Is this the summer of our discontent, with apologies to Will Shakespeare? For investors, the first half of the year seems to have come as a rather pleasant surprise. Rising rates have not done as much damage as thought. Growth stocks have been doing quite nicely, thank you. Apple is worth $3 trillion again. But as people retreat to the beach and sip their pina coladas, it may finally be dawning on even the most optimistic portfolio manager that rates may have to keep rising higher and for longer. It is enough to wilt one’s straw and collapse the cocktail umbrella. Sell in May and go away?

Over at Ninety One, in the perfect summer read, Steve Woolley and Alessandro Dicorrado have been reminding us of the difficulty of forecasting even if you are a very well-known firm. “A well-known UK-based fund manager once said to us: ‘If you have to give a numerical forecast, never give a date. If you have to give a time-based forecast, never give a number.’ A nice quip, highlighting that precise forecasting is notoriously difficult – notwithstanding the legions of economists, strategists, analysts and other purveyors of wisdom whose careers are dedicated to this task. Even if the outcome of an event were known, meaning you could invest with perfect foresight, the market may react to that outcome in an unexpected way. In other words, it can be very difficult to make a profitable trade in financial markets even when your event-forecast is 100% accurate.” Nailed it.

Eastspring Investments has been investing in India and China for as long as Spy can remember. This month, Yuan Yiu Tsai a portfolio manager with the Asian giant has put out a little insight on the contrast between India and China that is worth reading. This paragraph caught Spy’s eye: “Although India has pipped China to become the world’s most populous nation, the country’s consumer class (defined as those spending more than $12 a day in 2017 PPP) is only half of China’s. However, China’s consumers are older and mostly live in cities. In contrast, India is on track to become the world’s biggest youth consumer market by 2030; yet the consumer class is both urban and rural.” India has traditionally held a very small portion of client portfolios. That, surely, has to change.

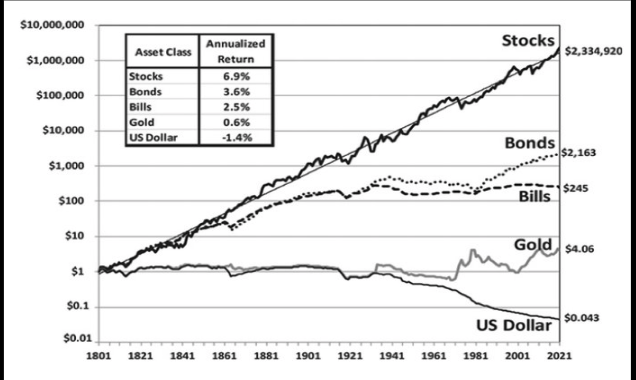

Who wins in the long term, investment wise? The answer is, and always has been, stocks. When equities are swooning and causing heart palpitations with their volatility, it is very easy to forget this simple truth. Spy came across this rather brilliant chart which compares the very long-term performance of Stocks, Bonds, Bills (Treasuries), Gold and the US Dollar. Spy is not surprised the Greenback has been a poor performer with Uncle Sam’s profligate habits. Gold’s weak performance may shock some. Stocks almost double fixed income’s return in the long term.

If you want to understand the mentality of the average millennial investor, sometimes venturing into the darker reaches of Twitter and other social networks can be instructive. Spy came across this illustration which, he supposes, was meant to be give out pithy wisdom to young investors. Apparently, one’s only choice is to lose money to inflation or lose money day trading. Buying a leading index fund, buying a property, buying inflation protected muni-bonds aren’t even given as alternative roads. Never have people needed ‘educated’ financial advice more.

If Spy had a dollar for every bond fund manager who has recently told us that “this is a great time to buy fixed income”, he would be rich. Yet rates keep rising. After yesterday’s big job number in the US, the 2-year Treasury yield is back over 5% and the 10-year is back over 4%. That’s the highest 2-year Treasury yield since June 2007. You may remember the biggest lies: The cheque is in the post, I will call you tomorrow, and your dad won’t mind. Well, add “inflation is transitory” to that list and hold on to your hats.

Another week, another scam with physical metals, notes Spy. A chap named Robert Higgins has been caught out with one of the oldest commodities wheezes around. He provided investors a way to buy physical silver coins and store it for them. Of course, he appears to have done no such thing. “The vault where precious metals dealer Higgins claimed to be storing over half a million of his clients’ silver coins was found by investigators to be empty – except for little boxes of paper IOUs,” reported Yahoo. This kind of fraud pops up with regular monotony. If one thinks this is only confined to small time dealers, it is worth considering that the US government has never allowed its own gold holdings at Fort Knox to be audited. Ever.

Until next week…