As shares in Nvidia have skyrocketed over the past year or so, a top-performing fund has been trimming its stake in the booming semiconductor stock.

Guinness Global Innovators portfolio manager Ian Mortimer told FSA in an interview that the strategy has recently trimmed its position in Nvidia this quarter down to 4%.

“Generally speaking, we let that position run to about 5.5% and then we’ve brought it back down,” he said. “Throughout this past 18 months, we have periodically rebalanced after we’ve let it run for a while.”

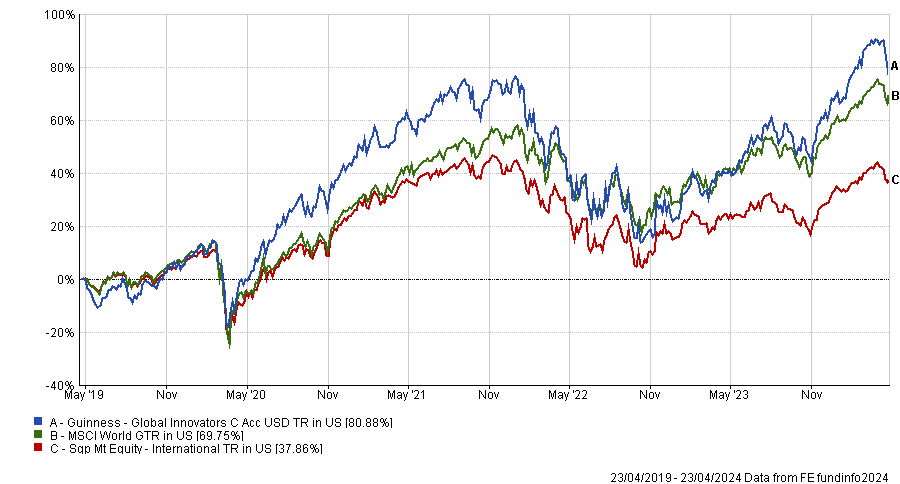

This approach to portfolio management seems to be paying off, given that the strategy ranks as the best-performing actively managed global equity fund over five years, according to data from FE fundinfo.

With a return of 80.9% over five years, the fund has more than doubled the 37.9% return of the sector average and is comfortably ahead of the MSCI World Index return of 69.8%.

This is over a very challenging time frame for active managers, which includes both the Covid sell-off of March 2020 and the inflationary sell-off of 2022.

Discussing his approach to position sizing, Mortimer (pictured) emphasised the importance of letting winners run, “but not to the point that they dominate your portfolio, and you have high stock-specific risk”.

He said: “If you let your winners run sometimes, they get more expensive, you own a higher weight in a more expensive name that’s done better: that doesn’t seem sensible.”

“At the same time, you don’t want to have a winner and keep trimming it,” he added. “So for us it’s a pragmatic approach: having guide rails but having a way of letting your winners run.”

The strategy has held Nvidia for over 15 years in the portfolio, through a 50% drawdown in 2018 on the back of disappointing crypto related GPU sales, and again in 2022.

The managers held their resolve during the depths of the inflationary downturn of 2022 which saw Nvidia shares decline over 65%.

At the time the managers said: “Despite this sell-off, we believe the investment thesis remains strong and intact – not just for Nvidia, but all of our semiconductor holdings.”

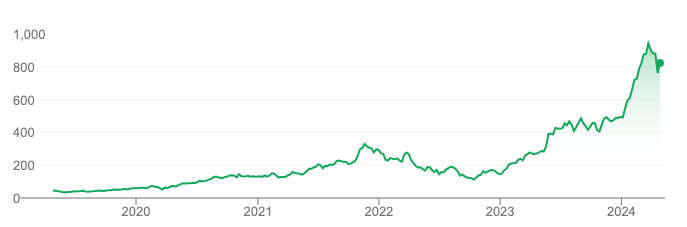

Since then, this thesis has paid off handsomely. The stock has run-up 630% in the span of less than 18 months.

Share price of Nvidia over 5yrs

“The growth we’ve seen in revenues and earnings are real,” Mortimer said. “This is what the market has rewarded.”

“We are not buying expectations; you are seeing it in real time: the extraordinary growth of that particular business.”

Nvidia’s revenues and profits have exceeded market expectations quarter after quarter, most recently tripling revenues year-over-year and increasing profits almost ninefold. Nvidia is set to report its next quarterly earnings on May 22.

Mortimer noted the company has become cheaper from a price-to-earnings perspective and price performance has still not kept pace with the earnings growth.

Although they remain “happy holders”, one reason why they have trimmed is because the risks now lie more with the earnings side, where he sees room for potential disappointment.

He also warned that market expectations about the long-term future of any dominant technology company can sometimes get ahead of themselves.

Indeed, eight years ago rival chipmaker Intel dominated the data-centre market with a 90% share versus Nvidia battling for a 5% to 10% share. That ratio has since flipped even though Intel poured billions of dollars into research & development.

Mortimer said: “Within technology things can change relatively rapidly, incumbents can shift, new technologies can come out and people can build moats quite fast.”

“Nvidia are taking market share, and their addressable market is growing, but that had a negative effect from the player they were taking it from.”

“Big winners can over time have that crown taken away,” he added. “It looks like these things will never be able to be shifted, but they can – and we’ve seen examples of that over time, so we should be conscious of that.”