In 2022, bonds suffered its worst year in history as the unwinding of ultra-low interest rates battered the asset class and caused billions in losses.

In 2023, bond investors were faced with continued interest rate hikes and unprecedented volatility at the long end of the curve. The US Treasury 10-year momentarily breached 5% and has continued to fluctuate on the back of an uncertain macroeconomic outlook.

But despite the downturns, a year-end rally in Treasuries and higher yields allowed most bond funds to finish the year 2023 with positive returns.

Against this backdrop, FSA highlights five bond funds larger than $5bn in size across the global, corporate, and high yield bond sectors that managed to post double-digit returns in 2023, according to data from FE fundinfo*.

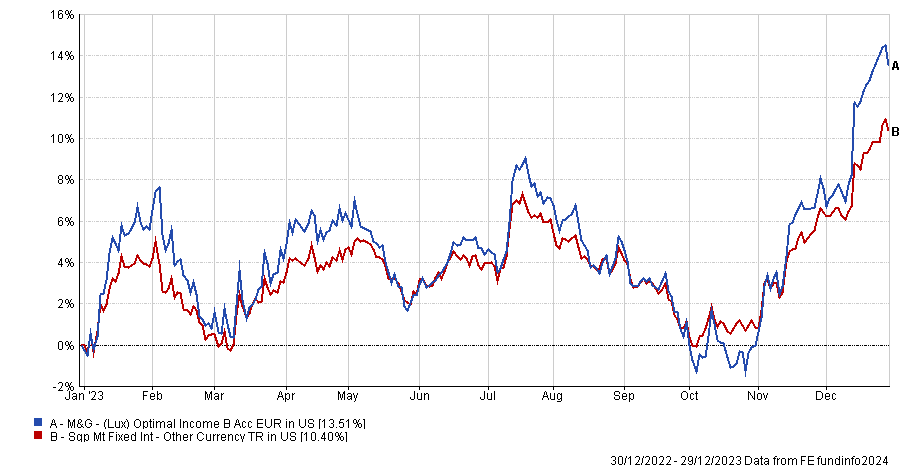

M&G (Lux) Optimal Income

This $10bn fixed income strategy is managed by Richard Woolnough. After suffering from a 17.69% loss in 2022, the fund delivered a return of 13.51% in 2023.

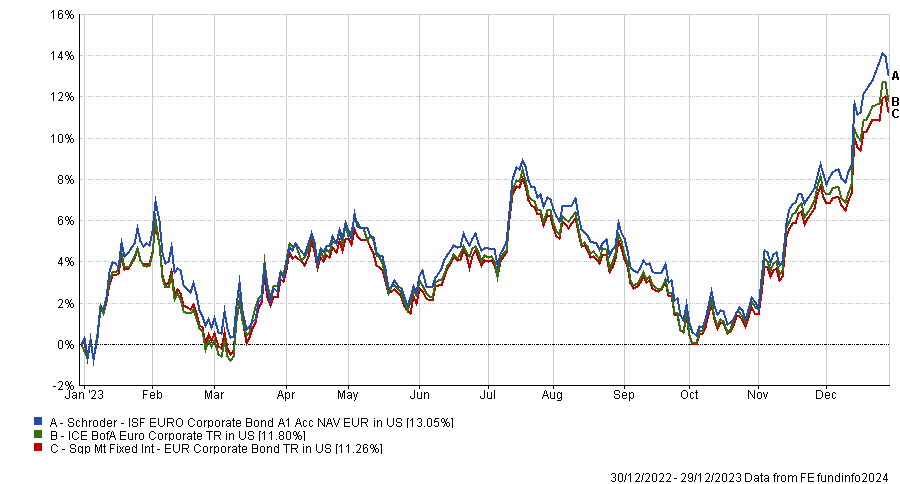

Schroder ISF EURO Corporate Bond

This $11.1bn corporate bond strategy is managed by Patrick Vogel. After a 21.54% loss in 2022, the fund posted a 13.05% return in 2023.

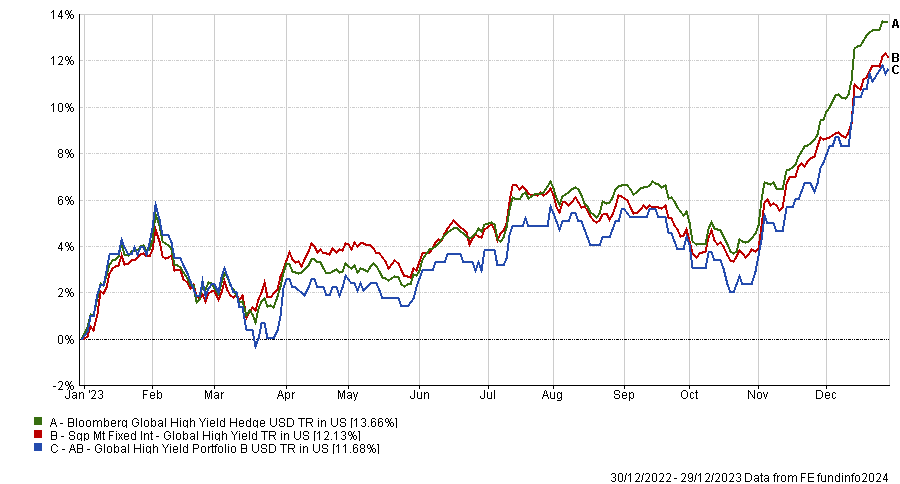

AB Global High Yield Portfolio

This $14.2bn high yield bond strategy is managed by Gershon Distenfeld, Matthew Sheridan, Fahd Malik, Christian DiClementi and Will Smith. After a 13.3% loss in 2022, the strategy was up 11.68% in 2023.

Eastspring Inv Asian Local Bond

This $5.2bn Asian bond fund is managed by Rong Ren Goh. After a 12.19% loss in 2022, the fund delivered a return of 10.77% in 2023.

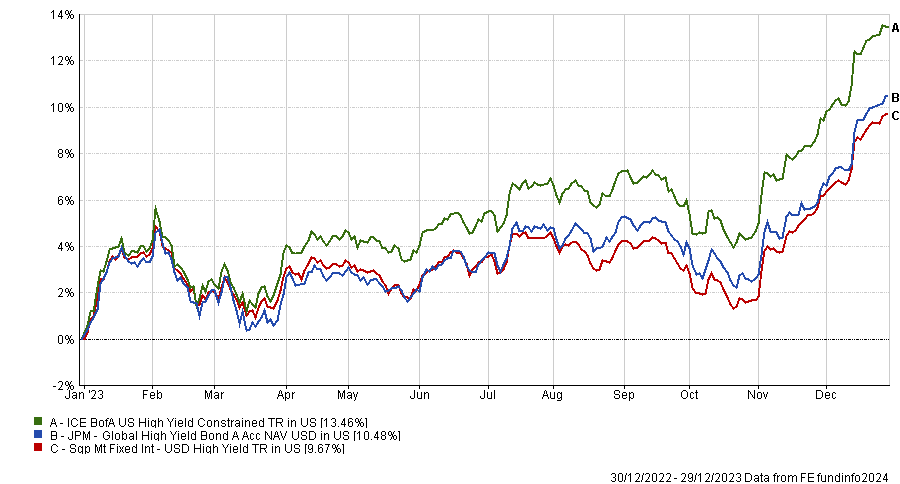

JPM Global High Yield Bond

This $5.3bn high yield strategy is managed by Robert Cook, Thomas Hauser and Jeffrey Lovell. After a 10.11% loss in 2022, the fund returned 10.48% in 2023.

*Returns are measured in US dollar terms. The data only includes funds available to Singapore and/or Hong Kong investors based on the fixed income sub-segments classified by FE fundinfo. This is not an exhaustive list of all strategies with double digit returns.