The past three years has been a difficult environment for global equity funds, but these five giant global equity strategies have bounced back after two years of underperformance.

The year 2021 was driven by massive central bank stimulus, whereas 2022 was dictated by central banks hiking interest rates aggressively.

So far in 2023, markets have been resilient amid higher interest rates and companies have delivered robust earnings despite an uncertain macroeconomic backdrop.

With this backdrop, FSA looked at the funds over $3bn in size, available for distribution in Hong Kong and Singapore, that have managed to outperform year-to-date, after enduring two consecutive years (2021 and 2022) of bottom-quartile performance, based on data from FE fundinfo*.

Below are the five funds ranked by year-to-date returns.

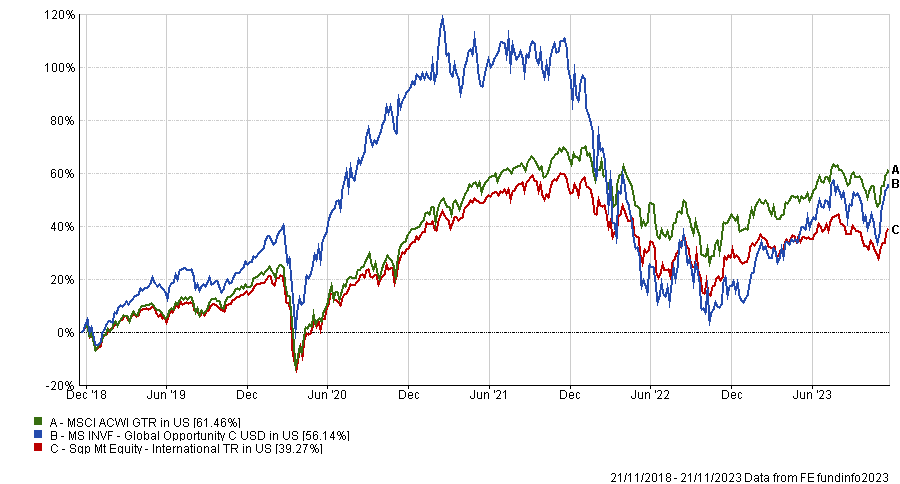

The $11.8bn Morgan Stanley Global Opportunity fund is one of the best performing global equity funds in the sector year-to-date with a return of 39.54%.

However, this follows a 42.92% loss in 2022 (versus a 17.73% loss from the MSCI World index) and a 0.86% loss in 2021 (versus a 22.35% gain from the MSCI World index).

Run by Kristian Heugh, this quality-growth focused strategy was soft closed at the end of 2020 due to its size, but reopened at the start of 2023. Its biggest holdings are Uber, ServiceNow and HDFC Bank.

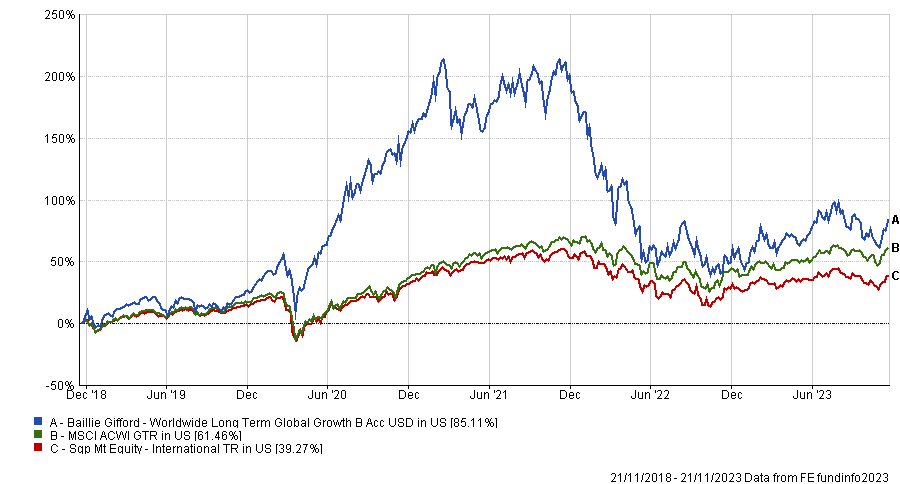

The $3.4bn Baillie Gifford Worldwide Long Term Global Growth fund is another top-performing global equity fund year-to-date with a return of 24.94%.

Managed by Scottish-based asset manager Baillie Gifford, the fund has bounced back after a 47.1% loss in 2022 and a 1.41% gain in 2021.

Run by the firm’s Long Term Global Growth team, its investment philosophy is centered around identifying companies with exceptional growth potential and holding them for the long term. Its biggest holdings are Amazon, Nvidia and PDD Holdings.

The $3.7bn Sands Capital Global Growth Fund is another global fund that has bounced back in 2023 after two years of underperforming its global peers.

This strategy is up 19.84% year-to-date, following a 43.95% loss in 2022 and a 9.59% gain in 2021. It is run by Brian Christiansen, David Levanson and Perry Williams.

The investment philosophy of Virginia-based Sands Capital is centered around identifying companies with sustainable competitive advantages, strong growth prospects, and exceptional management teams. Its largest holdings are Alphabet, Amazon and ASML.

The $3.4bn T. Rowe Price Global Focused Growth Equity is another top-performer year-to-date, with a return of 19.71%.

The Maryland headquartered firm’s strategy was down 29.62% in 2022, and up 8.67% in 2021.

T. Rowe Price’s David Eiswert runs the fund with a focus on finding companies with above average and sustainable earnings growth. Its largest holdings are Microsoft, Amazon and Apple.

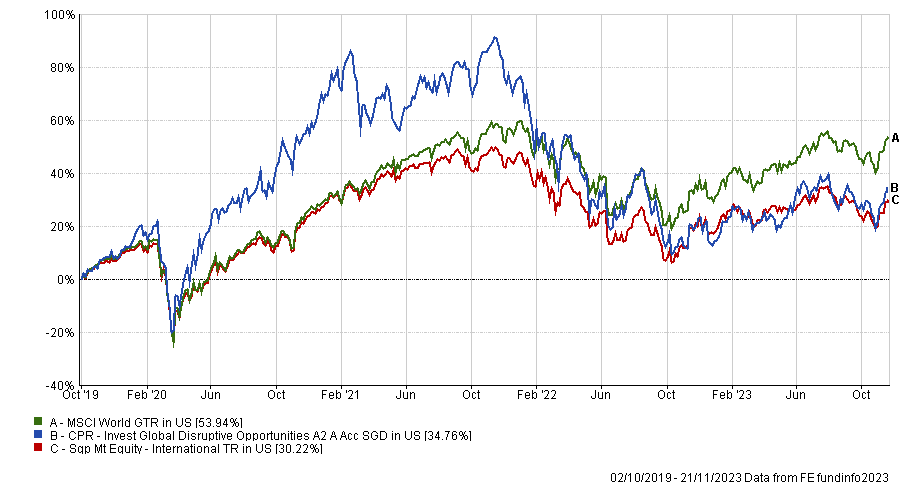

The $4bn CPR Invest Global Disruptive Opportunities fund is a strategy with a top-ranked return year-to-date.

So far in 2023, it is up 18.23% after suffering from a 35.44% loss in 2022 and posting a 3.96% gain in 2021.

Run by CPR Asset Management, a subsidiary of French asset manager Amundi, the firm focuses on investing in companies that are at the forefront of disruptive trends and technologies. Its largest holdings are in Microsoft, Amazon and Apple.

*The top-performing funds were measured in US dollar terms. The year-to-date performance is based on data from FE fundinfo ending 21/11/2023. The data only includes fund vehicles that fall under the Hong Kong SFC Authorised Mutual or Singapore Mutual equity international sectors in the FE analytics platform. The performance ranking was based on the fund’s Singapore or Hong Kong sector peer group.