The FSA Spy market buzz – 16 May 2025

Playing monopoly with ETFs; Eastspring is worrying about loss aversion; Family office explosion; SGX wants more action; The Fear and Greed Index; Retail investors plough on; Deepfake fraud and much more.

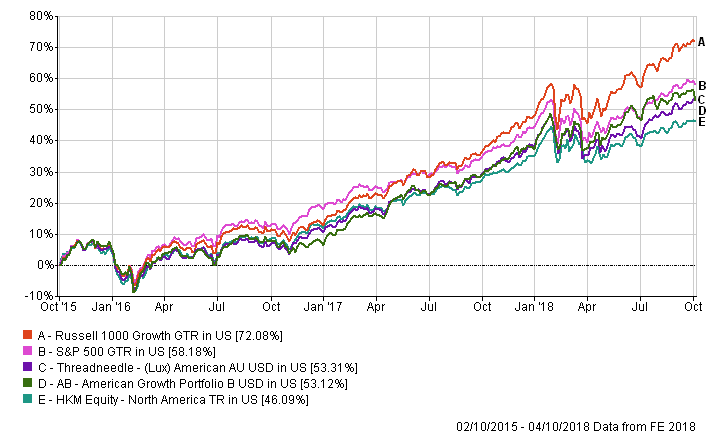

Although both funds have underperformed their benchmark indices, Ng noted that they have outperformed their sectors on a three-year basis.

Ng highlighted 2016, when both funds largely underperformed.

Discreet annual calendar performance

| Fund / Index |

2018 |

2017 | 2016 | 2015 | 2014 | 2013 |

| AB American Growth Portfolio |

13.14 |

28.92 | 0.52 | 8.52 | 11.71 |

34.37 |

| Index: Russell 1000 Growth |

17.09 |

30.21 | 7.08 | 5.67 | 13.05 |

33.48 |

| Threadneedle (Lux) American Fund |

11.14 |

24.8 | 5.08 | 1.61 | 8.94 |

32.91 |

| Index: S&P 500 |

11.01 |

21.83 | 11.96 | 1.38 | 13.69 |

32.39 |

|

Sector: HKM Equity |

8.3 | 20.51 | 7.19 | -1.31 | 10.22 |

32.5 |

“When Donald Trump was elected US president, there was a strong cyclical rally, with low-quality stocks going up.”

At the time, fund managers focusing in growth-oriented companies underperformed during the period, he added.

Meanwhile, both funds performed well in 2017, benefitting from the performance of growth stocks during the year, particularly in the IT sector. However, the AB Fund underperformed its own benchmark.

“The AB fund is a growth-oriented strategy, but it doesn’t mean that 100% of the fund invests in growth areas,” said Ng. “It still holds some consumer staples and even financial and material names, which may not be in the Russell Index.”

In terms of volatility, Ng is not concerned by ether fund, since they are in line with the market.

| Fund / Index |

YTD volatility |

| AB American Growth Portfolio |

14.42% |

| Index: Russell 1000 Growth |

15.52% |

| Threadneedle (Lux) American Fund |

15.03% |

| Index: S&P 500 |

14.72% |

| Sector: HKM Equity North America |

14.34% |

China bonds: plugging the yield gap

China bonds: plugging the yield gap

Fixed income – making ground in ESG as ETFs see rapid growth in AUM

Fixed income – making ground in ESG as ETFs see rapid growth in AUM

Dynamism is the name of the game for this global macro strategy

Dynamism is the name of the game for this global macro strategy

Who’s afraid of higher interest rates?

Who’s afraid of higher interest rates?

Taking a thematic approach to harness disruption

Taking a thematic approach to harness disruption

M&G Episode Macro shines after tough year

M&G Episode Macro shines after tough year

Ninety One: Finding opportunities in times of change

Ninety One: Finding opportunities in times of change

Tech WELLcovered | Work reimagined

Tech WELLcovered | Work reimagined

Healthcare’s innovation shifts into high gear

Healthcare’s innovation shifts into high gear

Step up your portfolio by doubling down on sectors set for long-term growth

Step up your portfolio by doubling down on sectors set for long-term growth

Playing monopoly with ETFs; Eastspring is worrying about loss aversion; Family office explosion; SGX wants more action; The Fear and Greed Index; Retail investors plough on; Deepfake fraud and much more.

Part of the Mark Allen Group.