Amy Kam, Gam Investments

A “seismic” change in approach to monetary and fiscal policy triggered by the coronavirus pandemic has prompted upward revisions to growth and corporate earnings expectations, Gam Investment’s macro-strategist Michael Biggs told a media briefing on Thursday.

In the past policymakers provided stimulus during recessions, and then withdrew the stimulus before it became inflationary. Now “they appear to be determined to wait until they see the inflation,” he said.

Meanwhile, the lifting of lockdown restrictions will unleash pent-up demand for services amid continued demand for physical goods which should bolster the balance of payments accounts of emerging market countries, according to Biggs.

In this environment, risk assets such as high yield bonds will benefit, and few more so than in Asia, said Amy Kam, head of Asian credit and manager of the Luxembourg-domiciled GAM Asian Income Bond Fund.

“Asia is the best emerging market region because of its current economic performance, led by China’s rapid recovery, its growth prospects, industry mix and diversification possibilities,” she said.

The GAM Asian Income Bond Fund has generated a 17.8% three-year cumulative return, in line with its JP Morgan Asia Credit Index benchmark (18.0%) and outperforming by a wide margin the average return of emerging fixed income funds available to Singapore investors (6.0%), according to FE Fundinfo.

The fund is also more stable than most emerging market fixed income funds, with annualised volatility of 7.16% during the past three years, compared with 9.42% for the category average, FE Fundinfo data shows.

HIGH YIELD PREMIA

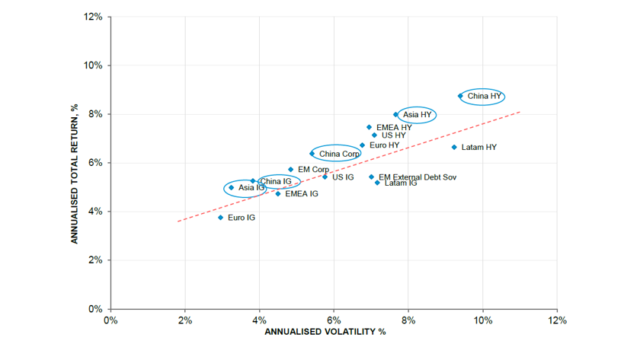

Kam highlighted Asian credit’s higher yields and lower volatility – represented by better Sharpe ratios — compared with other regions, low correlations with core developed bond markets, underpinning by a loyal domestic investor base, improving liquidity as the market approaches $1.2trn in size, and stable credit metrics, which are reflected in sub-3% corporate default rates.

“However, while there is limited potential for a narrowing of investment grade credit spreads, high yield spreads have room to compress further,” she said.

High yield Asian bond spreads are about 590 basis points (bps), which although narrower than the 650-700bps difference during the March 2020 sell off in risk assets, is wider than most other periods during the past decade, despite current expectations of declining bond default rates in the region, according to Kam.

“There is a fundamental and valuation disconnect,” she said.

Among high yield sectors, China property and India renewables are Kam’s top picks, while in investment grade she favours companies involved in new technologies, e-commerce, renewable energy, and electric vehicles.

Indeed, Asian credit is “turning green”, according to Kam.

“Only a small legacy of fossil fuel assets means there is tremendous potential for greenfield development, and there is also strong political will to drive sustainability,” she said.

Meanwhile, “China seems to be embracing its open-door policy, with or without the US,” said Kam, highlighting the Comprehensive Agreement on Investment reached with the European Union in December 2020, and the launch this year of the Yulan Bond programme, which allows global investors to settle their purchases of Chinese bonds issued through the Shanghai Clearing House within Euroclear’s network.

The biggest risk to the asset class in general, according to Kam, remains a deterioration in Sino-US relations, despite the ascension of a less strident president to the White House.

Sharpe Ratios: annualised total returns vs annualised volatility by region 2009 – Mar 2021