After Joe Biden’s success at passing his giant stimulus bill this week, Spy sat down with a triple Irish whisky and contemplated the insanity of the whole thing. Nearly 100 million Americans who have not lost their jobs, have not had much of their income disrupted and who, quite frankly, have had to pay less for their commute and their daily lunch for a year are about to get a check in their bank account for $1,400. When US policymakers said, “Let’s help those who were economically devasted by the pandemic,” what they really meant was, “Let’s print more money than ever before and dish it out to everyone for a giggle.” Who knows how this experiment ends, but Spy strongly suspects that voters and politicians will find it harder than ever to not just “print more money” whenever the faintest whiff of trouble arrives.

News reaches Spy that JP Morgan Asset Management in Hong Kong has added to its marketing team. The American firm has hired Charlene Cong to support its content and marketing efforts. Charlene was previously with FSA’s friendly competitor, Asian Private Banker, as a journalist and reporter. Over the years, Spy has seen many fine journalist colleagues jump ship from budget-constrained, scruffy media venues to the plusher offices our clients… JP Morgan has had success in the last twelve months with its Technology Fund, which is up a healthy 99%.

All around the world, retail investors have discovered these things called “stock markets”. Formerly, arcane and exotic to many, stock markets have had a bout of re-entering mainstream consciousness like the late 1990s. Downunder, in sunny and bright Australia, 435,000 complete novices bought some shares for the first time. The number of active investors in Australia has reached a new high of 1.25 million, according to research from Investment Trends. Famously parochial, Aussies have even been buying shares beyond their own borders with 109,000 now actively buying foreign shares. Fancy that, mate – there are companies out there not called ANZ or Commonwealth Bank! Spy can only imagine this is a good thing. When retail investors discover, as they will sooner or later, that investing is hard, they will be only too happy to find a decent portfolio manager to do the hard work for them.

If there is a magic formula for asset managers to crack retail banks in Asia, Spy can’t say it is an obvious one. This week, Spy perused UOB’s retail offering. It lists 18 asset managers. To say that the list represents the ‘usual suspects’ would be an understatement. Spy has no doubt that the 18 listed: Aberdeen Standard to Franklin Templeton to UBS, etc are all credible and worthy partners. However, smaller players with interesting, niche strategies are nowhere to be found. Is the hassle of maintaining smaller partners too much effort or is this nothing more than institutional inertia, wonders Spy?

Have we reached peak ETF? This week Tuttle Tactical Management has launched FOMO – for every investor who fears they are missing out. This fund, which sounds like it will dabble in absolutely everything that people are discussing on Twitter, on Reddit, even the pages of the Financial Times, so that one does not miss out. This sounds fairly hair-brained to Spy but then again, he also feels another new ETF, BUZZ which is doing something similar, is equally idiotic. There used to be a saying, “If it is in the press, it is in the price”. To Spy, this feels, as the French might say, “Fin de Siecle”; the end of one era and, perhaps, the beginning of a very different, new one?

Has gold finally met its match? The millennia-long hard currency asset seems to have disappointed its supporters this year, mightily. In the face of rising inflation, stocks and Bitcoin have soared in 2021 while gold has been woeful – it is off about 10%. This week, Blackrock has added to its detractors. “Gold is failing as an equity hedge… and gold’s ability to hedge against inflation has been somewhat exaggerated. While it is a reasonable store of value over the very long-term – think centuries – it is less reliable across most investment horizons”, wrote Russ Koesterich, portfolio manager for Blackrock’s Global Allocation Fund in a blog post. Spy is willing to concede, he does not have centuries before his retirement arrives…

What is the correct punishment for putting out fake news about your own performance? This week, Cornerstone Capital, an asset manager in Guangzhou, was fined just $163,000 for gross misstatements of NAVs and more; which does not sound terribly much to Spy. The managers inflated its net asset value of 35 funds by a total of RMB 1.83bn ($280m) between May 2018 and January 2020, which surely lead to higher fees. Cornerstone once tried to become the first private equity manager listed in New York. Spy suspects that unless the fines more accurately reflect the seriousness of the crime, there won’t much disincentive not to massage the figures.

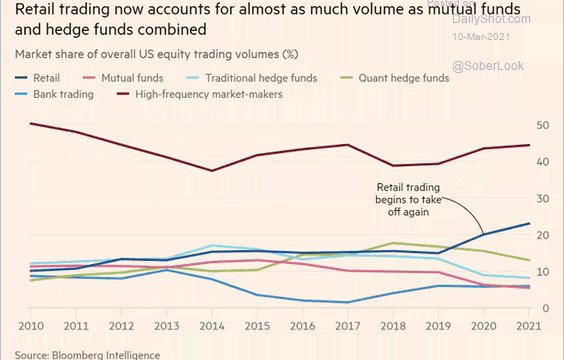

When experienced investors spoke about the market, they almost always thought about professional money managers and their allocations and fluctuations. The last 12 months has truly upended this. A fabulous graph Spy saw from the FT captures this very well. Retail trading now accounts for almost as much volume as mutual funds and hedge funds combined. . The only category of traders with greater volumes, are the tech driven algo players: High-frequency market makers.

What a difference a year makes. It is twelve months and one day since the WHO declared Covid-19 a pandemic. One suspects 99% of people had never heard of Zoom, the word Furlough, Robinhood, mRNA and so much more. A word we had heard, but perhaps had been overused: unprecedented.

Spy’s advert hunters spotted a new ad running in Singapore this week from Fidelity. The firm is promoting its China RMB Bond Fund for those people who want income and to bet on the appreciation of the renminbi. Hat tip to the Fidelity team, that picture of the Panda is utterly gorgeous!

Until next week…