Sam Witherow, JP Morgan Asset Management

The JP Morgan Global Dividend Fund is designed to deliver excess returns for clients from a portfolio generating a higher yield and compounding at a faster rate than the average from world markets, according to JP Morgan AM.

“Our approach is to try and find the ‘sweet spot’ in terms of sustainable dividend growth. We do this by primarily investing in compounders – those stocks in the upper-middle cohorts of dividend yield and dividend growth,” Sam Witherow, portfolio manager of JPM Global Dividend Fund, told FSA.

These typically offer the best long-term absolute and risk adjusted returns. The fund then makes more tactical allocations to stocks with the highest yields and those with the fastest dividend growth, Witherow explained. The gross yield on the fund is around 3.1% and the distribution yield is currently 2.6%, according to Witherow.

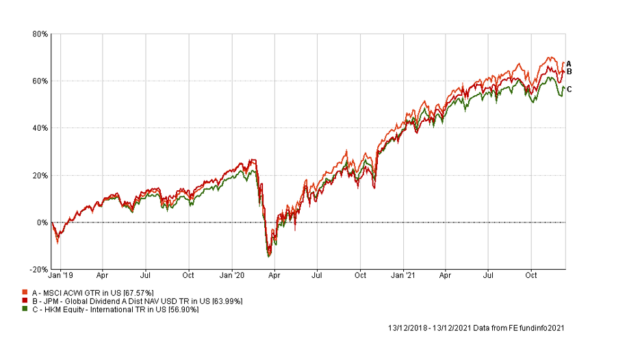

The $647.2m fund has posted a three-year cumulative return of 63.99%, compared with its benchmark MSCI ACWI of 67.57%, and its sector average of 56.90%, according to FE Fundinfo.

Its top five sectors as at end October 2021 are: others (40.4%), technology- semi & hardware (10.7%), banks (10.5%), pharmaceuticals/medtech (9.9%), industrial cyclicals (7.8%), according to the fund’s factsheet. Top five holdings include Microsoft, Analog Devices, Coca-Cola, Apple and Prologis. Geographically, the fund invests in the US, Europe & Middle East, emerging markets, Canada and UK.

Technology companies can be “excellent examples of stocks which offer sustainably fast dividend growth, offsetting lower yields today,” said Witherow. An example is Texas Instruments, which has grown to be one of the largest suppliers of analog and embedded processors globally, whilst consistently growing their dividend for 15 sequential years.

“We find technology companies with proven business models and a material runway for earnings growth provide access to more diversified investment insights,” he said.

Europe overweight

The fund remains overweight cyclical stocks in Europe, a position it initiated last year, as Witherow identified an appealing risk/reward proposition in a sector distinguished by low valuations and an improving macroeconomic backdrop.

European banks, for example, still largely trade below their book values despite returns on equity nearing double-digits and with the prospects of rate rises at some point down the road, he added.

The fundamentals of dividend paying stocks more broadly are looking cyclically attractive. The fund expects to see above trend dividend growth over the next few years, which is particularly prevalent across more cyclically exposed sectors, such as banks and industrials, as economies begin to recover to a more normalised level of output.

This is in stark contrast to some sectors, such as the telecommunication sector, where we think the current level of dividend payouts are unsustainable, given increased competitive pressures and the need for further investment to support wireless rollout, according to Witherow.

“As we start to think more towards the midterm, we continue to favour stocks and industries, such as the semiconductor industry, which have the capacity and willingness to sustainably grow dividends throughout the cycle,” he said.

Inflation risk

In terms of the risks that investors should be aware of, Witherow pointed out that equities typically perform well in an inflationary environment relative to other asset classes as they are nominal assets priced off nominal cash flows.

Inflation typically favours asset heavy industries like banks, materials, energy and industrials the most. But it can also favour industries with high pricing power and high gross margins such as software or luxury goods, he said.

However, higher interest rates will put more pressure on equity valuations, especially sectors that are trading on loftier valuations. Investors who are biased towards growth should consider a more balanced portfolio in such environment, adding exposure to cyclical- and value-oriented sectors that are cheaper, positively correlated with interest rates and poised to benefit from the post-pandemic economic recovery, Witherow argued.

Meanwhile, given the high correlation between value and income, a more income-oriented portfolio will likely deliver strong performance in this constructive environment for value, he said.

“It’s crucial for investors to strike a balance between dividend yield (for less volatile returns) and future growth potential (for long-term capital growth) and stay diversified by region and sector.”

JPM Global Dividend Fund vs benchmark and sector average