The FSA Spy market buzz – 16 May 2025

Playing monopoly with ETFs; Eastspring is worrying about loss aversion; Family office explosion; SGX wants more action; The Fear and Greed Index; Retail investors plough on; Deepfake fraud and much more.

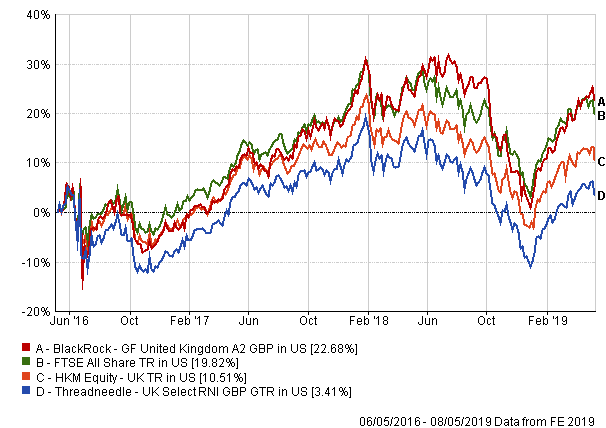

“The funds have generated similar returns over 10 years, but the Blackrock performance has been superior over five years and also for shorter periods,” said Ng.

Threadneedle has achieved 112.16% cumulative return since May 2009, slightly higher than the 110.76% return earned by Blackrock.

However, the relative performances of the two products have sharply diverged since Nicholas Little became manager of the Blackrock fund in 2013.

He has generated a 41.46% five-year cumulative return, 14 percentage points more than Mark Westwood at Threadneedle during that period. His fund has achieved a 22.6% return over three years, compared with only 3.41% by Threadneedle, while the annualised volatility of both funds is a little over 13%

Moreover, “Blackrock has outperformed Threadneedle in each of the past calendar years, doing better in positive periods as well as negative periods for the UK market,” said Ng.

“In 2017 it also produced better returns than the benchmark index, which it has also outperformed over three years.”

“But, neither fund did well in 2016, with both underperforming the FTSE All Share index,” he added.

Ng attributes Blackrock’s better outcomes to its stock selection style, “which combines earnings growth with a quality bias, and also a top-down overlay that allows the fund to make sector re-allocations when economic or market conditions change”.

“In contrast, Threadneedle made some poor stock picks in 2016 and again in 2018, notably in the industrial sector, which largely accounts for the fund’s disappointing performance,” said Ng.

Discrete annual performance % (US dollars)

|

2018 |

2017 |

2016 |

2015 |

2014 |

|

| Blackrock |

-10.77 |

15.31 |

7.07 |

10.52 |

-0.40 |

| Threadneedle |

-14.32 |

12.03 |

4.00 |

11.05 |

5.02 |

| Sector average* |

-11.43 |

9.99 |

10.88 |

3.55 |

1.83 |

|

FTSE All Share |

-9.47 |

13.10 |

16.75 |

0.98 |

1.18 |

Healthcare’s innovation shifts into high gear

Healthcare’s innovation shifts into high gear

M&G Episode Macro shines after tough year

M&G Episode Macro shines after tough year

Riding the wave of alternative income amongst HNWIs in APAC

Riding the wave of alternative income amongst HNWIs in APAC

Federated Hermes SDG Engagement Equity: 2021 H1 Report

Federated Hermes SDG Engagement Equity: 2021 H1 Report

Appetite for thematic investments grows amid rates and inflation concerns

Appetite for thematic investments grows amid rates and inflation concerns

Step up your portfolio by doubling down on sectors set for long-term growth

Step up your portfolio by doubling down on sectors set for long-term growth

Tech WELLcovered | Work reimagined

Tech WELLcovered | Work reimagined

Smartphones on wheels

Smartphones on wheels

Turning environmental hopes into investment reality

Turning environmental hopes into investment reality

Ninety One: Finding opportunities in times of change

Ninety One: Finding opportunities in times of change

Playing monopoly with ETFs; Eastspring is worrying about loss aversion; Family office explosion; SGX wants more action; The Fear and Greed Index; Retail investors plough on; Deepfake fraud and much more.

Part of the Mark Allen Group.