“Your mission, should you choose to accept it….” Yes, Tom Cruise is back on screens with the blockbuster of the year, ‘Mission Impossible: Dead Reckoning Part 1’. Tom, as the ever-youthful Ethan Hunt, will, no doubt, be battling life and limb against unknown evil villains. Again. It got Spy thinking, the average investor’s real mission impossible is to stay the course. The hardest part of all investments is simply to ignore the volatility, the noise, the cross currents and keep invested. For all too many, this proves mission impossible and rather like these Hollywood fantasies, a trail of financial destruction is left in its wake.

Who wants to buy a hedge fund, asks Spy? It seems that at the beginning of this year, everyone did; after years of outflows, hedge funds are, once again, gathering assets. The fear factor induced by a market sell-off and accompanying volatility during 2022 have probably played their role in making hedge funds sales teams’ jobs a little easier. However, whether this will do any good for investors, remains to be seen. By 31st May, hedge funds were flat for the year, according to data firm HFR. US bonds had delivered a modest 2.5%. The S&P 500, by contrast, had delivered 9.6% and year-to-date that has risen to 17.4%. Buying a low-cost S&P tracker, without those nasty 2- and-20% fees with their esoteric strategies, seems a no brainer.

So, PwC, the consultancy, thinks one in six asset managers around the world will disappear by 2027. This kind of alarming report always tends to get people excited. Whilst Spy sensibly agrees that consolidation will take place, he is utterly convinced the report underestimates the number of new firms that will be created by 2027, too. Consolidation has been taking place for decades and yet new firms pop up all the time. The very act of merging usually means redundancies. What do those people do? Go and write sentimental poetry? Wash cars? No. More often than not, they go and start a new firm. So, yes, the landscape is going to change but Spy confidently predicts there will many more firms launched over the next few years despite the mergers taking place.

The battle for the soul of ESG simply gets hotter and hotter, reckons Spy. This week, some US Senators have attempted to introduce legislation which would effectively ban pension fund managers from taking ESG into consideration for pension investments. “Investment funds like BlackRock, which millions of Americans trust with their hard-earned savings, should prioritise investments that result in the highest returns – not fund ESG scams,” said Senator Cotton, the Republican representative from Arkansas. He added: “My bill will make sure investment fund managers are making the best financial decisions on behalf of their clients.” Whether that will make the best long-term decision for their clients’ children, is another debate entirely.

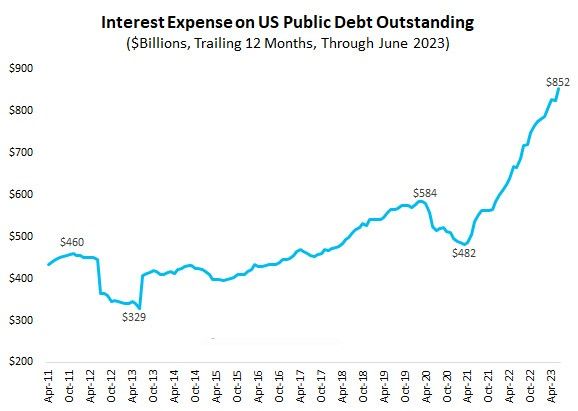

Those who understand interest, earn it. Those who don’t, pay it. Spy can’t remember who came up with that pithy line. It is a good line because it has more than a grain of truth to it. The US and Europe seem to be in the latter camp – they have never seen a debt they did not like. The interest expense on US public debt rose to a whopping $858 billion over the past year. This is a record high. If it continues to increase at the current pace, it will soon be the largest single line item in the Federal budget, surpassing Social Security. When you are paying nearly $1 trillion a year in interest, you would think it would give some lawmakers pause for thought. Don’t bet on it.

Fun Friday fact: in 1999, Larry Page and Sergey Brin wanted to sell Google for $1 million. They were rejected by Excite. They then considered selling for $750,000. They were rejected again. They carried on building instead. And the rest, folks, is history.

Elon Musk is up to his eye-catching tricks again. The launch this week of xAI, his new artificial intelligence firm, was bathed in bravado. The ‘modest’ goal of his company is, “to understand the true nature of the universe”. Most of us would be happy if we achieved a 5km run on Saturday in under 30 minutes. Nobody ever said the fellow lacks ambition.

Until next week…