There is still relative value among high yield bonds in Asia ex-China compared with developed markets, although that’s not the case in investment grade, where relative spreads are tight, Julio Callegari, chief investment officer of Asia fixed income at JP Morgan Asset Management, told FSA.

Based in Hong Kong, Callegari (pictured) is responsible for overseeing portfolio management, research, and trading in Hong Kong. He moved to Hong Kong from Brazil in 2018 as lead portfolio manager for Asia local rates and FX in 2018 and has been a member of the firm’s global fixed income, currency & commodities group since 2011.

In an uncertain environment for US interest rates, JPMAM has deployed a barbell strategy for its flagship $1.38bn Asian Total Return Bond Fund, which is managed by Callegari and his colleagues Shaw Yann Ho and Jason Pang. It captures a yield of 6.5-7% and minimises volatility with short-dated corporate bonds, and takes long duration exposure through US treasuries and euro government bonds.

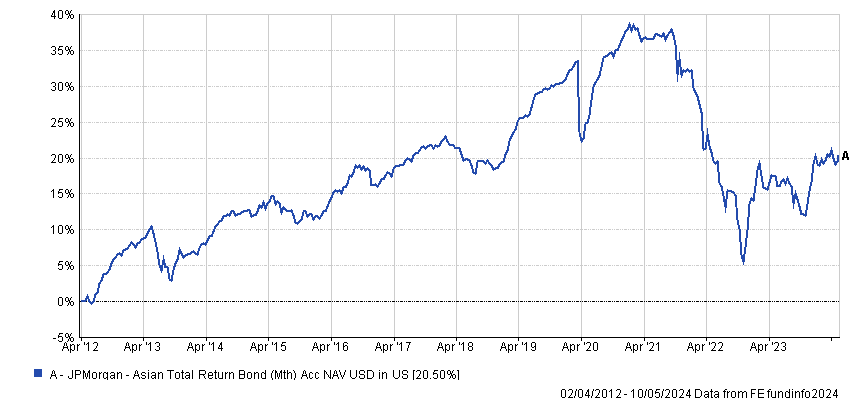

The fund has generated a return of 20.5% since inception in April 2012, according to FE fundinfo data. The past three years have been tough for bond fund managers, and the fund is down 4.07% during that period, although with relatively low volatility of 6.15, and a respectable 1.14 information ratio (a measure of risk-adjusted returns), FE fundinfo data shows.

In fact, the Asia bond market has changed radically in just the past two years. At its peak it was worth $1.5trn, but net redemptions by Chinese state-owned enterprises and defaults by China property companies has contracted its size by $200bn and a further $50bn this year so far.

“This significant contraction in the market is technically supportive; there is scarce new supply in the Asian market, despite strong local demand,” said Callegari.

Sovereign US dollar issues by some Asian emerging markets, such as Indonesia and the Philippines, are also able to price at low spreads because local banks gain tax exemptions to buy them. The Philippines, for example, recently launched a 10-year bond issue at just 80 basis points over the equivalent US treasury yield.

Yet, there are some sweet spots in Asia credit. “A particular favourite is Macau gaming, whose bonds trade at a yield premium over US gaming bonds,” Callegari said.

“They are typically cash-rich and have a very different business model to other sectors, notably debt-burdened China property companies.” In India, Callegari prefers renewables and energy.

He also likes South Korean banks’ AT1 (additional tier 1) bonds, despite the write down of $17.5bn of Credit Suisse AT1 debt to zero as part of its forced rescue merger with UBS a year ago. “In Korea, there is clear expectation that banks will call their bonds early to maintain their reputation among investors,” said Callegari.

Moreover, few fixed income investors in the past have considered Japanese and Australian corporate bonds, “but absolute yields have moved higher in tandem with US treasury yields, which has provided an opportunity to lock in yields for superior credits.”

Local rates for funding rather than carry

The opportunities in Asia domestic markets are fewer, because of the potential for foreign exchange losses.

The US dollar is fundamentally over-valued and should weaken over the next couple of years, according to Callegari. It is especially strong versus Asian currencies – notably the yen — where the real effective exchange rates are among the lowest in the past two decades.

However, US “exceptionalism” means that the US economy can probably still thrive despite “higher for longer” interest rates, and without an incentive for the Fed to cut rates, the interest rate differential with most Asian countries (where central banks have been reducing their key rates) is likely to remain tight for a while.

“Nevertheless, current rates are too restrictive, and the Fed will eventually cut them,” said Callegari.

For the moment, JPMAM’s Asia funds have a small underweight to Asia domestic fixed income, and in fact use the yen, renminbi and Taiwanese dollar to finance other positions.

Among typical high yielding domestic markets, Callegari has a positive tilt towards India (where the central bank is successfully stabilising the rupee), but the Indonesian rupiah market is less appealing than usual with 10-year yields now as low as 7%.

Callegari’s team had owned China government bonds (CGB) for a long time when the 30-year yield was at 3%, which on a hedged basis generated a further two percentage points, but they sold out their positions when the yield broke through 2.5%.

“For carry, there are better opportunities among Latin American currencies, such as the Mexican peso and (tactically) the Brazilian real,” said Callegari.

The key risk for all bond markets, according to Callegari, is sticky or a reacceleration of inflation in the US, and then investors might start to speculate about interest rate hikes rather than cuts.