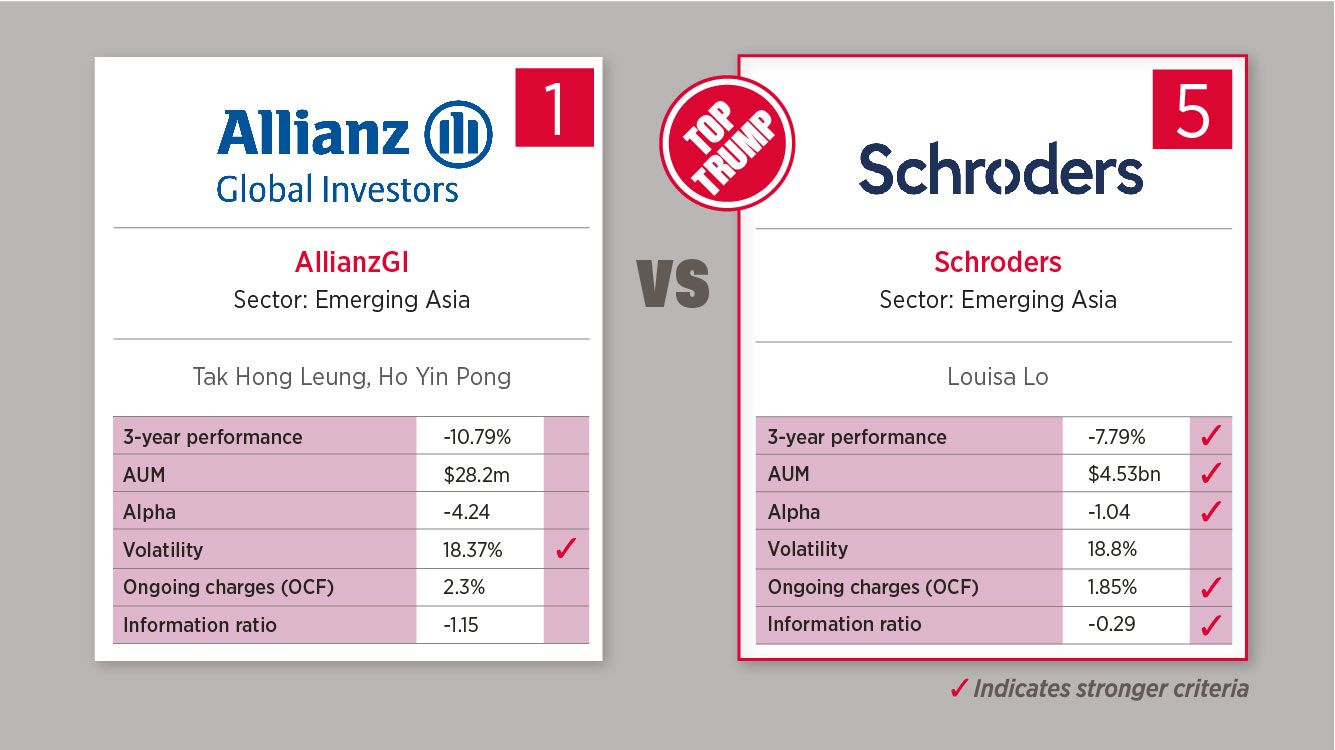

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the Schroder International Selection Fund Emerging Asia fund defeats the Allianz emerging Asia equity fund 5-1.

Allianz emerging Asia equity fund

The fund aims at long-term capital growth by investing in equities of Asian emerging markets (excluding Japan, Hong Kong and Singapore) and/or of countries which are

constituents of the MSCI Emerging Frontier Markets Asia.

Country breakdown:

- China (27.9%)

- India (22.2%)

- Taiwan (18%)

- Korea (17.9%)

- Indonesia (3.5%)

- Vietnam (3.4%)

- Thailand (3%)

- Hong Kong (1.3%)

- US (1.1%)

- Singapore (0.7%)

Schroder International Selection Fund Emerging Asia fund

The fund aims to provide capital growth in excess of the MSCI Emerging Markets Asia (Net TR) Index after fees have been deducted over a three to five year period by investing in equities of companies in the emerging markets in Asia.

County breakdown:

- China (32.1%)

- India (19.9%)

- Taiwan (16.6%)

- Korea (11.7%)

- Hong Kong (6.4%)

- Singapore (6.2%)

- Indonesia (2.7%)

- US (1.4%)

- Thailand (0.9%)

- Sri Lanka (0.4%)