“Who has more power: the asset manager with a top performing strategy or the wealth manager who controls the end client?” was the question posed to Spy by a private banker this week over too many Mojitos at a rather decent cocktail bar in Mid-Levels. “Performance comes and performance goes, but the relationship with the client is the ultimate key to long-term wealth management. If I had one bit of advice for my younger self, it would be: spend more effort learning the true art of relationship building. It gives you longevity and that is a precious commodity.” In a brave new world of AI and robo-relationships, it was refreshing advice from someone who has seen an economic cycle or three.

Has the doom and gloom over China been rather overdone of late, ponders Spy. Writing China off (investment wise) for demographic and political reasons has almost become a cheap parlour game. Spy would happily remind the naysayers of China’s phenomenally large domestic market.

Case in point: Cotti Coffee, a local chain, had six (yes, six) coffee shops in October 2022. It now has 6,570. That is opening 365 stores per month. Its larger competitor, Luckin, has grown from just under 8,000 to more than 18,000 during the same period, or 555 per month, according to a tracking company named GeoHey. Where else in the world, can one possibly scale up a basic retail idea, a coffee shop brand, that massively and that rapidly?

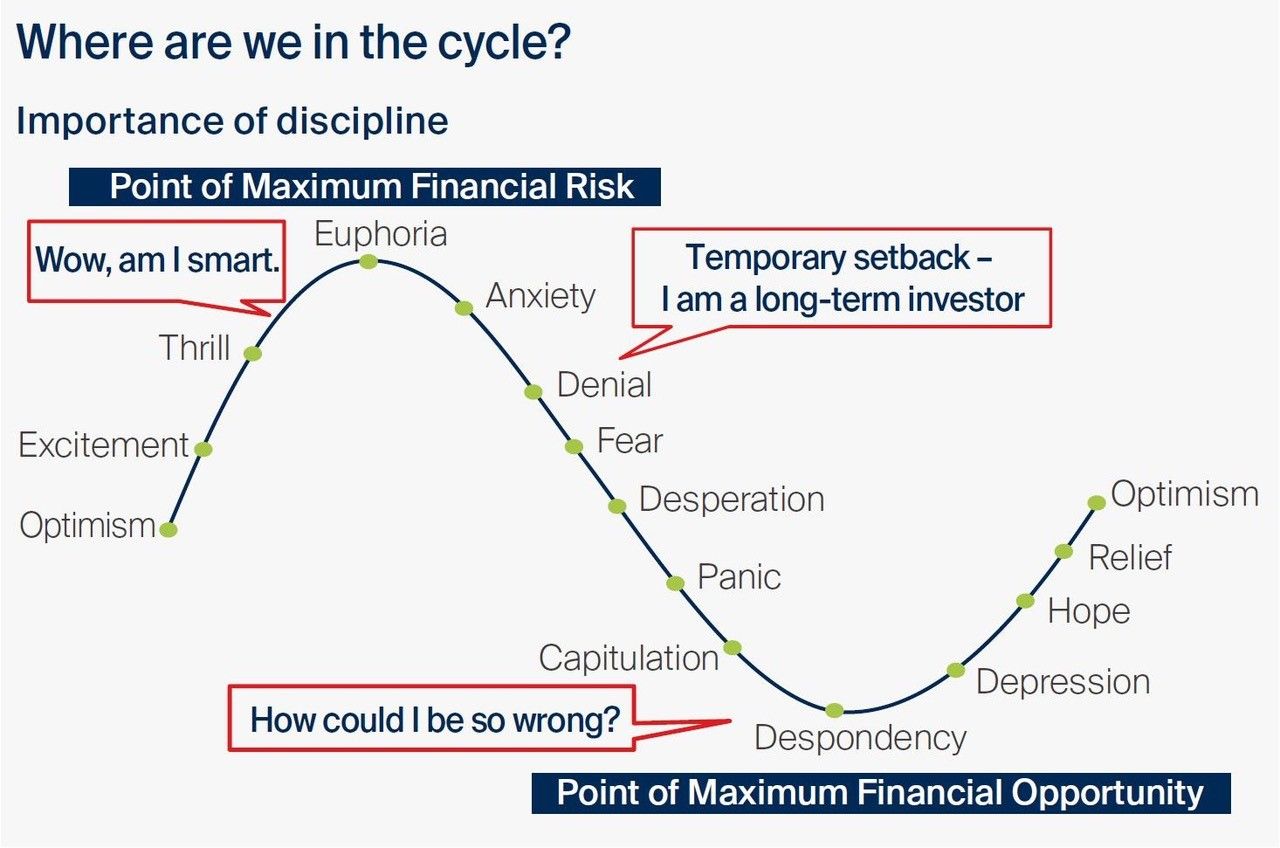

In light of the growth story above, Spy was interested to read some recent insights notes from Martin Lau, managing partner and veteran China investor at FSSA Investment Managers, “China is undergoing a difficult cycle because the property bubble has burst and also because of negative sentiment around geopolitics and regulations. There are usually signs of exuberance which mark the peaks of cycles, and signs of giving up which signal the troughs… Rather than trying to time the cycle, we focus on investing in quality companies.” It is very hard to disagree with that.

Hat tip to Alessandro Dicorrado and Steve Woolley, portfolios managers at Anglo-South African asset manager, Ninety One. They have written a superb and highly readable piece on risk. Namely the very real risk of going bust and how we underestimate it. They use Sam Bankman-Fried, the poster boy of crypto fraud and disaster, as a good example. “Quite how willing he was to take risky bets became very public during his recent court testimony, where it emerged that Bankman-Fried once told co-workers that he would always take a bet with a 50% chance of destroying the world if it offered a 50% chance of making it twice as good. This statement may look insane [it is], but it is only an extreme example of a miscalculation that we humans commonly make: we under-account for the probability of going bust.” Spy would recommend reading the article in full – it is the perfect reminder to worry about the downside and not always think about the upside.

Is the trend your friend? If Lombard Odier Investment Management (LOIM) is right, after a period where the United States has had the lion’s share of growth and outperformance, it might be Asia and Europe’s turn in the limelight. “When growth momentum in the US is stronger than in the rest of the world, US equities outperform. When the opposite happens, the situation can go the other way. At present, our growth indicators are starting to tilt in favour of the rest of the world, while the 12-month performance of US equities remains well ahead of peers.” If the art of investing is knowing when to pivot one’s broad asset allocation, the LOIM team is highlighting the relative attractiveness of the rest of the world – which makes a rather nice a change.

In the last week alone, one of Spy’s long-suffering readers has been asked to “circle back” on an idea after it has “been fully socialised” and thoroughly “cascaded through the team”. The daily spewing of this style of nonsense corporate jargon is tedious for all involved. Spy has to wonder if the overlord issuing such instructions ever stops to wonder what happened to good old-fashioned plain-talking that does not require verbal gymnastics or humiliating metaphors? How about “Get some feedback, please.”

Anyone fancy a trip to Japan? Now might be a good time to look at flights, reckons Spy. This week, the yen dropped to ¥154 to the US dollar, which just happens to be a thirty-four-year low. If Abenomics turns out to be nothing more than “money printer goes brr” with a Japanese accent, and a gush of paper printing, how long before people work out the United States is doing something very similar, on an even larger scale?

Spy’s quote of the week comes from, Peter Lynch, Fidelity’s star investment manager of the Magellan Fund in the 1980s, “You get recessions, you have stock market declines. If you don’t understand that’s going to happen, then you’re not ready, you won’t do well in the markets.” Some might call it folksy – but it isn’t wrong.

Until next week…