Spy caught up with a senior wealth manager this week who was lamenting overall market pessimism and what he thought was unnecessary gloom. “Every single recession we have had for fifty years has been rather shallow and rather short”, he said to Spy over a pint of Guinness. “Why should this one be any different?” He added, “Perhaps you can tell asset managers to come and talk to us with some positive data to show our nervous clients that these things are never permanent and brighter days are around the corner.” Spy, being a faithful servant, has duly passed on the message.

It seems the innovation theme has not run out of steam. Well, not at DWS anyway muses Spy. The German asset manager has added to its ETF line up with four new funds that are all based around innovation themes. The manager has teamed up with Cathie Wood’s Ark to create the underlying indices, on which the strategies are based. Using the Xtrackers brand, the firm has launched: Xtrackers MSCI Fintech Innovation UCITS ETF, Xtrackers MSCI Next Generation Internet Innovation UCITS ETF, Xtrackers MSCI Genomic Healthcare Innovation UCITS ETF and Xtrackers MSCI Innovation UCITS ETF. The charges are fairly low – 0.35% and the funds trade in Europe but, of course, can be purchased by Asian investors.

Is the hot air coming out of the ESG market, wonders Spy? Possibly. Ark is closing its Transparency ETF because it has not attracted much in the way of assets. Looking around the world, the hottest of all trends seems to be faltering a little as regulators ask more questions and investors themselves wonder what the actual benefits of the label are. There is an old saying, “By the time an entrepreneur is on the front cover of Time magazine, the peak was probably already in” Spy can’t help but think that recent widespread, ‘non-investment media’ coverage of ESG in mainstream publications may, indeed, be heralding some sort of interim peak. Just this week venerable British publication The Economist is arguing that ESG needs to be shrunk to just “E” – for Emissions. It argues in a leader that [carbon] emissions is the only true measure that can be compared across companies, everything else is too subjective and confusing. Interestingly, there is currently only $571m invested, on average, in the 132 US-listed ESG-labelled ETFs, according to Bloomberg. Food for thought indeed.

The SPAC market has truly died (and not necessarily gone to heaven). These rather dubious investment vehicles which are premised on the odd idea that a large blank cheque, hunting for an investment in a time limited fashion, is an excellent way to asset allocate. As any third-rate real estate agent will tell you: a forced buyer or seller never gets the best deal. At this point last year, wildly enthusiast investors had poured $115bn into the speculative vehicles. This year? $12bn. By the end of 2021, investors threw a massive $163bn into the sector and $260bn over the last 3 years.

If you are thinking of buying a beaten down technology fund, Spy has a casual thought for you for Friday. One of the single most remarkable features of consumer tech is that your CEO of a global corporate, the person founding a start-up or a university student pretty much all use the same devices – laptop and mobile smart phone. There is no real “luxury segment” in tech – unlike watches, clothes, cars. It is remarkably democratising.

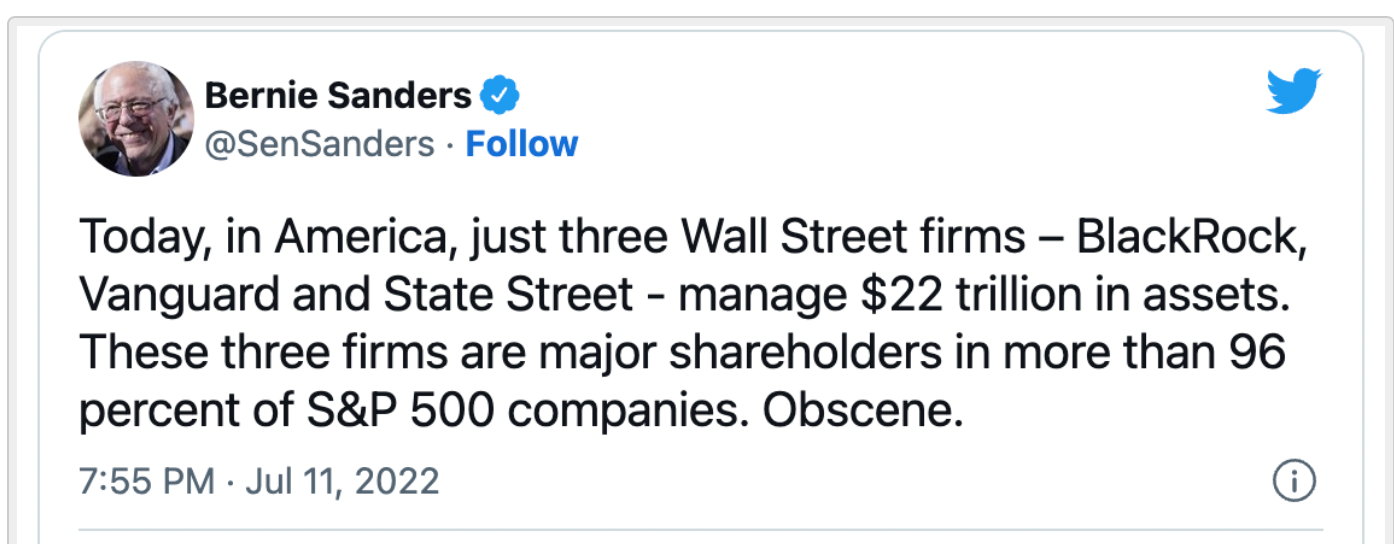

There is ignorance and then there is ignorance on a grand scale. Spy caught this tweet from influential American Democrat Bernie Sanders. What level of financial illiteracy does it take to think that Blackrock, Vanguard and State Street actually truly control these companies through their ETF or mutual fund holdings. Still, ladies and gentlemen, these are the times we live in.

Italy is going through one of its periods of psychodrama. Italy’s government has just dramatically collapsed like a leading actor in one of their famed operas. New elections are being called. Mario Draghi, the well-respected technocrat PM, is out and no doubt some exciting populists will take over demanding all sorts of ludicrous spending – perhaps while singing, too. The ECB has had to raise interest rates to a whopping 0% as it finally exits it Negative Interest Rate Policy and confronts inflation raging across the EU. It has now also hatched a cunning plan to try and stop the market speculating in (i.e. selling) Italian sovereign and corporate debt. The plan is called TPI or the Transmission Protection Instrument. It is basically a secret fund to secretly buy Italian debt in secretive circumstances, whenever the market does not play nicely with Italy. Good luck with that.

Spy rather liked this quote of the week. “Your net worth to the world is usually determined by what remains after your bad habits are subtracted from your good ones.” That was by Benjamin Franklin, the former US President and has Spy rather worried…

Spy’s photographers have been out and about. In Hong Kong, JP Morgan Asset Management has plastered the MTR with posters galore. The manager is promoting its Sustainable Infrastructure Fund. Spy has no word if the posters are recyclable.

Meanwhile in Singapore, Axa Investment Management is on the outside of busses. The French manager is also focussing on sustainability as a theme across all its asset classes.

Until next week…