MSCI has made recommendations on how to conduct ESG analyses of long-short portfolios because, it said, there is currently a dearth of consensus on how to do so, reports our sister publication, ESG Clarity.

Following in-house research and a consultation with 20 asset owners, asset managers and hedge funds, MSCI recommended “long-short portfolios report ESG and climate metrics separately for both the long and short legs.”

MSCI said the most important principle for long-short portfolio ESG reporting is transparency.

“Transparency allows both regulators and clients to more accurately assess the ESG risks and opportunities to which the fund is exposed on both the long and the short sides of the portfolio,” the report stated.

Implications of shorting

The researchers found that for ESG investors it is important to be clear about what the implications of shorting are and are not.

According to the report, examples of what shorting a company could mean in an ESG context include:

- Possible portfolio upside from price declines associated with ESG risks.

- Signalling a view on poor company practices that could be improved.

- Initiating an activist campaign against a company on a specific ESG-related issue.

Examples were also provided for what shorting a company does not mean in an ESG context:

- Complete removal of exposure to a company’s ESG risks and opportunities. Divesting removes all portfolio exposure to a stock’s ESG risks, while short selling retains an economic exposure.

- Formal shareholder engagement, voting rights or any form of stewardship to influence future company practices as part of a responsible investment strategy.

- Compliance with existing sustainable finance labels.

The authors noted it is also important to consider whether the ESG reporting is from the approach of financial material impact or the approach of double materiality – in effect, the impact on the company and on its external environment and stakeholders.

Reporting

Exploring practical options for long-short portfolio ESG reporting, MSCI looked at net and gross market exposure.

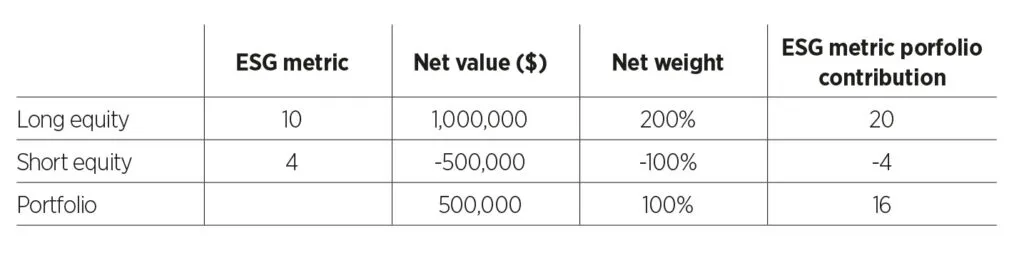

“Net exposures measure a portfolio’s sensitivity to price risks, while gross exposures measure the total amount of money the portfolio transacts in the market through both long and short legs,” the report authors wrote.

ESG metrics in the net exposures scenario would be offset between long and short legs to get the net portfolio level attributes. In the gross exposures scenario they would be summed across long and short legs.

Potential long-short portfolio ESG weighting

Other options for ESG reporting included:

- Long only reweight where the short leg of the portfolio is ignored in the calculation of the capital invested in each asset.

- Long only gross reweight which uses the gross weights of all assets but only considers ESG metrics for the long leg.

- Long and short legs being reported separately in terms of ESG metrics.

Although the last option provides transparency for both legs, it does not provide a portfolio level aggregated ESG metric, MSCI noted.

If an investor is aggregating their ESG reporting using any of the above options, investors should still put this alongside separate metrics for both long and short legs, according to the researchers.

ESG issues

As ESG data varies so much, the report also looked at reporting structures for three types – controversial business involvement, positive impact and carbon emissions.

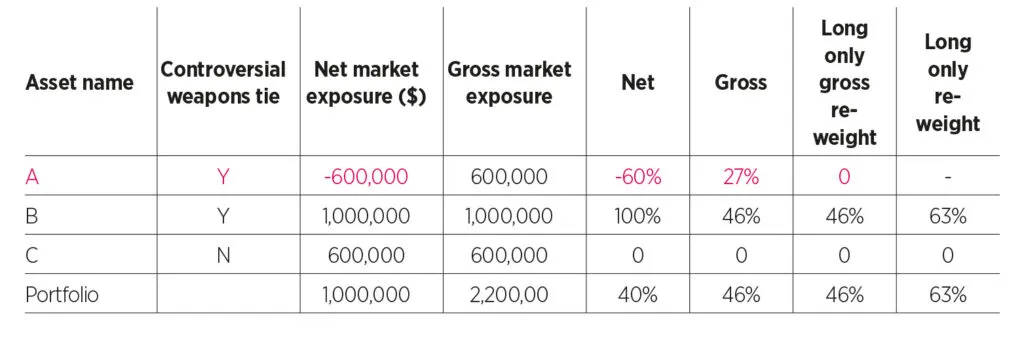

Controversial business involvement weighting

MSCI provided recommendations for which reporting type it found best suited these kinds of ESG approaches:

- Business involvement: gross reporting, as this demonstrates total portfolio exposure to the business activity and flags potential reputational or values-based risks.

- Positive impact: long-only gross reweight, as this demonstrates the directly financed and owned positive impact for the portfolio.

- Carbon emissions: long-only reweight, as this demonstrates the directly owned ‘real world’ carbon emissions.

Shorting and ESG investing

Short positions are sometimes argued to be an effective part of an ESG investment strategy as it could punish a company through raising its cost of capital and thereby influence company management to adopt ESG. However, MSCI said it found little evidence to support the view shorting raised the cost of capital on a consistent basis. The group concluded this advantage may only apply in certain individual cases.

Other ways short positions can exercise active ownership are by publicly declaring a short position based on ESG or climate principles or through indirect engagement with the company even though they do not have a vote as those with long positions do.

An investor with a purely economic interest in a company through a short position may benefit from that company performing poorly on ESG. MSCI said due to this fact, investors ought to disclose both their economic exposure to ESG risk and their ownership stake in a company in order to maximise transparency in their portfolio.