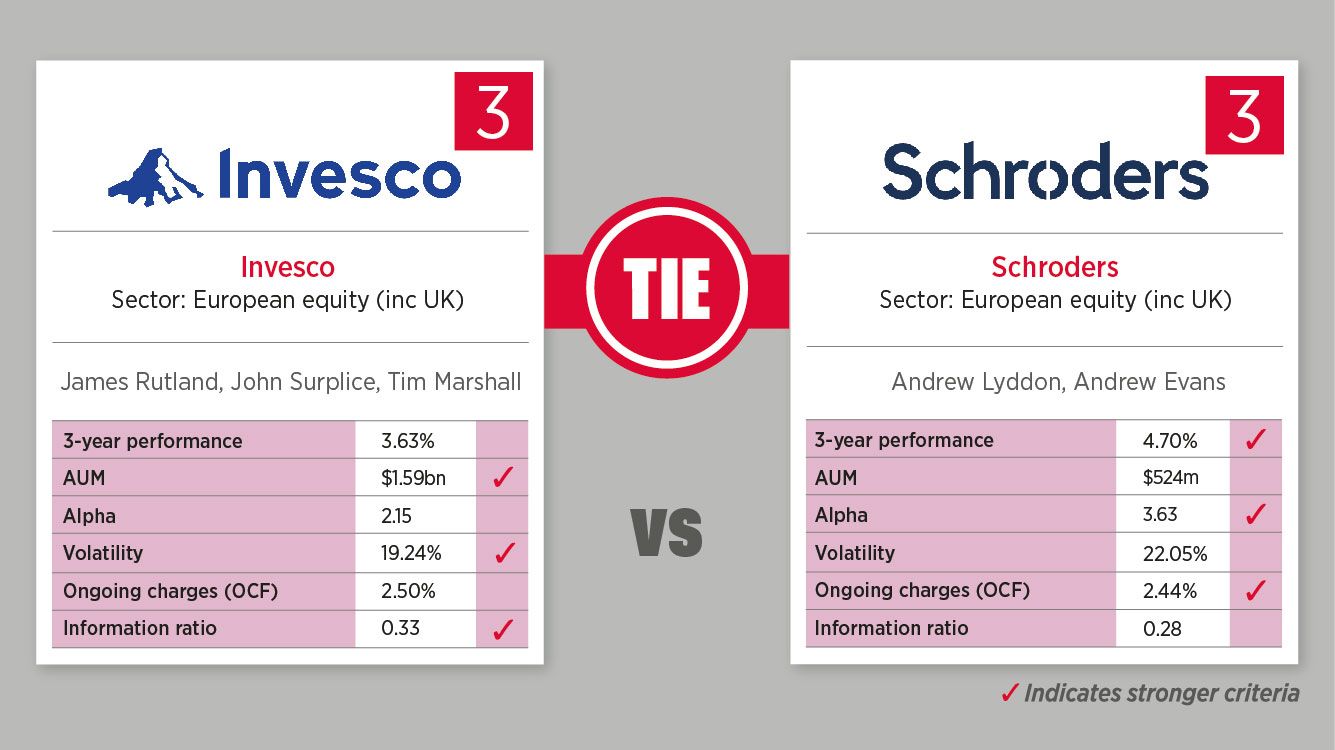

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the Invesco Pan European Equity fund ties with the Schroder ISF European Value fund.

Invesco Pan European Equity fund

The objective of the fund is to achieve long-term capital growth. The fund invests primarily in shares of companies engaged in discretionary consumer needs worldwide. It is actively managed and is not constrained by its benchmark, MSCI World Consumer Discretionary Index (Net Total Return).

Top 10 holdings:

- Totalenergies SE (3.54%)

- Astrazeneca (3.07%)

- UPM-Kymmene Oyj (2.98%)

- Unicredit Spa (2.67%)

- Sanofi (2.64%)

- Smurfit Kappa Group (2.52%)

- Merck SA (2.47%)

- Siemens Aktiengesellschaft (2.25%)

- BP (2.18%)

- Deutsche Telekom AG (2.18%)

Schroder ISF European Value fund

The fund aims to provide capital growth in excess of the MSCI Europe (Net Total Return) index after fees have been deducted over a three-to-five-year period by investing in equities of European countries.

Top 10 holdings:

- Sanofi (2.73%)

- Natwest Group (2.43%)

- Orange SA (2.34%)

- British Land (2.31%)

- Bonava AB (2.30%)

- Standard Chartered (2.26%)

- Grand City Properties SA (2.24%)

- Barclays (2.22%)

- ITV (2.22%)

- Anglo American (2.19%)