“The thing about emerging markets,” said an emerging markets portfolio manager to Spy over a very agreeable New Zealand Sauvignon Blanc at the Mandarin Oriental, “is the sheer and utter energy of their youth. Visit Istanbul, Ho Chi Minh, Bangkok or Jakarta and the city streets and shops have an energising pulse. It is perpetually exciting because young people do crazy things and have not had the experience to develop a cynical veneer. Developed markets, across the world, are ageing rapidly and with that comes a cautious, stultifying conservatism. For an active manager, emerging markets is by far the best pond to swim in.” Her enthusiasm was certainly infectious to Spy, if only those giant American firms weren’t making quite so much money.

News reaches Spy that BNP Paribas Asset Management in Singapore has hired a new director of private bank sales. Chestnuk Luk has moved across from Invesco, where she was associate director, intermediary Sales. Chestnut was at Invesco for nearly seven years and has held roles at Neuberger Berman and British private bank, Coutts, in Hong Kong. Spy has no news on who is replacing Chestnut at Invesco. BNP Paribas Asset Management has success with its Disruptive Technology Privilege Capitalisation fund, up 38% in the last year. Meanwhile, Invesco’s star performer is its Responsible Japanese Equity Value Discovery Fund, up a healthy 35% over twelve months.

In another sales move, Spy understands that Joanne Kwek, who has been sales director at Nordea Asset Management in Singapore for more than a decade, has stepped down from her role. Joanne is not moving within the industry but is taking time out to look after young children. Nordea has a reputation for its strong focus on sustainable, impact and ESG investment. The firm has had good performance from its North American Stars Equity Fund over the last year with the fund returning about 25%.

Spy was always taught that about half of all new businesses fail within six months of launch and only about 10% remain after three years. With that in mind, Spy was not shocked to read from a report by Boston Consulting Group, that most mutual funds do not last for ten years these days. They typically fail to gain enough assets to remain viable. With fee compression and lower investor tolerance for periods of weaker performance, funds get pulled from the market more quickly. The research group noted that the asset management industry did well in 2023, with global assets rising a healthy 12% to almost $120trn. This contrasted with 2022, when the industry experienced a 9% drop in assets under management.

Spy was intrigued to read that Andrew Balls, the CIO of fixed income at PIMCO is not buying the AI trend, at least where investment itself is concerned. He told the Wall Street Journal, “I don’t think it will help us generate alpha investment outperformance, but it can help support the people whose job it is to do that.” If Spy understands Andrew’s point, AI is a decent productivity-enhancing tool in PIMCO’s view, not something that would replace primary research or the security picking skills of their portfolio managers. Spy finds that hard to disagree with.

If AI is not about choosing securities, Manulife has different idea for the technology. The insurance and wealth management company has introduced an AI-driven robo-advisory service in Hong Kong for its MPF members, using technology partner AutoML Capital’s ML Brain service. The idea is that the technology helps members choose appropriate funds and portfolio allocation decisions — one of the things people say they have the most difficulty with. The service is currently under a pilot scheme. Manulife and AutoML have not provided any backdated data that would illustrate superior selection performance using the service and so it is a case of wait and see.

Are companies any good at timing the market? This is surely the question investors would want to ask, with the prediction from Goldman Sachs that S&P 500 stock buybacks are expected to hit a record $1.075trn in 2025. This would be a 16% increase from 2024’s total. In Spy’s experience, companies are just as likely to buy at the top of the market as any retail punter.

For decades, Apple, has hardly put a step wrong. This week, it has shown just how damaging a poorly received advert can be for its brand. A massive online backlash has prompted an almost unprecedented apology from the computer and phone giant for its tasteless slow-motion interpretation of various musical instruments, cans of paint and numerous artistic tools being crushed by a giant hydraulic press. The idea is that its new iPad is so thin you need to smash everything to squeeze it in. What came across was something rather dystopian instead of aspirational, and caused dismay among artists and performers, especially in Japan, where musicians revere their instruments. Still, Apple is a company whose cult followers are known to tattoo its logo onto their skins – it will shake this one off.

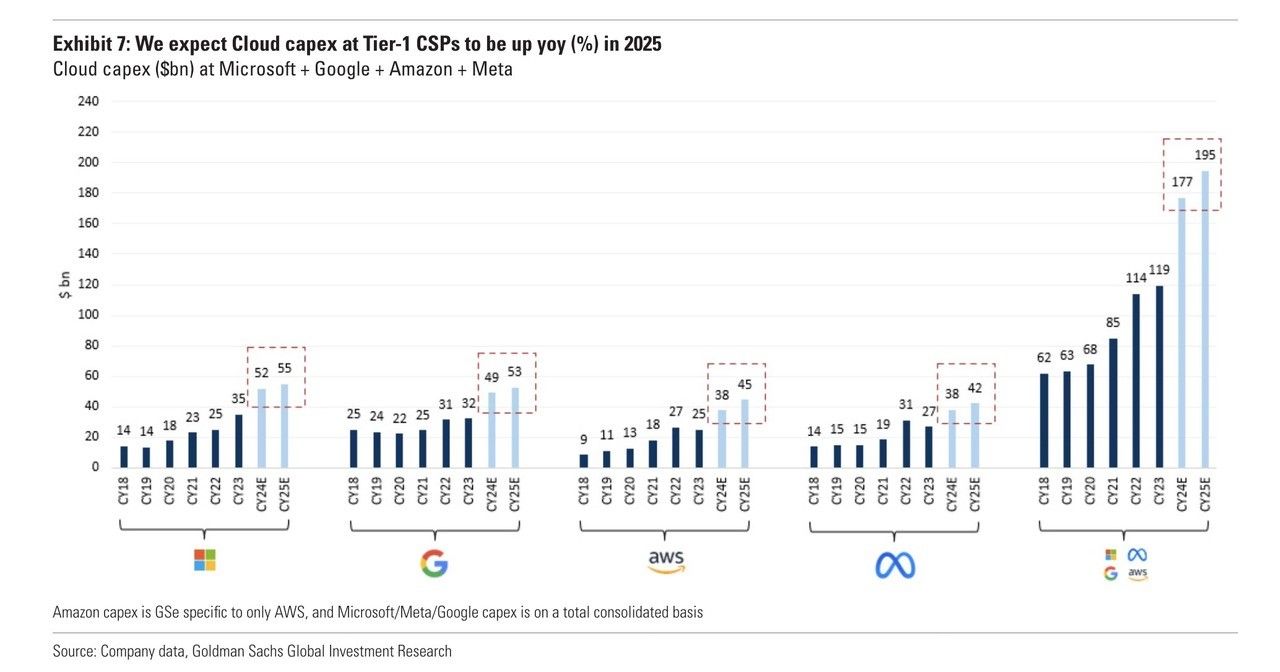

You are probably reading this article from your phone, delivered from where it is stored by FSA’s cloud service provider. Is it any wonder that Goldman Sachs expects cloud capex at Microsoft, Google, Amazon and Meta to reach almost $200bn per annum by 2025? That enormous number excludes Chinese players such as Alibaba’s Allyun and Tencent Cloud. In a gold rush, they say invest in picks and shovels; in a cloud rush, surely it is memory, chip and storage manufacturers?

Who is afraid of big, bad debt? It seems nobody whatsoever in government. Global debt rose by $1.3tn to a new all-time high of $315trn in the first quarter of 2024, according to the IIF Global Debt Monitor. Remember the adage: those who understand interest, earn it; those who don’t, pay it. Spy suspects a lot of government officials don’t have a clue.

Until next week…