Investor education, distribution, and scale are three major areas where Hong Kong’s ETF market needs significant improvement, according to a recent Morningstar report.

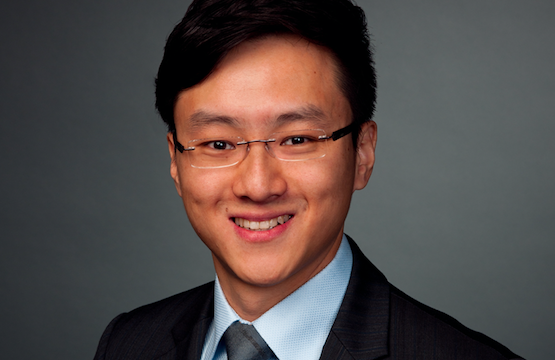

Market education on ETFs is lacking in Hong Kong, Jackie Choy, director of ETF Research in Asia at Morningstar and author of the report, told FSA.

This is despite the fact that Blackrock’s i-Shares and Vanguard, the world’s largest passive product providers, run a spate of ETFs in Hong Kong. In fact, the SAR,now has 23 ETF providers with local listings.

“Many firms have education materials on their website but I don’t see there are any leading fund groups in terms of investor education,” Choy said.

“Retail investors in Hong Kong are generally unfamiliar with ETFs and the pros and cons of using them in a portfolio.

“What I would like to see more of, is that the contents can span further afield into how ETFs can be used in building portfolios.”

Moreover, he believes investor education should not be limited to website materials, but include seminars and other investor events.

A survey from the Hong Kong Stock Exchange in May 2019 noted that “ETP (Exchange-traded products) are gaining popularity with around 15% of the Hong Kong population being ETP investors.”

This compares to a reading of 7% in 2011. However, this is far less than the 56% figure for stocks, the report noted.

Another hindrance is distribution, the report noted. Hong Kong’s commission-based wealth management model is dominant while the fee-based model has been adopted in other jurisdictions such as the UK and Australia.

Fund distribution in Hong Kong is mainly through a handful of banks that do not have a strong incentive to sell the low fee (and thus low commission) ETFs to individual investors.

A shift to fee-based model would spur development of the ETF market, but Choy was not optimistic it wold happen anytime soon.

“A number of years ago, the Securities and Futures Commission did a consultation about this fee-based advisory business model, and said the model was not ready for Hong Kong.

“And now, I don’t think the model is moving closer to acceptance in Hong Kong,” he said.

Another obstacle is the fragmented markets in Asia, which limit how many assets an ETF can gather.

The fragmented markets limit ETF scalability “and local rules and regulations could limit accessibility of different products to investors in the region”, the report said. Morningstar also mentioned that regional fund passporting schemes could promote ETF scaling.

“We believe ETF passporting schemes among a wider network of markets within the region could increase the overall size of the market and allow ETFs to ultimately achieve economies of scale.

“The connectivity of the ETF markets in Hong Kong and mainland China remains an area where industry participants see huge opportunities,” the report added, alluding to the ETF Connect.

ETF Connect, a scheme based on the Stock Connect, was slated to be a channel for ETF investment between the Hong Kong and China markets. General expectations were that the scheme would unfold this year, but the regulators seem to have shelved the plans. Additionally, neither Choy nor asset managers contacted by FSA had any update on the ETF Connect.