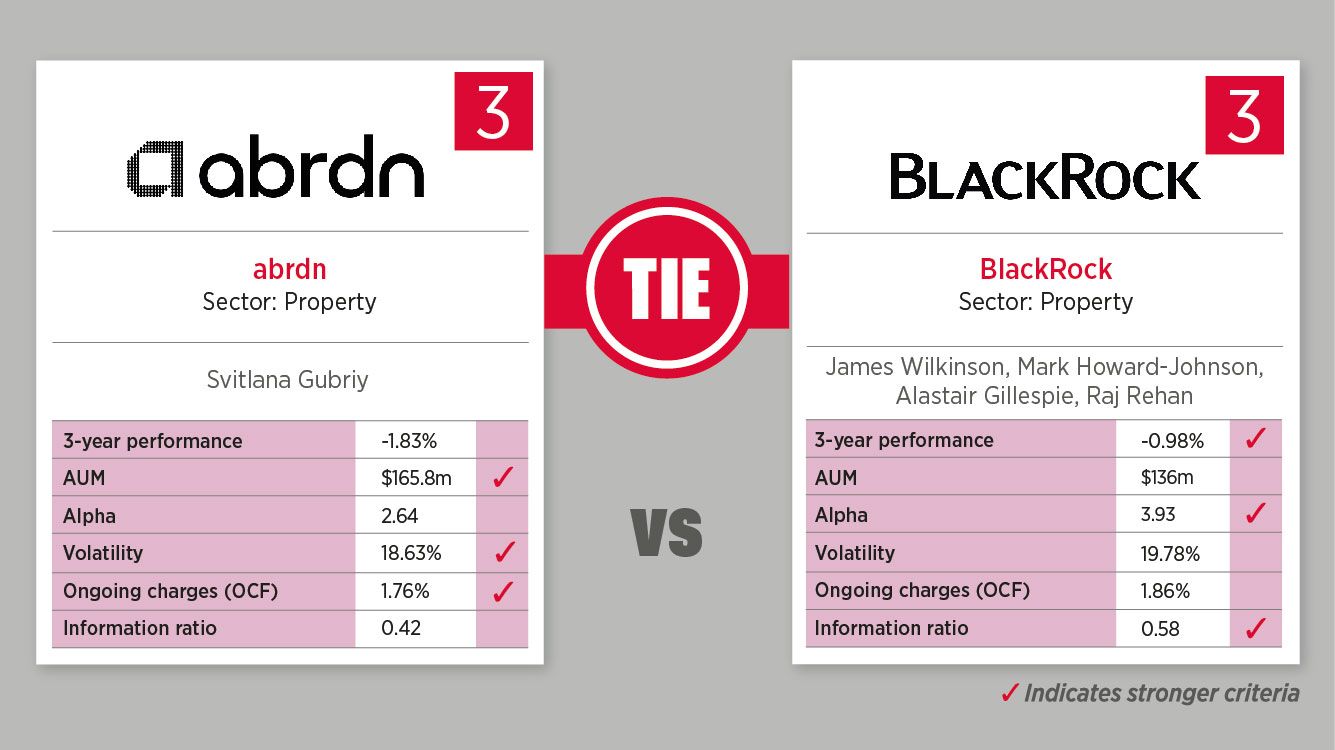

Based on the popular 80s card game, each week we select an asset class and use FE Fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide who is the Top Trump.

This week the abrdn Global Real Estate Securities Sustainable fund and the BlackRock – GF World Real Estate Securities fund tied 3-3.

abrdn Global Real Estate Securities Sustainable fund

The fund aims to provide long term growth from a combination of income and capital growth by investing in listed real estate investment trusts (REITs) and companies principally engaged in real estate activities.

Top 10 holdings:

- Prologis (8.8%)

- Equinix (6.5%)

- Digital Realty Trust (4.2%)

- Welltower (4.2%)

- Public Storage (3.7%)

- AvalonBay Communities (3.5%)

- Realty Income Corp (3.3%)

- VICI Properties (2.7%)

- UDR (2.4%)

- Americold Realty Trust (2.2%)

BlackRock – GF World Real Estate Securities fund

The fund aims to maximise the return on your investment through a combination of

capital growth and income on the Fund’s assets. The fund invests globally at least 70% of its total assets in the equity securities (e.g. shares) of companies the main business of which is real estate.

Top 10 holdings:

- Prologics REIT (5.99%)

- Equinix REIT (5.029%)

- Extra Space Storage REIT (3.54%)

- Avalonbay Communities REIT INC (3.3%)

- VICI Properties (3.23%)

- Digital Realty Trust REIT (3.02%)

- Invitation Homes (2.67%)

- LINK REIT (2.62%)

- Welltower (2.45%)

- Simon Property Group REIT (2.38%)