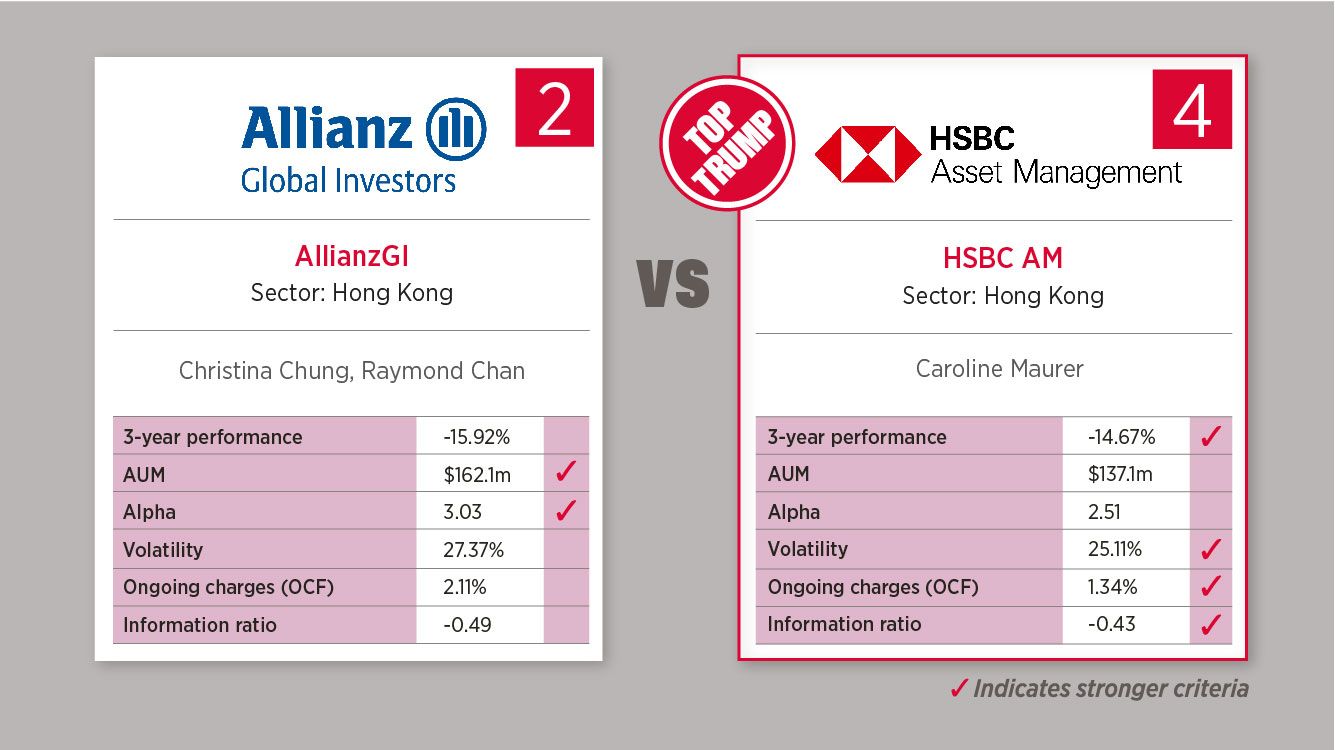

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the HSBC Asset Management Hong Kong Equity fund defeats the Allianz Global Investors Hong Kong Equity fund 4-2.

Allianz Global Investors Hong Kong Equity fund

The fund invests primarily in the stocks of companies domiciled in Hong Kong or that do a major proportion of their business in Hong Kong. Its aim is to attain capital growth over the long term.

Top 10 holdings:

- Tencent Holdings (9.01%)

- Alibaba Group Holding (8.08%)

- HSBC (6.47%)

- AIA Group (5.19%)

- China Construction Bank (4.73%)

- China Merchants Bank (3.11%)

- Meituan (3.09%)

- Ping An Insurance (2.9%)

- PetroChina (2.83%)

- Hong Kong Exchanges and Clearing (2.54%)

HSBC Asset Management Hong Kong Equity fund

The fund aims to provide long-term capital growth by investing in a portfolio of Hong Kong shares, while promoting environmental, social and governance characteristics. The fund

qualifies under Article 8 of SFDR.

Top 10 holdings:

- Tencent Holdings (9.59%)

- HSBC (9.42%)

- Alibaba Group Holding (8.93%)

- China Construction Bank (8.22%)

- CNOOC (4.55%)

- AIA Group (4.25%)

- Taiwan Semiconductor Co (4.15%)

- China Mobile (3.59%)

- NetEase (2.61%)

- CMOC Group (2.52%)