While the “Magnificent Seven” helped drive the global equity market back towards its former highs with a 22.81% gain in 2023, Asian stocks finished the year lagging the wider market with just a 6.34% return.

Although the equity markets of India, Taiwan and South Korea performed reasonably well, Chinese equities saw a continuation of its prolonged bear market which dragged down the broader MSCI Asia ex Japan index.

Despite being weighed down by the weakness of the Chinese equity market, which still accounts for roughly a third of the index, some funds managed to deliver strong returns in 2023.

Below are five top performing Asia ex Japan funds available for distribution in Hong Kong and Singapore, based on data from FE fundinfo. For a fair comparison of diversified Asian strategies, single-country products were not included.

JPMorgan SAR Asian

The $1.2bn JPMorgan SAR Asian fund, managed by Mark Davids, Oliver Cox and Alice Wong managed to deliver a 19.87% return in 2023.

It benefited from its lack of exposure to Chinese equities, with overweight allocation to Indian, Australian and Taiwanese stocks instead.

Instead of exposure to Chinese tech giants such as Tencent and Alibaba, the strategy has Australian miners BHP and Rio Tinto in its top-10 holdings, alongside Singaporean bank DBS Group and Indian bank HDFC.

Nikko AM Shenton Emerging Enterprise Discovery

The $20m Nikko AM Shenton Emerging Enterprise Discovery fund was another top performer, up 19.6% in 2023.

Managed by Grace Yan, it is a small- and mid-cap focused fund with a bottom-up approach to investing in stocks the manager sees as undervalued.

It has 84 holdings, with its top 10 positions making up roughly 10% of its portfolio. According to its latest factsheet, its largest position is in Phoenix Mills – an Indian commercial real estate developer.

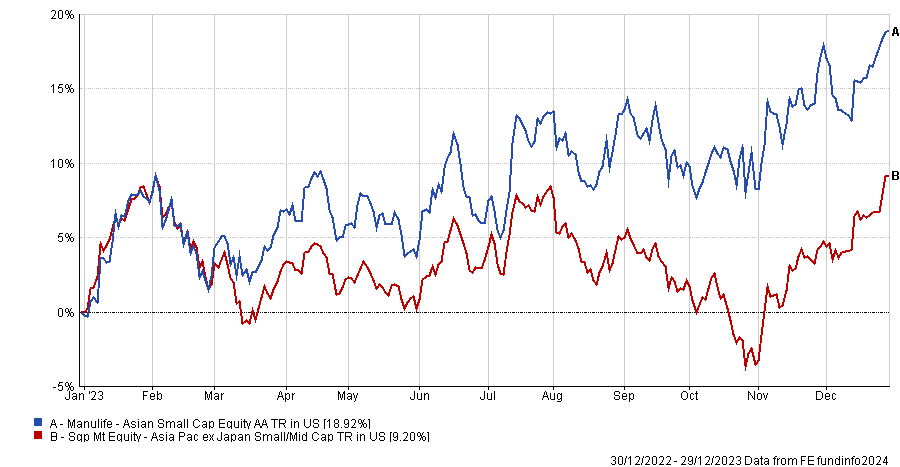

Manulife Asian Small Cap Equity

The $112m Manulife Asian Small Cap Equity fund was another small-cap fund which posted strong returns in 2023, up 18.92% for the year.

Managed by Jasmine To, the small-cap strategy takes a growth at a reasonable price (GARP) approach to investing in Asian stocks.

This fund takes a slightly more concentrated approach, where its top 10 holdings make up roughly 40% of its portfolio. Its largest position is in Korean semiconductor equipment supplier HPSP Co Ltd.

Eastspring Investments Asian Low Volatility Equity

The $261m Eastspring Investment Asian Low Volatility Equity fund was another top-performer, with a 18.67% return for the year.

Managed by Chris Hughes and Jie Lu, this strategy managed to deliver top-ranked returns in 2023 despite its largest country weighting being allocated to China.

As the name suggests, the fund takes low-volatility investment approach which would’ve helped mitigate the downturn in Chinese equities. Its largest two positions are in Taiwanese telecoms firm Chunghwa Telecom, and Chinese commercial bank, Bank of China.

TT Asia-Pacific Equity

The $176m TT Asia-Pacific Equity Fund was another large-cap Asian fund that managed to outperform its peers with a 15.96% return in 2023.

Managed by Duncan Robertson, this unconstrained quality-focused strategy runs a concentrated portfolio of between 50 and 60 stocks.

With only a slight underweight to the China region (25% versus 30% in the index), its overweight positions in specific companies such as Alibaba, Tencent and TSMC helped bolster its performance last year.

*The top-performing funds were measured in US dollar terms. The performance is based on data from FE fundinfo ending 29/12/2023. The funds only includes fund vehicles that fall under the Hong Kong SFC Authorised Mutual or Singapore Mutual equity international sectors as classified in the FE fundinfo platform.