The FSA Spy market buzz – 13 June 2025

Fund costs are sky high; Jupiter is using its shoes; Shenzhen and Hong Kong cosy up some more; A juicy space IPO; Global currencies and the dollar’s death; Charts from left to right and much more.

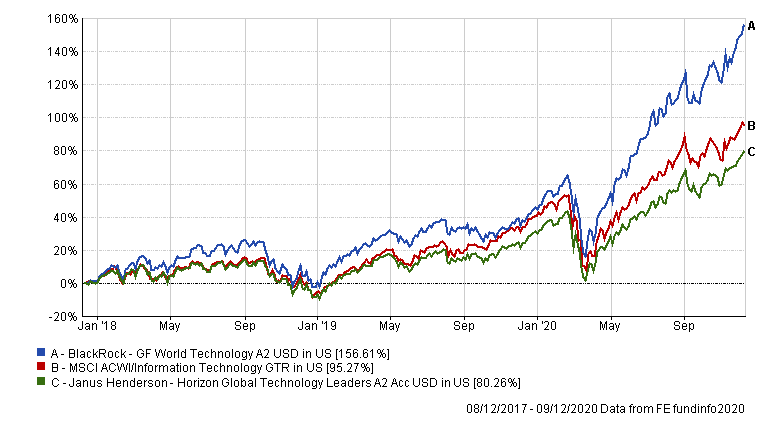

Given its tilts in opportunistic companies, the Blackrock fund is expected to outperform in environments where highly valued high growth stocks continue to outperform, such as most of 2020, according to Meakin.

“However, if we were to see a significant, sustained reversal of the current market leadership where high growth stocks on very high multiples de-rated, then the Janus Henderson fund’s more conservative approach to valuations may help it to outperform,” he said.

Annual calendar performance (%)

| Fund / index | YTD 2020 | 2019 | 2018 | 2017 | 2016 |

| Blackrock fund | 77.39 | 43.48 | -0.34 | 51.99 | 5.92 |

| Janus Henderson fund | 38.44 | 39.52 | -6.91 | 43.79 | 6.17 |

| Index: MSCI ACWI/Information Technology | 38.97 | 47.52 | -5.47 | 42.27 | 12.71 |

In terms of volatility, the Blackrock fund has been more volatile than the Janus Henderson offering.

“The Blackrock fund’s tilt towards names lower down the market-cap scale may explain some of this, and valuation risk is higher since it is willing to hold companies on higher valuation multiples than the Janus Henderson fund,” Meakin said.

Three-year annualized volatility

| Fund / Index | Volatility | Sharpe ratio |

| Blackrock | 24.37 | 1.33 |

| Janus Henderson | 21.66 | 0.81 |

| MSCI ACWI/Information Technology Index | 23.24 |

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Investment Ideas for 2021: Explore the untapped potential in China Small Companies

Impact opportunities: investing to limit biodiversity loss

Impact opportunities: investing to limit biodiversity loss

The future of mobility

The future of mobility

Unmasking the dividend opportunity

Unmasking the dividend opportunity

Tech WELLcovered | Work reimagined

Tech WELLcovered | Work reimagined

Sustainable Investing in Changing Market Conditions

Sustainable Investing in Changing Market Conditions

Exciting opportunities in AI & Robotics outside of traditional tech

Exciting opportunities in AI & Robotics outside of traditional tech

China’s post-pandemic growth gathers pace

China’s post-pandemic growth gathers pace

The year of living dangerously for income investors

The year of living dangerously for income investors

Step up your portfolio by doubling down on sectors set for long-term growth

Step up your portfolio by doubling down on sectors set for long-term growth

Fund costs are sky high; Jupiter is using its shoes; Shenzhen and Hong Kong cosy up some more; A juicy space IPO; Global currencies and the dollar’s death; Charts from left to right and much more.

Part of the Mark Allen Group.