“You don’t know who is swimming naked until the tide goes out.” Warren Buffet’s pithy and much-repeated quote came back to Spy last night as he was enjoying several glasses of the highly recommended Hitachino White Ale from Japan (delicious notes of orange peel and coriander with a hint of nutmeg). China Fortune Land Development has admitted to the Shanghai Stock Exchange that it has “lost contact” with China Create Capital to whom it handed $300m in 2018 to invest on its behalf. Spy would hate to speculate on where the money has gone but there must be some very anxious investors and regulators, who can see yet another property-related scandal tumbling their way. As China’s capital markets have blossomed in the last twenty-five years, lessons that America and Europe have had to painfully learn are now being experienced locally. Knowing who runs your money, where it is, who has custody and what is actually being done with it is really rather important.

News reaches Spy that PGIM has made some new hires. The $1.5trn AUM American firm has pinched Sashi Nambiar from Wellington Management as managing director, head of Southeast Asia. This is a new role for PGIM and Sashi will be leading the sales and distribution efforts of the company in key Asean markets and will report to Jessica Jones, PGIM’s head of Asia, based in Hong Kong. Nambiar, himself, will be based in Singapore and brings more than twenty years of experience with him. PGIM has also hired Wincy Mak to lead its marketing effort in Hong Kong and Southeast Asia. Mak has huge experience having worked for many years at abdrn in Hong Kong where she was head of marketing for Hong Kong and China.

Wisdom Tree and Van Eck have both recently introduced ETFs that are targeting our food and the way it will be grown and managed in the future. Wisdom Tree has named its strategy The BioRevolution and listed the ETFs in a number of markets in Europe, including London. Van Eck names its thematic, The Future of Food. They are both targeting the entire value chain of disruptive technology that is supposedly going to change the way our food is grown, produced and put on our plates. Of the two, Spy feels at least Van Eck’s marketing team has a sense of humour. Their ticker in NY is YUMY, even if synthetic beef on an artificial lettuce does not sound very yummy at all…

“A trillion here and a trillion there, pretty soon we are talking about real money”, to paraphrase Senator Everett McKinley. Spy was not surprised to hear that global ETF assets have now reached $10trn. The rise of the ETF is simply unstoppable. For Spy, the best innovation within the space is the active funds that now simply use ETFs as a distribution mechanism.

Crypto may have wobbled a bit of late as people take year-end profits, but the believers are throwing money at the sector. This week, New York Digital Investment Group (NYDIG to its friends) raised $1bn, at a $7bn valuation. The company runs a bitcoin trading, brokerage, custody and asset management business that caters to institutional investors. Morgan Stanley was one of the participants in the funding round.

One of the things that the Spy has always loved about active asset managers, is their enthusiasm for their own research. Businesses such as Matthews Asia, First Sentier, abrdn and many others, send their own analysts and researchers out into the field to knock on doors and find out what is really going on. Spy was thinking about this fact this week when considering the following: Uber, the ever-unprofitable taxi company, currently has 41 Buy ratings, 5 Holds, and absolutely no Sells. Uber’s shares are currently 45% below its average price target of about $68.7. Talk about groupthink going on and perhaps even wishful thinking. These analysts should hang their heads in shame. When it comes to Asia, especially China, there is absolutely no substitute for getting out there; relying on desk bound spreadsheet junkies is a mug’s game.

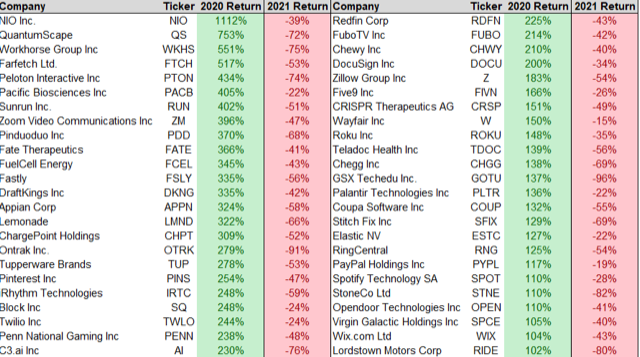

If you fancy Korean horror films, Japanese nasties or other such scary fare, Spy could recommend having a quick look at what is happening to high growth share prices. The picture is looking worse than a Hong Kong B-Grade fright flick. It is a bloodbath out there as reality sets in. The chart below is thanks to wealth manager, Compound Growth. The figures are true to 16 December.

Should we all be worried? Time Magazine has a knack of putting tech moguls on its front covers just as tech shares take a dive. In 2000 it was Jeff Bezos. The Nasdaq dropped 40%. In 2011 it was Mark Zuckerberg and the Nasdaq dropped 2%. This year it is Elon Musk…and, well, the Nasdaq is currently up 19% but we still have two weeks to go!

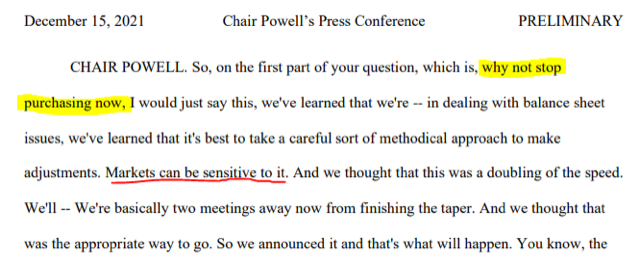

If anyone had any doubts that the Fed is not really interested in price stability rather than market stability, Chairman Jerome Powell let the cat out the bag rather clearly this week. “Markets can be sensitive to it”, he said. The poor schmucks on main street experiencing breakneck inflation can go and jump, just as long as Powell’s mates in the markets are fine.

Spy is sensing that bond fund managers are now beginning to get real with conversations about what is happening as interest rates rise. JP Morgan Asset Management’s advert in Singapore is just the latest to address the elephant in the room. Asia has purchased such large quantities of high yield bonds in the last decade, there must be some wobbly investors and portfolio managers out there.

Until next week…