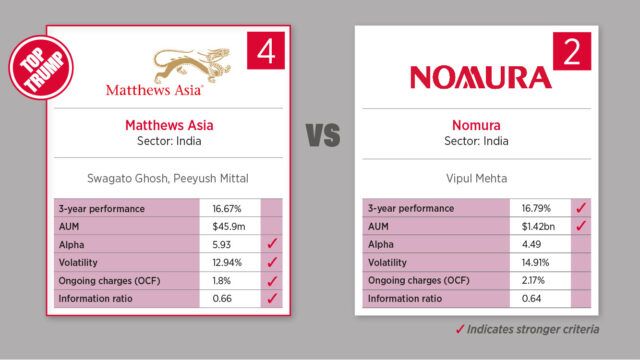

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the Matthews Asia India fund defeats the Nomura India Equity fund 4-2.

Matthews Asia India fund

The fund invests at least 65% of its net assets in publicly traded common stocks, preferred stocks and convertible securities of companies located in or with substantial ties to India.

Top 10 sectors:

- Financials (29.6%)

- Consumer Discretionary (16%)

- Industrials (14.6%)

- Information Technology (13.3%)

- Healthcare (8.4%)

- Consumer Staples (7.7%)

- Energy (5.3%)

- Materials (2.3%)

- Real Estate (1.5%)

- Communication Services (1.4%)

Nomura India Equity fund

The fund aims to achieve long-term capital growth through investment in an actively managed portfolio of Indian securities, taking a focused approach by investing in 25-35 high conviction stocks.

Top 10 sectors:

- Financials (25.04%)

- Consumer Discretionary (15.03%)

- Materials (12.75%)

- Industrials (11.35%)

- Real Estate (9.18%)

- Information Technology (8.48%)

- Energy (6.25%)

- Consumer Staples (6.25%)

- Healthcare (4.49%)

- Cash & Others (1.18%)