Spy chatted to an Australian fixed income portfolio manager based in Singapore this week. Sadly, no wine, whisky or beer was involved; it was strictly an online call. Spy posed the simple question, “What worries you more: the Delta variant or inflation.” The precocious young manager replied instantly, “Neither. Talking heads and excited economists are constantly worrying about abstract big ideas on TV shows, but as an investor it is always the same: find great companies that pay their bills and worry about that only and you will do just fine.” Sage advice that is forgotten all too often, no matter how often it is said, thought Spy.

Schroders is walking the walk and not just talking the talk about ESG in Asia, reckons Spy. The manager has just announced the hire of Mervyn Tang to head up its sustainability strategy across Apac. Mervyn was previously with Fitch Ratings as their senior director, global head of ESG research. Tang will be based in Hong Kong for a while before relocating to Singapore. Schroders has also appointed Dan Chi Wong as head of ESG integration. Schroders is clearly trying to ensure that every part of its business has ESG built in, rather than as a greenwashed advert, thinks Spy. The company has had success in the last twelve months with its International Selection Fund, which is up 56%.

With the news this week that HSBC has pinched Stefan Lecher from UBS to be regional head of investments and wealth solutions, Spy could not help but approve of the message HSBC wants to send. Lecher is highly experienced and held the role of CIO for global investment management at UBS. The battle for Asia’s wealth pile is intense and very competitive. HSBC is apparently investing $3.5bn in the region in an attempt to become a dominant wealth manager. This jostling for position in Apac can only be good for wealth management employees, as banks will pay top dollar for talent.

Goldman Sachs Asset Management jumped on the active climate change ETF bandwagon this week with the launch in the US of its Future Planet Equity fund (ticker GSFP). The fund is focusing on five main areas: water sustainability, resource efficiency, clean energy, sustainable consumption and the circular economy. This falls into the GSAM’s thematic area of investments and is not based on a specific index.

If you think the ARK Innovation Fund is a bit over banked, Spy has good news for you. Boisterous asset manager out of California, Gerber Kawasaki, has just launched a new active ETF targeting disruptive innovation. The blurb, however, sounds awfully familiar: “The goal of the AdvisorShares Gerber Kawasaki ETF is to identify growth companies positioned to benefit from transformative changes in our society. GK focuses on multiple investment themes with potential widespread impact to create a growth-focused portfolio of large, mid and small cap stocks.” Spy is hoping that we might actually see some innovation in the way these innovation funds describe their innovative investment processes…

Spy loves a good space story just as much as the next person. Richard Branson got sci-fi fans and Star Wars enthusiasts all excited with his Virgin Galactic test flight last Sunday. The beardy entrepreneur may be exploring the final frontier, but Spy does wonder whether he has thought about some of the more prosaic barriers back on earth. There is, apparently, a grass roots campaign in California to denounce space tourism on ESG grounds. Sending wealthy, suntanned people to sub-orbital space sounds fun but is apparently not good for the old carbon footprint. Shaming of space tourists is becoming “a thing” and investors in the company or the Spacs that track space may be in for an unexpected backlash from some very noisy Twitter mobs. Incidentally, the person who paid $28m to go on Jeff Bezos’s Blue Origin inaugural space flight has just cancelled due to “scheduling issues”, which sounds awfully like “the dog ate my homework” sort of an excuse.

What if you could use artificial intelligence (AI) to sniff out complete bullshit in corporate disclosures? Spy came across a fascinating business based in Toronto that is doing just that. It is named Bedrock AI and its sole purpose in life is to sift through filings working out which claims are dodgy. It was founded by an auditor and an AI specialist, combining those two skills together. While companies are obliged to disclose risks about their business, they are not obliged to make it easy to understand those disclosures and have long used opaque language to hide those elephants in the balance sheet room. Bedrock is trying to help investors find red flags so they can avoid those companies or, if they prefer, get the shorts on…

This morning China’s long awaited carbon trading market opened up for business. On day one, as in many other ways, China’s market is already larger than Europe’s well established one. The initial companies involved in the scheme have a cumulative 4bn tonnes of emissions to trade and that is just the start. Citigroup reckons $800m worth of carbon credits will trade this year with that figure rising to a staggering $25bn by 2030. Spy has not seen a fund taking advantage of it yet, but it can’t be long. Watch this space.

Do you remember the Spac excitement of the last 18 months? Of course you do. Spy has bad news for investors. The ETF that tracks Spacs which was launched last October is now down 10%. In contrast, leaving your money in an S&P 500 tracker, you would be up 30%. Spy is never quite sure why investors fall time and again for the hype that Wall Street pushes out periodically as it pretends it has found “overlooked” investment ideas that are truly “undervalued”. Giving investment managers blank cheques they HAVE to spend seems a particularly poor way to asset allocate. But that may just be Spy.

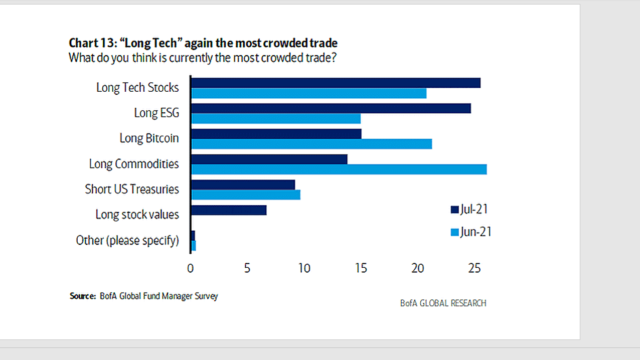

If you think tech trade is crowded again, you are not alone. The BofA Global Fund Manager Survey agrees with you.

Until next week…