After a better-than-expected year for global fixed income strategies in 2023, some of last year’s top-ranked funds have continued to deliver strong returns in the first quarter of 2024.

Although the widely expected recession was avoided in 2023, markets struggled to find an equilibrium for long-term interest rates, subjecting the US Treasury 10 year note to wild swings in volatility.

However, thanks to higher interest rates and a recession that never came, some of the higher yielding bond funds delivered the best gains in 2023.

Markets have moved from pricing-in up to five rate cuts at the start of the year, to potentially just one or two cuts after recent higher-than-expected inflation figures in the US.

Despite this dramatic change in interest rate expectations, some fixed income strategies are on track for another bumper year of returns.

Below are five top-ranked global fixed income strategies available for distribution in Hong Kong and/or Singapore* that have continued to deliver high returns in Q1 of 2024.

The data only considered funds that delivered top-ranked returns in 2023 and in the first quarter of 2024.

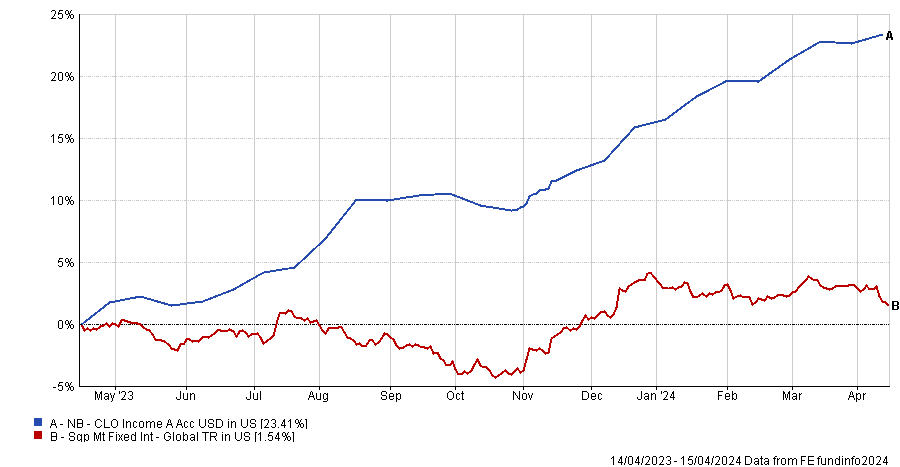

NB CLO Income

The NB CLO Income fund returned 5.8% in the first quarter of 2024, after delivering a top-quartile 20.4% return in 2023.

The $255m strategy focuses on investing in collateralised loan obligations (“CLOs”) and US high yield debt.

It is managed by Neuberger Berman’s Stephen Casey, Joseph Lynch and Pim van Schie.

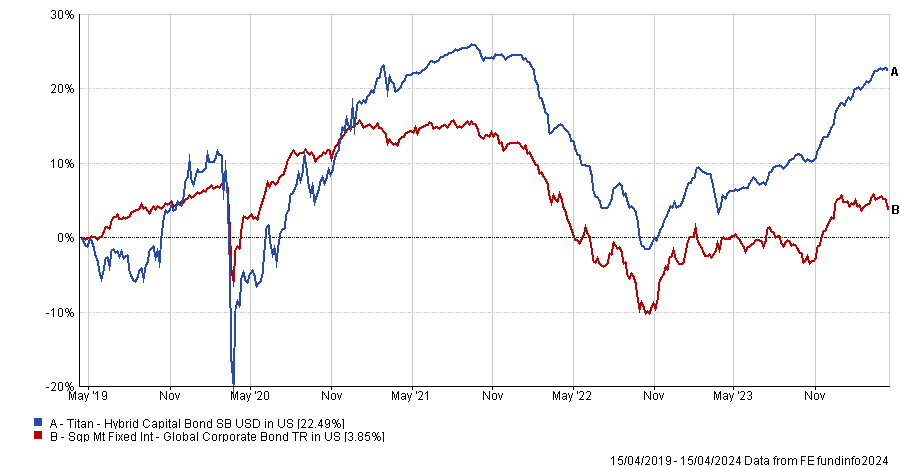

Titan Hybrid Capital Bond

The Titan Hybrid Capital Bond fund returned 4% in the first quarter of 2024, after delivering a 13.4% return in 2023.

The $258m strategy, previously the Sanlam Hybrid Capital Bond Fund, focuses on buying subordinated debt, investing lower down in the capital structure of high-quality A and BBB issuers.

It has been managed by Titan Asset Management’s Peter Doherty since it launched in 2016.

MDO – Fair Oaks Dynamic Credit

The MDO – Fair Oaks Dynamic Credit fund returned 3.6% in the first quarter, after a 18.59% return in 2023.

This $480m strategy is a long-only fixed income fund that invests in investment grade senior secured loans and CLOs.

It is managed by independent asset management and advisory firm Fair Oaks Capital, which specialises in CLOs and secured loans, founded by two former GSO Capital Partners veterans.

Securis Catastrophe Bond

The Securis Catastrophe Bond fund returned 3.5% in the first quarter of this year, after a 16.2% return in 2023.

This $254m fund invests in catastrophe bonds (“cat bonds”) – a type of insurance-linked security that transfers the risk of financial loss due to catastrophic events to capital markets.

It is managed by independent asset manager Securis Investment Partners, which specialises in insurance-linked securities.

Vontobel TwentyFour Strategic Income Fund

The Vontobel TwentyFour Strategic Income Fund returned 2.9% in the first quarter of the year, after a 9.8% return in 2023.

This $4bn fund is an unconstrained fixed income strategy that invests in assets ranging from government bonds to asset-backed securities.

It is managed by TwentyFour Asset Management, a boutique investment manager of Vontobel specialised in fixed income investing.

*Returns were measured in US dollar terms. The data only includes funds available to Singapore and/or Hong Kong investors based on the fixed income sectors classified by FE fundinfo. This is not an exhaustive list of all the top-performing strategies. Where five-year track record is not available, a 1-year return chart is shown instead.