Despite being weighed down by a strong US dollar and weakness in Chinese equities, certain value-focused emerging market funds have come out with strong returns over the past 12 months.

Emerging market economies are set to grow faster than developed markets and investors looking to diversify away from the risk of a recession in US and Europe may be considering increasing their emerging markets exposure.

As such, below are the five best performing emerging market equity funds available for distribution in Hong Kong and Singapore, based on data from FE fundinfo*.

One common factor with all the top-performing strategies was the existence of at least one contrarian top-10 position that deviates from the benchmark.

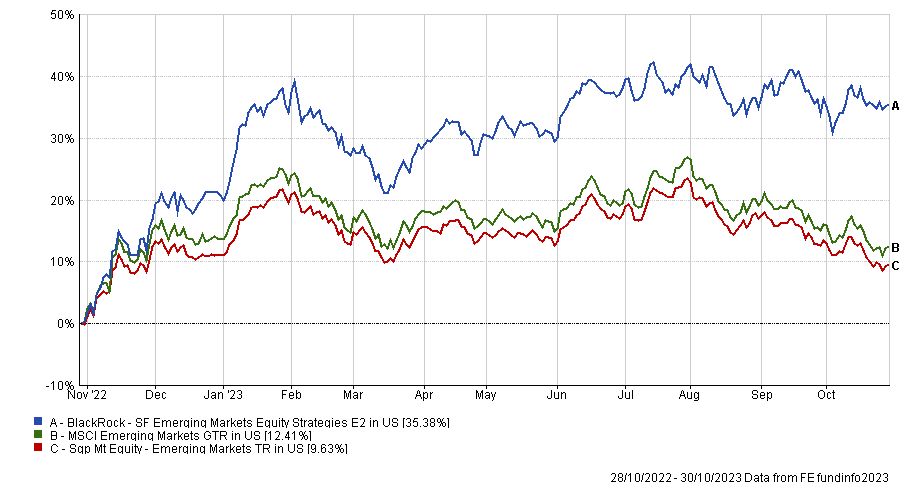

The top performer was the $503m BlackRock SF Emerging Markets Equity Strategies fund run by Samuel Vecht and Gordon Fraser, which has returned 35.18% over the past 12 months.

With over 102 positions, the managers focus on investing for both capital growth and income.

This fund is significantly underweight Taiwan Semiconductor Manufacturing Company and has a large overweight position in Philippines based company Ayala Corporation, a stock not found in the top-10 in the emerging markets benchmark index.

The second highest performer was Brandes Emerging Market Value, which has returned 29.98% over the past 12 months.

Managed by Mauricio Abadia, Christopher J. Garrett, Louis Y. Lau and Gerardo Zamorano, this strategy has a classic value investing approach, buying stocks trading below the team’s estimates of intrinsic value.

With 62 positions, one of its largest overweight positions is in Brazilian energy firm Petroleo Brasileiro SA, which is also not found in the top-10 of the emerging markets benchmark index.

The $451m Arga Emerging Markets fund was another value-focused strategy which delivered sector-busting returns of 28.83% over the past 12 months.

Arga’s investment philosophy focuses on opportunities arising from investor reactions to macro or company specific stress, buying what it considers deeply undervalued stocks with substantial upside.

One of its largest overweight positions is in South Korean memory chip supplier SK Hynix, also not found in the top-10 of the benchmark index.

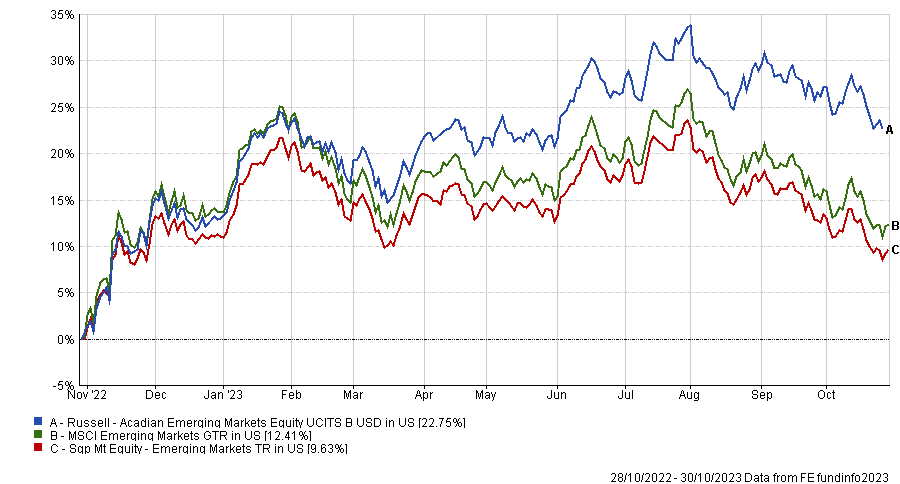

The Russell Acadian Emerging Markets Equity was the fourth highest performer over the past 12 months, returning 22.75%.

This multi-manager fund is run by Kathrine Husvaeg, who has appointed eight different managers including the likes of Oaktree, Pzena and Sands Capital, running different styles of investment strategies within the portfolio.

Shanghai headquartered travel service conglomerate Trip.com Group is one of the funds largest overweight positions, and not found in the top-10 of the benchmark.

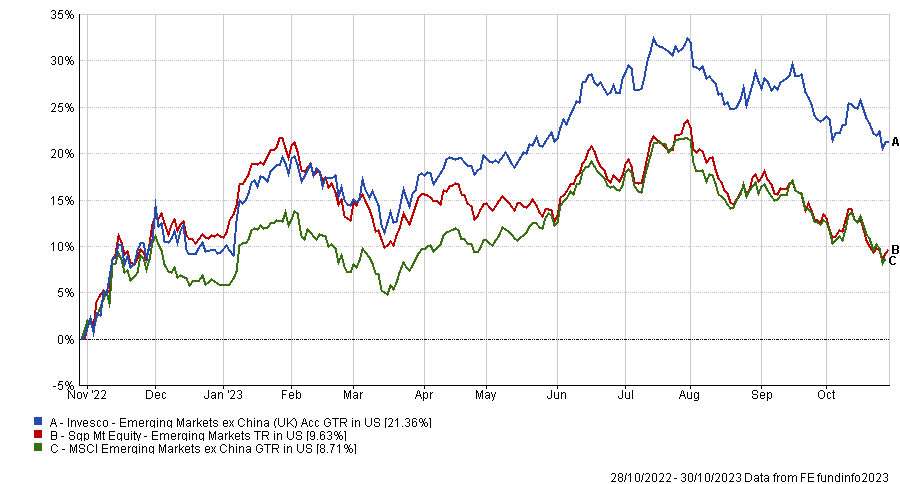

Invesco Emerging Markets ex China was the fifth top-performer, with returns of 21.36% over the past 12 months.

Managed by Invesco’s William Lam, Charles Bond and James McDermottroe, this value strategy runs a more concentrated portfolio with between 35 and 45 positions.

Mexican beverage and retail firm Fomento Economico Mexicano (FEMSA) is one of the fund’s top overweight positions, a stock not found in the top-10 of its benchmark MSCI EM ex-China Index 10/40.

Its performance has been buoyed by its lack of exposure to Chinese equities over the past year.

*The top-performing funds were measured in US dollar terms over a 12-month period ending 30/10/2023 based on data from FE fundinfo. The data only includes funds benchmarked against MSCI Emerging Markets indices that fall under the Hong Kong SFC Authorised Mutual or Singapore Mutual sectors in the FE analytics platform. Single country strategies were not considered.