

“I expect the FSSA fund to be more volatile for two reasons. Firstly, it is more concentrated, and secondly, it has a higher exposure to mid- and small-caps,” Genderen said.

The T Rowe Price fund has achieved a strong outperformance versus peers and relevant indexes; there are only a few periods where it didn’t beat these yardsticks. The strategy benefited from its growth orientation as this style was favoured by investors over this period, according to Genderen.

Discrete calendar year performance

| Fund/Sector |

YTD* |

2020 |

2019 |

2018 |

2017 |

2016 |

| FSSA |

8.54% |

42.47% |

36.05% |

-14.37% |

44.17% |

3.17% |

| T Rowe Price |

-5.54% |

35.22% |

25.42% |

-12.68% |

– |

– |

| Sector – Equity Japan |

5.33% |

17.48% |

20.44% |

-17.22% |

27.31% |

2.15% |

| MSCI Japan |

4.71% |

14.48% |

19.61% |

-12.88% |

23.99% |

2.38% |

| TOPIX |

4.44% |

12.62% |

18.79% |

-14.02% |

26.15% |

3.12% |

Investors turn to real estate for alternative income

Investors turn to real estate for alternative income

Unmasking the dividend opportunity

Unmasking the dividend opportunity

Sourcing resilient yield and income through short-dated credit

Sourcing resilient yield and income through short-dated credit

The year of living dangerously for income investors

The year of living dangerously for income investors

Appetite for thematic investments grows amid rates and inflation concerns

Appetite for thematic investments grows amid rates and inflation concerns

Accessing Asian 5G innovation: three key portfolio themes

Accessing Asian 5G innovation: three key portfolio themes

China’s post-pandemic growth gathers pace

China’s post-pandemic growth gathers pace

Don’t get left behind in fixed income

Don’t get left behind in fixed income

Step up your portfolio by doubling down on sectors set for long-term growth

Step up your portfolio by doubling down on sectors set for long-term growth

An investment opportunity for the coming decades: the environment

An investment opportunity for the coming decades: the environment

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

Part of the Mark Allen Group.