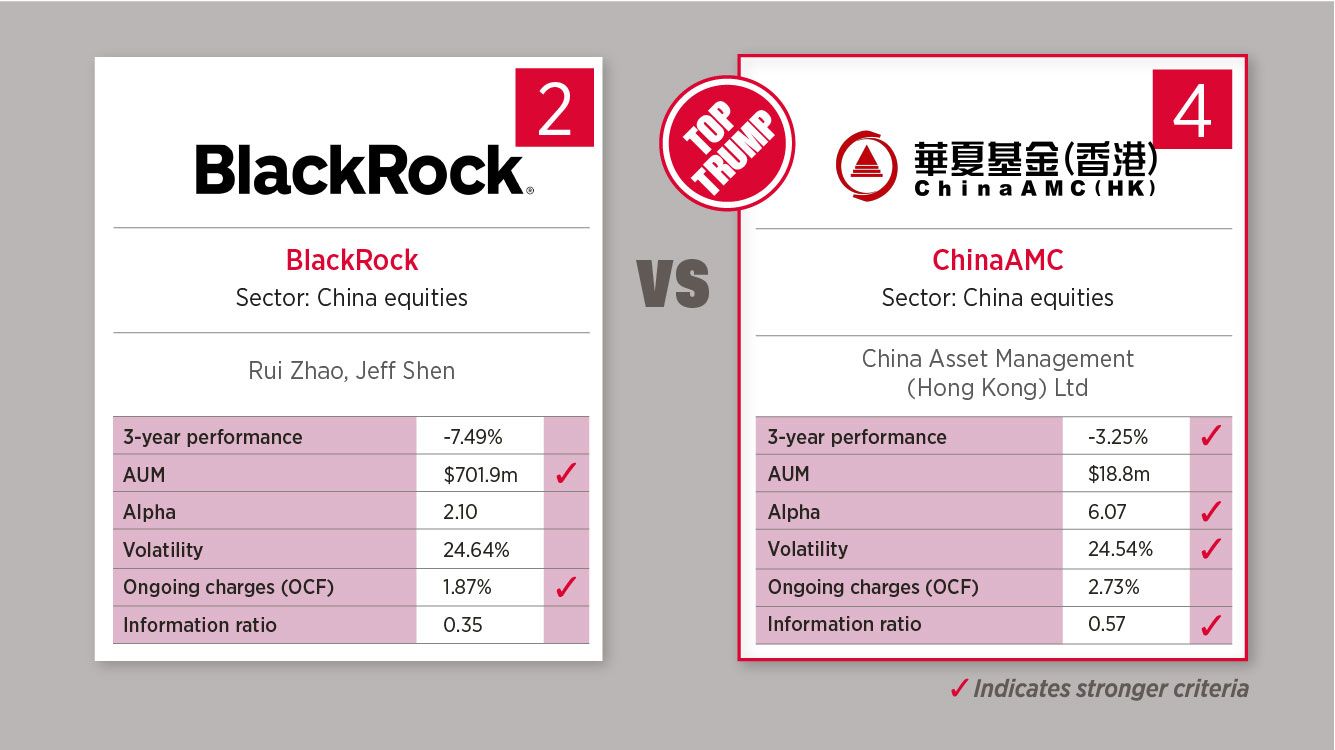

Based on the popular 80s card game, each week we select an asset class and use FE fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide which is the Top Trump.

This week, the ChinaAMC China Focus fund defeats the BlackRock Global Funds Systematic China A-Share Opportunities fund 4‐2.

BlackRock Global Funds Systematic China A-Share Opportunities fund

The fund invests at least 70% of its total assets in the equity securities of companies domiciled in, or the main business of which is in, the People’s Republic of China.

Sector breakdown:

- Financials (21.59%)

- Information Technology (19.2%)

- Industrials (16.89%)

- Consumer Discretionary (12.39%)

- Materials (11.36%)

- Consumer Staples (7.59%)

- Healthcare (5.94%)

- Utilities (1.79%)

- Cash and/or Derivatives (1.34%)

- Energy (0.95%)

ChinaAMC China Focus fund

The fund seeks to provide investors with long term capital growth through exposure to China-related companies by investing in equities and equity related instruments.

Sector breakdown:

- Communication Services (19.15%)

- Consumer Discretionary (17.93%)

- Information Technology (15.36%)

- Financials (15.1%)

- Consumer Staples (11.01%)

- Healthcare (9.34%)

- Industrials (2.08%)

- Cash and Cash Equivalent (10.03%)