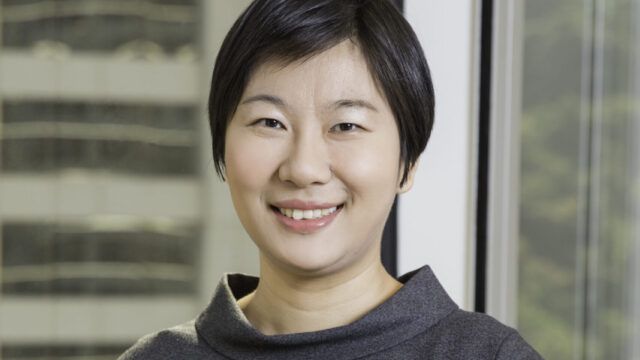

The managing director will lead the asset manager’s new wholly foreign owned enterprise.

The managing director will lead the asset manager’s new wholly foreign owned enterprise.

Significantly divergent monetary policies could give them an edge over western economies.

The region will outperform in the second half of 2022 amid a general reopening of economies – and fuelled by China’s growth and stock market, predicts DWS.

Recent pro-market, pro-growth messages should stem fears and give investors reason to view China favourably longer term, says Fidelity International.

Chinese stock carnage; Cheap in Russia; When is defence an ESG play? Kangaroo market; Inflation bonanza; Reasons to sell; Russian company exits; Advertising from Janus Henderson; and much more.

The pilot programme for retiree products is expanded to other cities.

But the asset manager warns about risks including data disclosure among Chinese companies.

Surging inflation and China’s property crisis led to a tumultuous year for fixed income markets.

In this benign environment Fidelity backs China equities and bonds.

Regulatory changes have made it a ‘much more interesting market for people that want to deploy resources’.

Part of the Mark Allen Group.