And so the tumbling down stage arrives. Spy is not talking about the crazy retail crowd, no, it is rather the news that Standard Chartered has given up multiple floors in its Central office block in Hong Kong. As the leases come to an end and need renewing, Hong Kong landlords, not renowned for their flexibility (or lack of greed), may be in for the shock of their careers. For what has felt like decades in Hong Kong, office space on the island has been at the most staggering global premium. When Li Ka-Shing sold The Center a few years, Spy remarked that others should be concerned when ‘Superman’ is selling. It may well have been the canary in the gold mine.

News reaches Spy that Merian Global Investors has had a change in its marketing team in Asia. Paco Lee, Hong Kong-based head of marketing for Asia, has stepped down from the business today after nearly 10 years in the role. He witnessed the business change from Old Mutual Global Investors to Merian and then the inclusion of Merian into Jupiter Investments. Spy has no news on where Paco is moving to but has no doubt that one of the most likeable and experienced people in the industry will appear again soon. Merian has had success in the last 12 months with its Pacific Equity Fund, up a very healthy 42%.

Thomas Lloyd, the German sustainable asset manager, with offices in Singapore, has recently hired Anneliese Diedrichs as its new head of corporate communications, understands Spy. Anneliese was with Eastspring Investments for six years and with First State Investments before that. Anneliese is now based in Zurich in Switzerland. Spy understands Anneliese took up the role last month. Thomas Lloyd specialises exclusively on the financing, construction and operation of sustainable projects in the infrastructure, agriculture and property sectors and manages more than $4bn in assets.

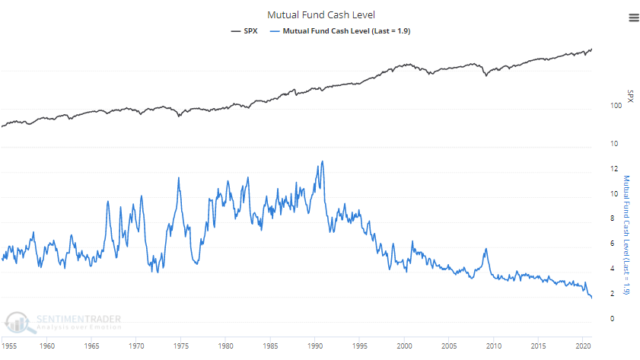

How bullish are asset managers feeling? Pretty bullish reckons, Spy. After all follow the money and the money is not sitting in bank accounts waiting to be deployed. Mutual funds in the US have less a less than 2% cash balance, or cushion, if you like for the very first time in history. Pension fund managers are not much better, only 2.6%. There is either a great deal of FOMO going on, or, the managers see a very bright a future and are “all in”.

DWS, Deutsche Bank’s offshoot global asset manager, had its results out this week for the fourth quarter. The business added €33bn ($39.5bn) in AUM to end the year with €793bn. The vast bulk of that came from rising markets, but interestingly, all areas of the world recorded growth, including APAC. In 2020 as a whole, their active division recorded net outflows of nearly €10bn, while passive, in the form of ETPs, had inflows of €16.6bn. In active equity, the bright spot was, you guessed it, ESG. The numbers are not massive by their standards, though – €236m.

One global bank that thinks sunny uplands are ahead of us is Goldman Sachs. Chief global equity strategist, Peter Oppenheimer, wrote in a research note to clients, “We believe that we are still in the early stages of a new bull market, transitioning from the ‘hope’ phase (which typically starts during a recession, led by rising valuations) to a longer ‘growth’ phase as strong profit growth emerges,” There must be a few Gamestop investors this week who are a feeling a tad hopeless, despite this bullishness, muses Spy.

Betting on consumption in Asia has been a core part of an asset manager’s playbook for nearly 20 years. Spy enjoyed a deep dive into the Chinese medical beauty industry put out by Eastspring Investments in its 2021 Asian Expert Series. According to the research, the Chinese industry, ranked 2nd in 2017, will become the largest in the world this year by value. The industry is growing at 24% a year, compounded. Botox, Hyaluronic Acid and Thermage treatments are all the rage driven by social media and its legion of influencers. When you are on camera eight hours a day telling people how great your life is, you have to look your best, supposes, Spy – even if that means injecting some sheep placenta into your face.

Ever heard the term, “Left holding the bag”? It comes from 18th century England where it colloquially referred to the poor sucker who was left holding the bag of swag from a recent burglary and was caught by the coppers while his partner got away Scot free. Spy reckons there is a fair number of Reddit Army / WallStreetBets latecomers who are feeling they are, indeed, ‘holding the bag’ this morning. As the ridiculous valuations of Gamestop, AMC, Nokia, etc, come crashing down to earth, some very big lessons have been learned, one would think. Interestingly, there are nearly 10 million people following WallStreetBets on Reddit. If each follower has merely $1000 to play with, that would still provide nearly $10bn of collective firepower. It is hardly surprising that if that firepower is concentrated, it causes serious market movements, if only for a while.

Spy has been in Asia long enough to remember when mention of Green, ESG, Socially responsible investing or something similar, merely got a yawn. “Asia is not interested or ready for that”, would be the retort. “It is only yoghurt and muesli munching, Birkenstock-wearing Europeans who care about this.” How times have changed! Spy can hardly go a day without some LinkedIn industry luvvie putting up a copy of their shiny new Certificate in ESG Investing from the CFA. How times change (for the better!).

In Singapore, Spy’s band of trusty researchers spotted a new consumer advert from Pinebridge promoting their active capability. The term that stood out for Spy? High Conviction. The only game in town for Active.

Until next week…