Regulators are pushing China’s companies to improve their corporate behaviour, as well as provide evidence that they are adopting measures to reduce carbon emissions and integrate more sustainable activities in their businesses, according to Blackrock’s China equity specialists.

“It is a misconception that Chinese companies are not pursuing best practices in the same way as companies in other parts of world,” Matt Colvin, a portfolio manager in the firm’s fundamental active equities global emerging markets team, told a media briefing this week.

Regulators, such as the China Securities Regulatory Commission, are providing the impetus, insisting that publicly-listed firms make relevant ESG disclosures in their annual reports and increase the data available for scrutiny, he said.

In addition, service providers (or investment advisors) and asset owners are having more influence on domestic asset managers, which should also have an impact, according to Colvin, who pointed out that last year 1,021 Chinese companies listed on domestic stock exchanges issued ESG reports compared with 708 in 2015 and 471 a decade ago.

However, as more data becomes available, so companies need to identify KPIs (key performance indicators) so investors can understand and better analyse the information, according to Colvin.

Fifty-two Chinese investment institutions have now signed up to the UN Principles for Responsible Investment, compared with 36 in 2019, he noted.

Meanwhile, Chinese companies are leading the world in many sustainable, climate-friendly industries, notably solar production where dominate the markets for polysilicon, wafer, cell and module “dual circulation technologies”, according to his colleague in the fundamental active equities team, Nicholas Chui.

“ESG is a game-changer for China,” he said.

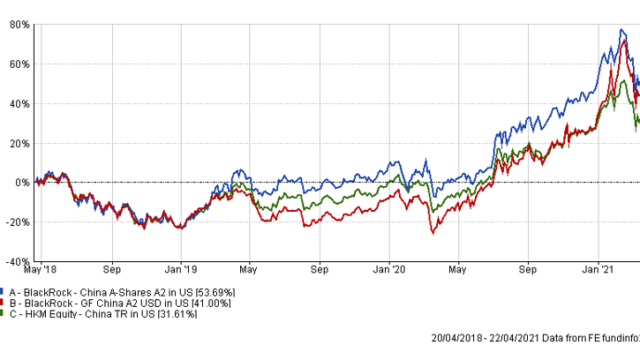

Colvin and Chui manage the Blackrock Premier China A-Shares Fund, which has posted a three-year cumulative return of 53.7%, compared with an average of 31.6% by China equity products available to Hong Kong retail investors, according to FE Fundinfo.

Top holdings include brewers Keichow Moutai and Wuliangye Yibin, Ping An Insurance, China Merchants Bank, electrical appliance maker Midea, Baoshan Iron & Steel, and China Petroleum & Chemical, according to the fund factsheet, which also states that the portfolio has an MSCI ESG quality score (which ranges from 0-to-10) of only 3.13.

Global recovery

Blackrock’s faith in China is also evident in its more immediate outlook for Chinese equities.

“We remain constructive about the market which will be supported by a synchronised recovery in global demand led by developed markets, a bounce-back in corporate earnings from last year,” said Lucy Liu, another member of the fundamental active equities team.

“Also, valuations are generally more reasonable after the recent market set-back,” she said.

In terms of sectors, Liu favours “upstream” industries such as energy, raw materials and high-end manufacturers, because the relative rise in producer prices compared with consumer prices is greater.

Blackrock also remains convinced about the momentum of familiar structural trends, including higher household spending by a growing middle class, innovation and technology.

Yet, Liu supports the Chinese government’s clampdown on tech giants, such as Alibaba and Tencent

“The tech sector has been growing too fast and had become too influential and dominant, so policy makers need to regulate the sector to make it healthier,” she said.

“The measures policy means that it will be an ongoing process, so Blackrock has been reducing its exposure to big tech firms.”

Liu manages the $1.6bn Blackrock China Fund, which has posted a cumulative three-year return of 41%, with a Sharpe ratio (a measure of risk-adjusted returns) of 0.36, according to FE Fundinfo.

Despite, concerns about the tech sector, the top three holdings include Alibaba and Tencent, according to the fund’s factsheet.

Blackrock China Fund and Blackrock China A-Share Fund vs sector average