Spy lunched this week with a wealth manager who only has about 30 clients. But boy do those clients have some healthy assets. AI came up as he noted that AI funds had been in relatively hot demand by his clientele. The one observation he had was how American stocks that might benefit from AI have soared so dramatically and how other countries such as the UK and Germany, with its listed dinosaurs, were suffering. The American future, to foreign observers, may seem a debt-laden, violent, gun-toting, culture war ridden, 2nd Trump election tainted one…however, those Yankees sure know how to innovate in tech.

The trend is your friend. At least that is how the saying goes, reckons Spy. This week, American Beacon, harnessing Man Group’s expertise, has launched a long/short ETF to follow market trends. Man’s AHL division has, of course, being doing this for decades. The strategy deploys a quantitative and systematic trading strategy which is possible to select long or short positions on more than 20 liquid markets across four major asset classes: bonds, stocks, currencies and commodities. The strategy’s “overall annualised volatility” target for this liquid alternative is 15%. The American Beacon AHL Trend ETF, trading under the ticker AHLT, has been listed on NYSE Arca with an expense ratio of 0.95%.

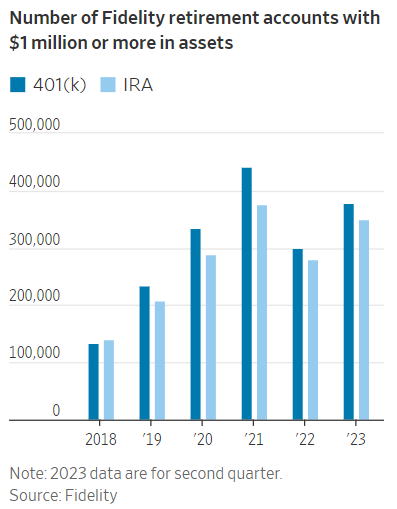

Pub quiz for a Friday afternoon while you contemplate the balance of your CPF, MPF or other pension account. How many Americans using Fidelity as their retirement accounts have more than $1,000,000 in value in their accounts? Spy was rather staggered to learn the number now sits at a whopping 378,000 individuals. What is the one thing these super savers all have in common? It is the fact that they are regular savers and contribute an outsized portion of their salary each month to the savings plan. The amount is reportedly 17.5%.

Singapore has become better and better at not crowing when it wins in the regional competition for multi-national headquarters or major investment firms, believes Spy. No doubt this week will be little different but the Lion City surely has news to smile about as Norway’s $1.4trn sovereign wealth fund announced plans to abandon its Shanghai hub and stick only to Singapore. Few officials are likely to go on the record with anything other than platitudes, but this decision mirrors a number of other Western firms retreating from China in recent years with many, privately, suggesting the harsher environment for foreign entities was the cause for retreat.

Spy has heard mutterings and complaints from a number of attendees of the Jefferies Asia Forum this week. Apparently, the turn-out has been rather poor. One disgruntled attendee whispered to Spy, “If you are going to pinch CSLA’s act, you better do it well because nobody prefers a tribute band to the real thing.” Ouch!

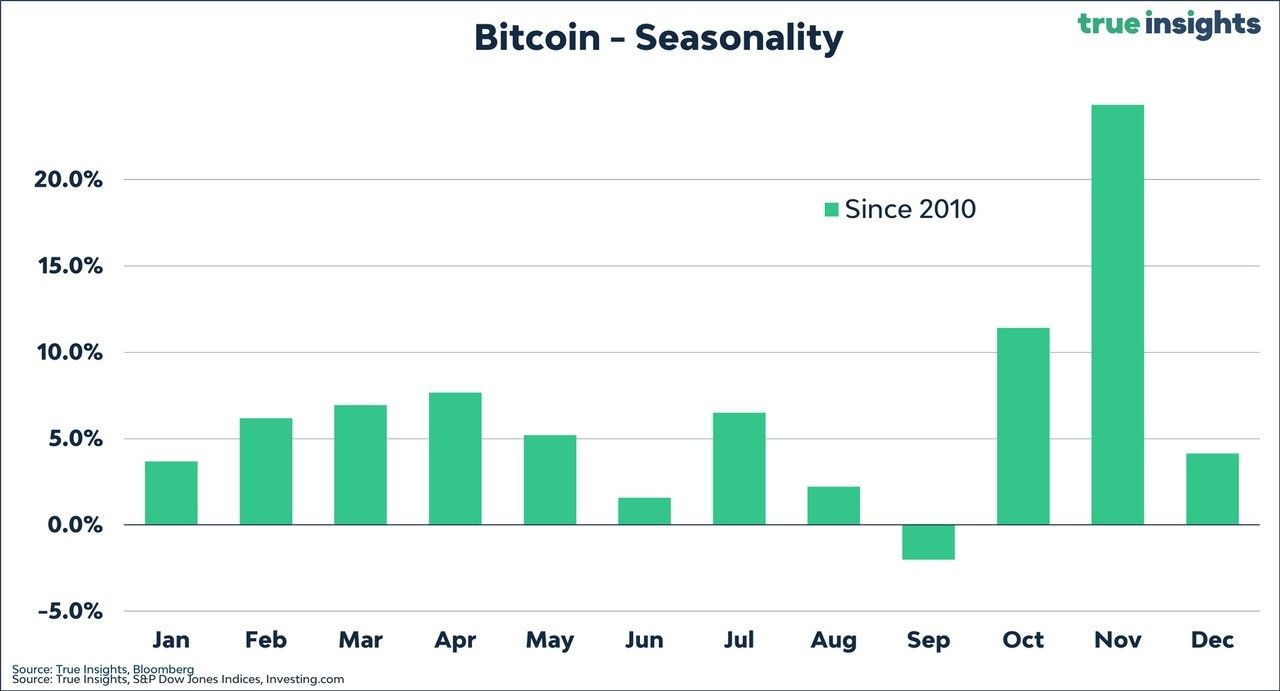

Spy has no truck with horoscope-driven investing or any other mythical co-incidents that happen to provide highly dubious “correlations” to market performance. However, the one month he will give some regular doubts to is September. September’s poor reputation is well founded as being the month most likely to provide negative performance for risk assets. (Spy sees you there, Apple.) Equities and other more volatile assets such as Bitcoin all seems to have September woes over the years. The chart for Bitcoin may well attest to the month’s nastiness. Good luck for the next few weeks.

Did you hear about the fellow who changed jobs because he was offered more flexible working from home time? No, Spy either. It seems that cold, hard cash is the reason people are moving jobs. Funnily enough, money remains an extraordinary motivator and it has always been so. Whatever people might say in public – money appears to be the main driver for nearly half of all people jumping ship, according to a report in London’s Financial News.

Spy read a mind-numbingly dull description of a new US large-cap investment fund, which shall remain nameless, that included, among many other clichés, “The investment process begins with quantitative screens to filter for structural constraints and positive financial characteristics… fundamental analysis… intrinsic value and growth opportunities… select stocks of large, seasoned companies that are expected to grow their value over time…” and so it droned on and on. Spy half-wondered if ChatGPT had not written the investment summary it was so generic. In 2023, if that is your marketing blurb, get another marketing bod – quick.

The investment world is often compared to the world of professional sports. Spy was reminded of this when thinking about how top funds take so much of the available investment money. As tennis legend Andre Agassi once put it, “Being number two sucks”.

Spy’s trusty photographers have spotted a new campaign out in Central. This week, abrdn is out and about promoting their more than 100 investment professionals working across Asia. Spy could not resist their promo pic.

Until next week…