Despite a blistering rally in semiconductor stocks and hype surrounding the IPO of chip designer Arm, this leading value-focused fund manager still sees “chunky upside” in the semiconductor sector.

”We see AI [artificial intelligence] as a structural, long-term story,” said Pictet Asset Management’s Young Jae Lee, co-manager of Pictet’s Global High Yield Emerging Equities fund.

The value-focused strategy is beating over 90% of its peers so far in 2023, and still has two of its top-three positions invested Taiwan Semiconductor Manufacturing Company and Samsung Electronics, which have rallied 20% and 25% respectively year-to-date.

Despite the recent rally, Lee still sees some “chunky upside” in the sector because he argues the market has yet to fully price in the better revenue contribution from manufacturing AI chips.

During the fourth quarter of 2022, the fund built an 8% overweight position in the technology sector, largely via semiconductor stocks, because the valuation looked “too compelling” at the time, Lee told FSA.

Although technology is still the fund’s biggest active position in terms of sector weighting, after a strong rally year-to-date, the fund has started to take profits on the way up. “We’re not going to let them [the fund’s chip stocks] run and continue to have a bigger and bigger position,” Lee added.

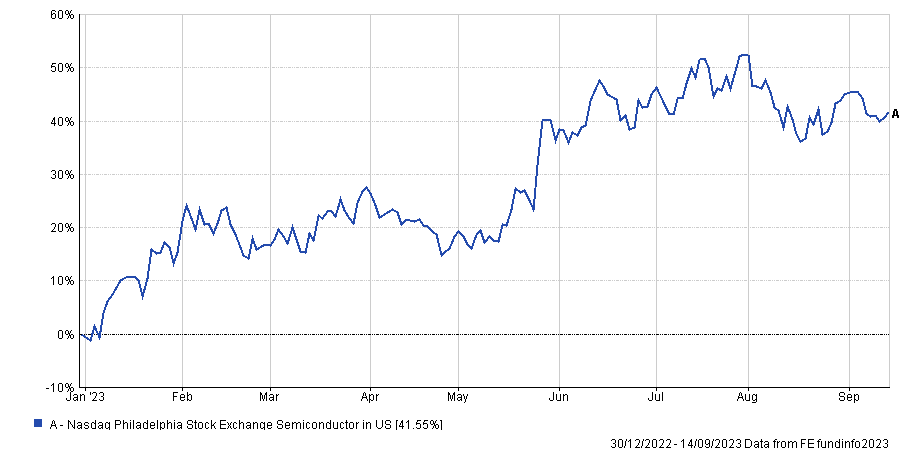

Despite the recent run-up, the two major semiconductor manufacturers have not experienced the same volatility as many other stocks in the wider semiconductor industry. Year-to-date, the PHLX Semiconductor Index is up 41% after falling almost 50% from its December 2021 peak.

This whipsaw in value comes as investors struggle to balance the outlook of an industry that faces excess inventory due to slowing PC sales post-Covid with the rise in demand for AI computing capacity enabled by cutting edge semiconductors.

One other area where Lee sees value today is in the United Arab Emirates, due to the rising price of oil. This is his fund’s second largest active position in terms of country weighting.

Oil prices have rallied some 30% from their lows in June after production cuts from Russia and Saudi Arabia have put pressure on supply while globally demand for oil continues to rise.

These higher oil prices drive the overall economy in the UAE region, according to Lee, who has invested in certain banks in the UAE poised to benefit from its improving economic conditions.

“Economic growth [in the UAE] is highly related to oil prices and we have a positive long-term view on oil prices at least until 2030,” Lee explained. “Our view on energy, especially on oil, is higher for longer, with higher refinery margins for longer.”

The reason for this is because although oil demand longer-term will most certainly suffer from the rise of EV [electric vehicle] penetration, replacing existing internal combustion engines, it won’t reduce overall oil demand until at least 2030 or 2040, according to Lee.

“Today we still need oil,” he said. “But given everyone knows that oil demand will at one point almost disappear or be much-reduced, when companies try to build facilities to get more oil (it requires a huge amount of investment), they can’t get enough return on invested capital to make that investment work in that timeline.”

He anticipates that oil demand is likely to still grow up until at least 2030, after which it may start falling. However, with seven years to go before oil demand peaks, he said that “oil prices can go quite high”.

When it comes to the energy companies the fund invests in, Lee added that there are ESG engagement programs in place to support their smooth energy transition in the long-term.