The entire Fund Selector Asia team and your humble Spy wish all our readers a very happy Lunar New Year break ahead. May the Year of the Wood Dragon be a happy and prosperous one for you and your families. No doubt, the Dragon will give some fiery moments ahead but if Spy has one prediction for the year ahead, it is that China itself is going to surprise to the upside. The pessimism on the Middle Kingdom and recent persistent selling has felt like a capitulation. It is often darkest before the dawn. Kung Hey Fat Choy!

If, despite Spy’s optimism, one remains bullish on Asia but nervous about China, Direxion has just the ETF for you. The ETF provider has added the Daily MSCI Emerging Markets ex China Bull 2x Shares (Ticker: XXCH) to the market in the United States. The fund will allow investors to take a leveraged bet on Asia, including markets such as India, South Korea, Thailand and Indonesia, without the currently moribund Chinese market. The fund covers large- and mid-cap equities. This passive strategy, which is hardly a core portfolio building block, is certainly not cheap: it comes with an expense ratio of 1.18%.

And another one arrives, notes Spy. Now Taiwan’s Financial Supervisory Commission has decided to allow the active ETF structure into its local retail market. The formal permission could come as soon as June, but a specific date has not been released, according to Chang Chen-shan who is the director general of the Securities and Futures Bureau. Japan and Singapore already allow active ETFs. The decision seems a sensible one. In the US, according to data from the NYSE, active ETFs gathered over $130bn in assets in 2023 and accounted for 22% of net flows. In total, active ETFs now have over $530bn under management.

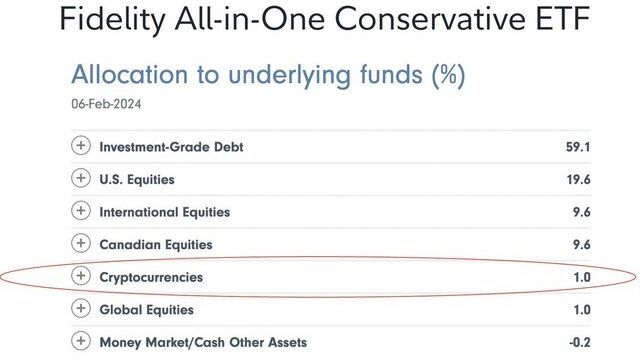

Crypto bulls must be licking their lips, thinks Spy. An eagle-eyed reader sent Spy an intriguing note. She pointed out that Fidelity has just tweaked their “All-in-One” asset allocation funds in Canada to include between 1-to-3% in Bitcoin. Fidelity is using spot bitcoin ETFs to achieve the investment. The “conservative” strategy’s potential breakdown is captured below. This legitimisation by such a huge fund house, is just what enthusiasts have been waiting for. The asset class is moving from the shadows to the mainstream.

The death of the star stock picker is a recurring theme in asset management. Headlines abound that hedge funds and long only managers are turning their backs on the maverick who can spot the real winners from the mediocre. After all, if the $SPY S&P 500 ETF can deliver 1,910% or 10.2% annualised since its inception in 1993, who needs more? Well Spy is reminded of the parents that tell their daughter “You WILL become an accountant and not a star actress, because accountants all have a decent standard of living, and most actresses don’t.” But the wannabe actress will opine, “I want to have the chance to become a star and make a fortune, not merely ‘a decent standard of living.’” Since 1993, McDonald’s has returned +9,220%, a whopping 15.8% annualised and how about Nvidia? The firm was worth just $9bn in 2014 and it is now worth almost $1.7tn, in other words, 184 times as much. That is the appeal of the star stock picker. For all the many failures and all the bumps in the road, real stardom awaits those who get exceptionally lucky. Most won’t but it won’t stop a few trying.

Over the years, there have been many attempts to find a reliable indicator on the future state of the economy. During the 20th century two indicators stood out for investors: the price of copper (Dr. Copper to his friends) and the Dow Transport Index. With new materials to carry water, copper is less reliable than it once was, but transport still holds a lot of sway. With that in mind, Spy saw a chart at the time of writing (Thursday) that made him go “hmmmm”. It is the share price of Maersk, the Danish shipping giant. The stock plunged 15% after a rather dire forecast. If there is trouble ahead, the ships are probably the first place to look.

Until next week…