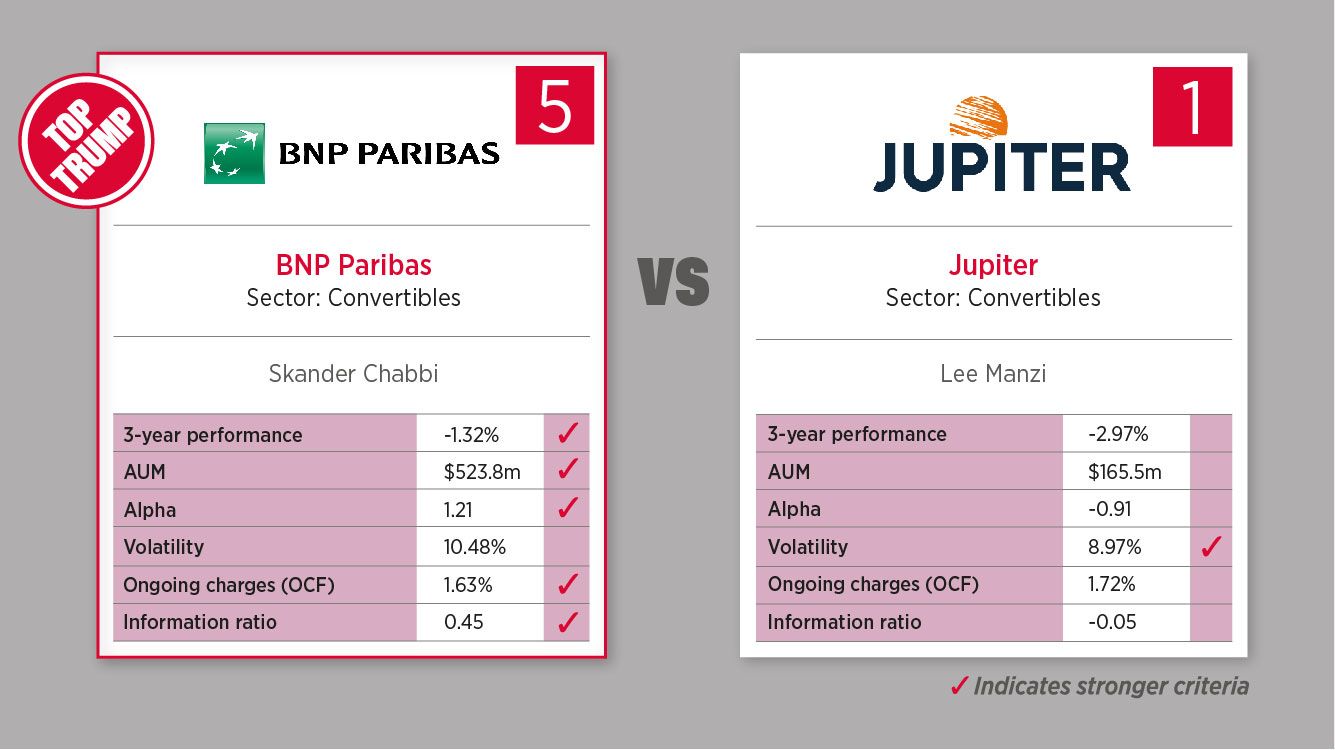

Based on the popular 80s card game, each week we select an asset class and use FE Fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide who is the Top Trump.

This week the BNP Paribas Global Convertible fund defeats the Jupiter Global Convertibles fund 5-1.

BNP Paribas Global Convertible fund

The fund invests in convertible bonds issued by companies from all over the world or gets exposure to the asset class through the use of fixed-income instruments and financial derivative instruments. The manager aims to optimise the risk-return characteristics of the fund by investing in mixed convertibles, avoiding convertible bonds that behave like pure bonds or pure equities.

Country allocation:

- US (65.92%)

- France (5.52%)

- Japan (3.9%)

- Germany (3.68%)

- Korea (3.47%)

- Italy (1.91%)

- Spain (1.81%)

- Mexico (1.8%)

- Singapore (1.73%)

- Hong Kong (1.66%)

Top 10 holdings:

- Akami Technologies (3.02%)

- Duke Energy Corp (2.56%)

- SK Hynix (2.09%)

- Wayfair (1.77%)

- AirBnB (1.67%)

- WolfSpeed (1.6%)

- Bharti Airtel(1.57%)

- On Semiconductor Corp (1.56%)

- Ford Motor Company (1.53%)

- Safran (1.46%)

Jupiter Global Convertibles fund

The fund aims to achieve long term capital growth through investment on a global basis in a diversified portfolio of convertible securities.

Country allocation:

- United States (45.4%)

- China (12%)

- France (9.9%)

- Germany (7.6%)

- Japan (7.4%)

- Singapore (2.7%)

- Australia (2.5%)

- Italy (2.4%)

- Netherlands (2%)

- Spain (2%)

Top 10 holdings:

- Ford Motor Company (1.9%)

- On Semiconductor Corp (1.8%)

- Interdigital Wireless (1.7%)

- Akamai Technologies (1.7%)

- Dropbox (1.7%)

- Live Nation Entertainment (1.7%)

- Macom Technology Solutions (1.6%)

- Cathay Pacific Finance (1.5%)

- Cyber Ark Software (1.5%)

- Glencore Funding (1.5%)