“Every single day, I am told the only way to make money in the market is to buy tech stocks,” said a rather pugnacious German fund manager to Spy this week, drinking Boulevardier cocktails laced with Campari. “Yes, tech has rallied hard but there is extraordinary money to be made if one runs your non-tech firm very well. Take Starbucks, the ubiquitous coffee chain. In 1987, Howard Schulz bought the firm from its founders for just $3.8m. It now has 38,000 stores and is worth $91bn.” Tech may get all the attention but the truly curious are looking for value elsewhere reckons Spy.

Perhaps it is only Spy’s particularly dodgy sense of humour, but when he came across the Enhanced Nasdaq 100 ETF, it sounded more like some dubious sex aid, than a serious fund. It is in fact a thing, and it launched recently: “The SGI Enhanced Nasdaq-100® ETF (QXQ) seeks to generate the return of the Nasdaq-100 utilising futures and options, while providing an additional enhanced yield through ultra-short-term options strategies.” With the Nasdaq reaching new highs, Spy is not convinced it really needs any ‘enhancement’ whatsoever, but there will always be those who think their best assets still need juicing up. If it is good enough for Dolly Parton, so to speak…

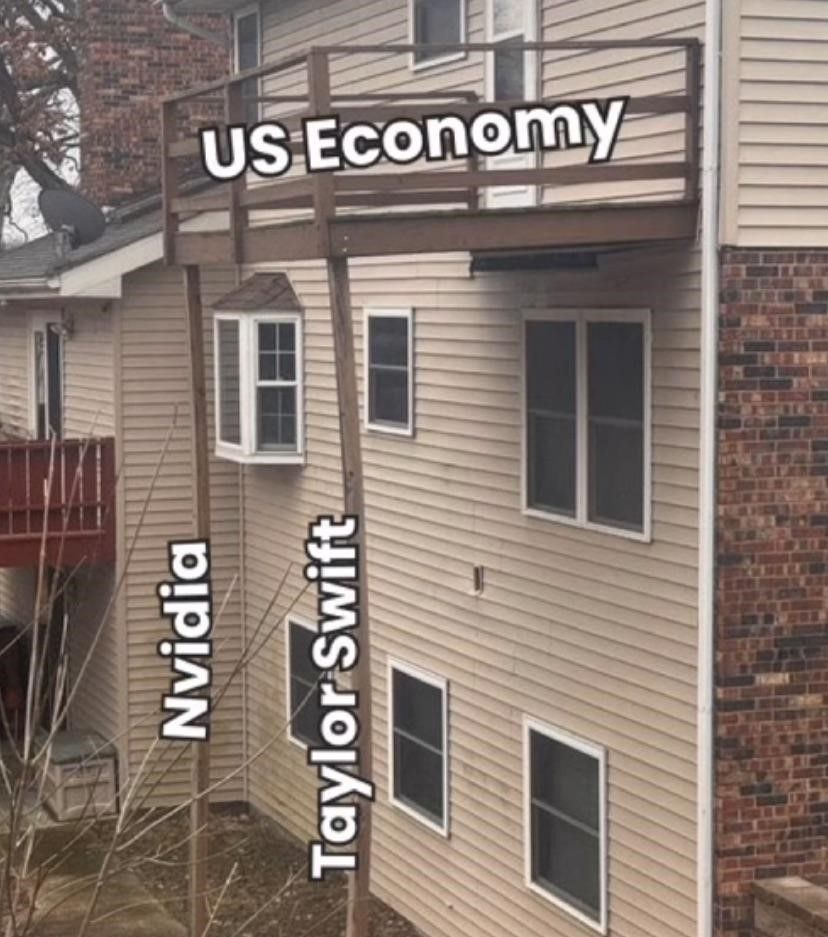

Sometimes the anonymous meme makers that riddle the internet with cat videos and lowlife drivel, nail an idea better than any long-winded economic analysis ever will. Spy has absolutely no idea who the fellow (or girl) who was that created this, but he or she deserves a hat tip. Right now, it does feel that two very different powerhouses, are driving the US economy along.

There is an old saying, “Sell in May and go away and don’t come back till St Leger’s Day”. It basically meant taking your trading profits and waiting out the summer until real traders got back to their desks in October after the hot mid-year holidays The rather pithy line has always been a half-baked truth, if one at all, as most sensible wealth and fund managers know: you simply can’t time the market. As if to prove that very point, the S&P 500 has just breeched, at the time of writing, the nice round number of 5500. That is, of course, a brand new high.

If you are planning to nip away to the beaches of Asia, or back to the bustling cities of Europe and are looking for something to read, Spy has a recommendation. Brave New Words by Salman Khan, who is the founder and CEO of Khan Academy, “a nonprofit with the mission of providing a free, world-class education for anyone, anywhere.” Khan explores what AI is going to do, in particular, to education. He refreshingly does not preach doom and gloom but understands that AI is simply another (remarkable) tool that has the capacity to personalise learning for every student. The book is not just about this rapidly advancing technology, it is about what AI means for our society and a sensible analysis of the revolution’s implications. A positive, insightful and ultimately inspiring book. It also happens to be on JP Morgan Private Bank’s Summer Reading List and Spy thinks its place is well deserved.

A couple of years ago, Spy sat through more than a few equity presentations on Europe. The message was the same from just about every portfolio manager. Europe is about to break out of its doldrums, and we should all be buying beaten down European equities. It is true that European Union stocks have a staged a bit of a rally but the beautiful but fractious and dysfunctional continent appears on the verge of convulsions once again. Emmanuel Macron, the energetic and impulsive President of France, has just called an election in which, if the polls are to be believed, he appears certain to lose. If either the hard left lunatics or hard right populists come to power, Europe’s stuttering stock market rally may well be thrown into doubt. The European Central Bank seems to have suddenly remembered that France is ridiculously indebted and has one of the most generous pension schemes around. Spy would hold out on buying those Euros for your summer holiday, you may get a whole lot more Chianti or Champagne for your dollars.

What does it take to be rich in this day and age? There is no question that being a millionaire in assets, especially in Singapore or Hong Kong, does not get you very far these days. How about $10m? Spy was intrigued to read that, according to Wealth-X, the number of people around the world with $100m in assets, stands at a whopping 90,870. That is up from 46,600 in 2009, a mere 15 years ago. The number of billionaires has also rocketed in the last 20 years with 2,781 being the current Forbes estimate. It is no wonder that the luxury segment of the market continues to grow at a phenomenal pace.

Old joke: a stock picker’s ability to predict the future accurately, makes misty-eyed tarot card readers look good. As Jack Bogle said once, “Don’t look for the needle in the haystack. Just buy the haystack!” That may indeed be true, but it isn’t much fun.

Until next week…