Invesco’s product director for the Asian and emerging market equities team favours Korean equities as part of an overall contrarian approach.

“We are contrarian at the point of purchase and like to buy companies that are trading below fair value,” said John Pellegry, product director for the Asian and emerging market equities team at Invesco.

“We look for areas in the market that are out of favour or might be temporarily troubled or sectors that are going through a rough period.”

To identify companies that are undervalued, Pellegry recommended looking at economies that people are cautious about.

As one of the few economies that adhered to a zero-Covid policy for the majority of 2022, China was one of the worst performing equity markets last year.

“We were leaning into risk taking positions as the market was negative on China because we felt that the market was too pessimistic on the outlook over the next three years.”

“As there is a lot of negativity embedded in the share price, there is not a need for a lot of good news for these stocks to do well.”

Prices for Chinese stocks rallied at the end of last year after the Chinese government announced it would end most of its Covid restrictions in December.

Looking forward, Pellegry favours Korea as the market sentiment there, given its reliance on the semiconductor and technology sector, has also dampened lately.

“We are at a point where the profitability of semiconductor companies is coming down and they are starting to cut cost and capital expenditure, which will potentially lead to a lack of supply in the future,” he said.

“This seeds for better profitability going forward. Given that we are looking at the long-term prospect, the cutting of supply is going to be beneficial for the semiconductor cycle.”

He notes that valuations for Korean companies, such as memory chip producers, are at a historical low now and is confident that the profitability of these companies will start to improve when the semiconductor cycle starts to pick up.

Invesco offers the Asian Equity Fund to Hong Kong retail investors.

Incepted in 2018, the fund allocates 32.7% of its asset under managements to Chinese stocks, 15% to South Korean stocks and 14.3% to the Taiwanese stocks.

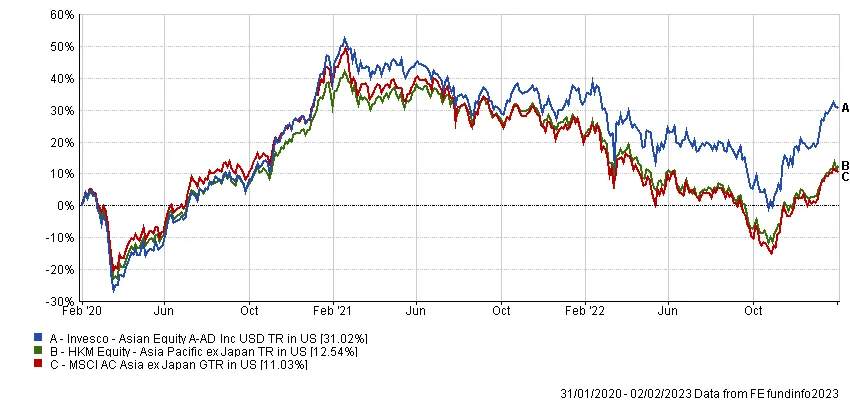

The portfolio has around $1.22bn in net asset value and invests in around 60 stocks across Asia. When compared with the Asia Pacific ex Japan average, the Invesco fund posted a 31.02% cumulative return over three years, while the sector reported a 12.54% return. Meanwhile, the MSCI AC Asia ex Japan benchmark posted a cumulative return of 11.03% over the same period, according to FE fundinfo.

Invesco Asian Equity Fund vs index average vs sector average