Spy had a very enjoyable, lazy lunch at one of Hong Kong’s finer Italian eateries with a veteran private equity executive on Thursday. She has been dealmaking for 25 years and told Spy she had never seen such a flood of deal flow as there was around at the moment. Companies were hungry for capital and prices were appealing. After sitting out much of 2023, she said her hands were getting itchy for her cheque book. Which segments, asked Spy? “Oh, tech of course, but at far better prices than last year.”

News reaches Spy that Laurent Lequeu has stepped down as head of research at Lumen Capital Investors in Singapore. Laurent held the position for several years. Prior to that he had stints at Taurus and RHB Asset Management. Spy understands that Laurent is on gardening leave and will be returning to the industry sooner or later. He has no news on Laurent’s replacement or where he might be moving too.

Not once, but three times in the last week, wealth managers have enthusiastically pushed gold to Spy. Over the past decade or so, Spy has heard innumerable pitches that “gold is going to the moon” because “the US is spending too much money”. Gold has done fine but has hardly blown the lights out, especially compared with big tech. Can this time be different? Well, perhaps. What is different this time round, for certain, is that the US now has to pay more than $1trn a year in annual interest just to keep the lights on. It is printing money so fast a cartoon treadmill might look slow in comparison. Each wealth manager had the same story – “buy the miners, they are hopelessly undervalued”. Time to look at the Jupiter Gold & Silver Fund again, wondersSpy?

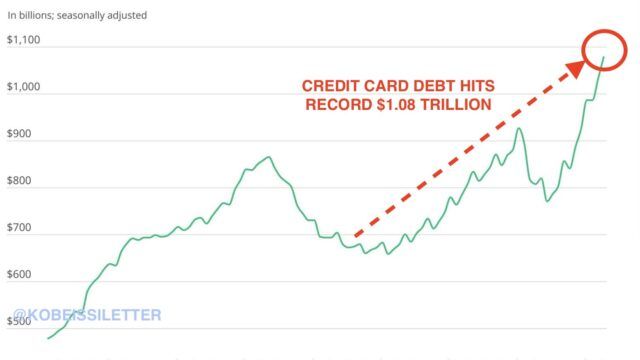

Talking of a trillion. Do you know what else hit the trillion mark this month? Global credit card debt has just gone through the 13-digit number. No wonder Visa and Mastercard continue to be stock market darlings. With events like Singles Day and Black Friday encouraging mindless consumption, it is not too surprising that people feel tempted to tap the plastic. Spy can only but wonder whether the credit card companies should be included in any ESG funds with the needless buying they facilitate.

The pain in the Hang Seng keeps on coming. This week the benchmark Hong Kong index dropped below 17,000. Since late January, the Hang Seng is now down 25% from its peak. Spy knows that we all know it is the property market causing most of the pain but the nasty sell-off illustrates how widespread the lack of confidence currently is in the local market. That said, Spy is old enough and certainly ugly enough to know that it is when things are truly out of favour, that is when real value is created. Caveat emptor, of course.

What do American execs know that we don’t? They like their own shares, that is for sure. November has seen healthy buy backs of company shares within the S&P 500 from firms outside the ‘big seven’. According to data compiled by the Washington Service, “Corporate executives and officers have snapped up shares of their own firms in November, with the ratio of buyers to sellers set to touch a six-month high” reported Bloomberg.

With the death, at the grand old age of 99, of Charlie Munger this week, his many pearls of wisdom have been doing the rounds. He and Warren Buffet have certainly coined a few pithy phrases over the years. Spy has quoted them a few times himself. What is Spy’s favourite? “It is remarkable how much long-term advantage people like us have gotten by trying to be consistently not stupid, instead of trying to be very intelligent.” Spy has seen, over the years, far too many people in asset and wealth management who truly believe they are brilliant and have exceptional intelligence. All too many have “blown up” sooner or later. Don’t Be Stupid. It might just pay to type it out and stick it above one’s desk.

The rush to the end of the year does not seem to be dampening the enthusiasm of asset manager outdoor advertising campaigns.

Spy’s trusty photographers have been out and about spotting new creatives. First up is Schroders. The British manager is pushing a rather juicy Global Credit Income strategy. At 6.%, the yield seems rather appealing.

Fidelity International is pushing a thematic: Biodiversity. The American firm is promoting the idea that ‘nature positive’ will be the new ‘net zero’, as climate change increasingly becomes a subset of how the firm perceives risks to biodiversity and natural capital.

Until next week…