The FSA Spy market buzz – 6 June 2025

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

The Abrdn fund has generated a three-year cumulative return of 60.26%, compared with 68.82% by its reference benchmark, the MSCI ACWI, and 57.44% by the average international equity fund available to Hong Kong retail investors, according to FE Fundinfo.

During the same period, had annualised volatility of 16.67%, which was lower than both the index (19.74%) and the sector average (18.38%), FE Fundinfo shows.

However, “the strategy’s objective was transformed in October to a sustainable and responsible investment mandate in October, so the fund’s long-term performance figures are not really relevant,” said Liu.

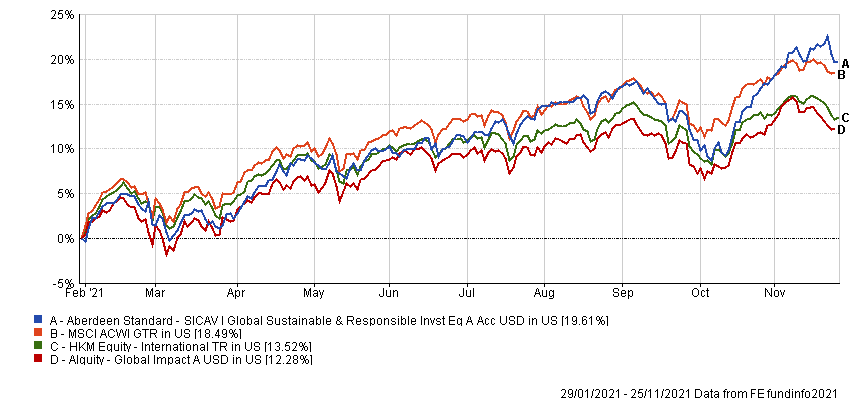

The Alquity strategy has delivered a 12.28% return since its inception on 29 January 2021, which is less than the Abrdn fund’s return of 19.61% since that date, according to FE Fundinfo.

“It’s too early to judge the performance of either strategy yet,” said Liu. “But, the concentrated nature of the Abrdn portfolio might mean that it will lag if stocks which had underperformed and been excluded due to low ESG scores recover,” she warned.

Meanwhile, by limiting its tracking error versus the MSCI World index to 4% to 6%, “the Alquity fund might be capping its future upside performance,” said Liu.

Who’s afraid of higher interest rates?

Who’s afraid of higher interest rates?

The year of living dangerously for income investors

The year of living dangerously for income investors

Driving decarbonisation: how to access new forms of alpha

Driving decarbonisation: how to access new forms of alpha

Don’t get left behind in fixed income

Don’t get left behind in fixed income

How ETFs offer an active way to drive sustainable returns

How ETFs offer an active way to drive sustainable returns

China bonds: plugging the yield gap

China bonds: plugging the yield gap

From “FAANG” to “MAMAA” to “Magnificent 7” – what’s in a name?

From “FAANG” to “MAMAA” to “Magnificent 7” – what’s in a name?

Tech WELLcovered | Work reimagined

Tech WELLcovered | Work reimagined

Healthcare’s innovation shifts into high gear

Healthcare’s innovation shifts into high gear

Appetite for thematic investments grows amid rates and inflation concerns

Appetite for thematic investments grows amid rates and inflation concerns

Animal spirits run wild; Franklin Templeton is taking credit; EM banking revolution; Not all luxury is equal; Death of search and the AI machine; George Soros on wins and much more.

Part of the Mark Allen Group.