This year has been a rocky year for fixed income, as expectations in October that the US Federal Reserve would hold rates steady pushed yields to their highest level since the global financial crisis. Subsequently, bonds reversed course and rallied in November amid growing optimism about interest rates.

Interest rate futures now show investors are expecting the Fed to cut rates by at least a quarter point in its May meeting compared with expectations just a few weeks ago that there was no chance of an interest rate cut until the second half of next year at the earliest.

Despite this seesawing, one curiosity has been the extent to which high yield has outperformed investment grade. The Bloomberg Global High Yield index, for example, is up 10.27% this year compared with a 2.16% rise in the broader Bloomberg Global Aggregate index.

Explanations for the robust performance of high yield this year include the fact that the number of issuers has shrunk and that the primary market has effectively ground to a halt.

Despite this outperformance, most asset managers still favour investment grade credits, arguing that the spreads on offer for high yield do not currently compensate them for the risk.

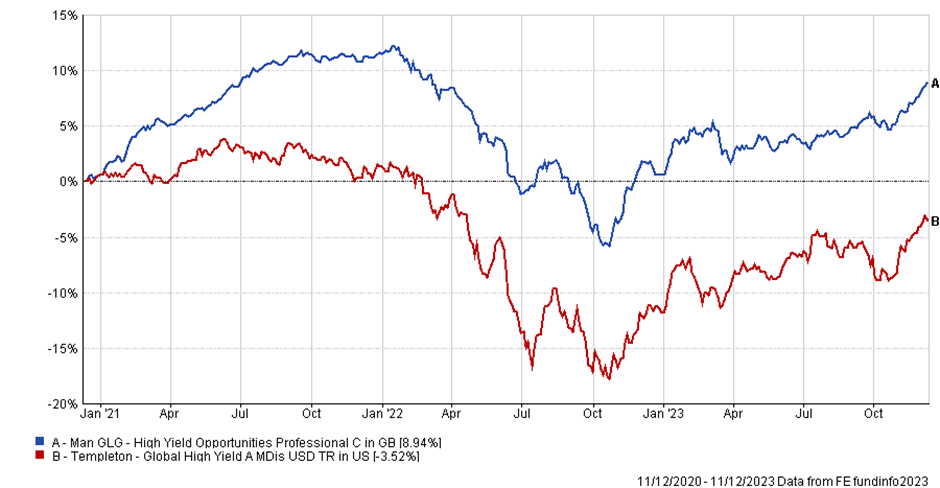

Against this background, Darius McDermott, managing director at Chelsea Financial Services, chose the GLG High Yield Opportunities and the Templeton Global High Yield funds for this week’s head-to-head.

| Franklin Templeton | Man GLG | |

| Size | $ 78.9m | $428.4m |

| Inception | 2007 | 2019 |

| Managers | Michael Hasenstab, Glenn Voyles, Tricia O’Connor, Calvin Ho | Michael Scott |

| Three-year cumulative return | -1.07% | 3.43% |

| Three-year annualised return | -1.13% | 2.87% |

| Three-year annualised alpha | -2.85 | 2.29 |

| Three-year annualised volatility | 8.03 | 5.05 |

| Three-year information ratio | -0.50 | 0.69 |

| FE Crown fund rating | * | *** |

| OCF (retail share class) | 1.25% | 1.57% |

Investment approach

Man GLG High Yield Opportunities is an unconstrained global high yield bond fund and manager Mike Scott focuses his efforts towards the more speculative end of the market, which includes shorting some issues.

The fund’s positions are weighted depending on how attractive the investment opportunity is with particular emphasis on the sector or country, the liquidity and the seniority of the debt.

Overall, Scott takes a top-down approach to investment, while the final portfolio comprises around 60 to 80 names altogether.

Meanwhile, the Templeton Global High Yield fund has a far larger exposure to emerging markets compared with the Man GLG strategy, including India, Brazil, Indonesia, Ecuador and Mexico. The fund also has around half of its allocation in the US compared with just 4% for the Man GLG fund.

The Templeton fund also has far more holdings at around 300 issuers as well as less exposure to higher yielding issuers with 27.5% held in single B versus 47.4% for Man GLG and 10.4% in triple C versus 13.4% for Man GLG.

Country allocation:

| Franklin Templeton | Man GLG | ||

| USA | 50.71% | Europe excl. UK | 53.37% |

| India | 5.28% | UK | 44.1% |

| Brazil | 4.36% | Latin America | 6.11% |

| Indonesia | 3.43% | Middle East | 3.34% |

| Ecuador | 3.04% | North America | 3.09% |

| Hungary | 2.66% | ||

| Mexico | 2.59% | ||

| Dominican Republic | 2.44% | ||

| Other | 21.3% | ||

| Cash & Cash Equivalents | 4.2% |

Sector allocation:

| Franklin Templeton | Man GLG | ||

| n/a | n/a | Financials | 36.32% |

| n/a | n/a | Consumer Discretionary | 22.55% |

| n/a | n/a | Communication Services | 9.44% |

| n/a | n/a | Real Estate | 9.16% |

| n/a | n/a | Industrials | 8.17% |

| n/a | n/a | Healthcare | 5.94% |

| n/a | n/a | Consumer Staples | 5.07% |

| n/a | n/a | Unclassified | 4.05% |

| n/a | n/a | Utilities | 3.02% |

| n/a | n/a | Materials | 2.94% |

| n/a | n/a | Information Technology | 2.2% |

| n/a | n/a | Energy | 1.16% |

Performance

McDermott notes that the high yield market is very much akin to stock picking, so the active management skills of each team are important.

“I’d argue that the Templeton fund should outperform when emerging market metrics are in favour and vice versa for developed markets with Man GLG. But, ultimately, it will be largely down to security selection,” he said.

Scott, he notes, is a high conviction manager and the typical holding period is just a year, so positions can turn around quickly, particularly for more opportunistic trades.

At least 80% of the fund is hedged back to sterling, whereas almost two-thirds of the Templeton fund is exposed to US dollars.

McDermott notes that the Man GLG fund comfortably beat the Templeton fund in 2021, but this was reversed last year.

Regarding fees, McDermott notes that at 1.57% versus 1.25%, fees for the Man GLG strategy are a fair bit higher.

Discrete calendar year performance:

| Fund | YTD* | 2022 | 2021 | 2020 | 2019 |

| Franklin Templeton | 9.37% | -12.8% | 0.63% | 0.9% | 7.12% |

| Man GLG | 8.25% | -9.75% | 10.9% | 15.66% | n/a |

Manager review

McDermott notes that Franklin Templeton has a large fixed income team and the four fund managers – Michael Hasenstab, Glenn Voyles, Patricia O’Connor and Calvin Ho – are all very experienced.

Hasenstab has been with Franklin Templeton since 1995, aside from a sabbatical to complete his PhD, while Voyles, O’Connor and Ho have been with the investment manager since 1993, 1997 and 2005 respectively.

Meanwhile, Scott has almost two decades worth of investment experience, starting his career at Cazenove Capital Management in 2005 before moving to Schroders a year later, where he spent four years as a European industrials credit analyst before becoming a portfolio manager on the Schroder High Yield Opportunities fund.

He joined Man GLG in 2019 to launch this fund.

Conclusion

Overall, McDermott notes that the two funds play different roles in a portfolio given the fact that they invest in different areas of high yield largely.

The Franklin Templeton fund has struggled a bit more during the past few years given its exposure to emerging markets, however.

“If forced to choose I would lean towards Mike Scott because he has demonstrated an excellent stock picking ability throughout his career. He has brought that talent into this fund and also expanded his investment flexibility to being able to take short positions,” said McDermott.

“He is also happy to run one of the riskier funds in the sector, buying distressed bonds low down the credit spectrum but with a chance of recovery. The flexibility of his mandate allows a lot of diversification within the holdings, which should help spread the risks.”