Schroders Singapore has partnered with UOB to launch the Schroder ISF Sustainable Asian Equity Fund to Singapore investors.

The product invests in companies in Asia Pacific, excluding Japan, and incorporates ESG considerations throughout the investment process, according to the asset manager, in a statement.

The Luxembourg-domiciled fund implements a bottom-up approach to identify investment opportunities in three areas, namely: sustainable companies, sustainable living companies, and sustainable transition companies.

“Sustainable investments in the region have been gaining pace as investors are increasingly concerned about the environmental and social impact of their investments, in addition to achieving financial returns,” said Jacquelyn Tan, head of group personal financial Services, UOB.

“The launch of the Schroder ISF Sustainable Asian Equity Fund further broadens our sustainable investment portfolio to meet the rising demand for sustainable investing, giving our customers the choice of different asset classes that suit their financial goals and risk appetite.”

The fund has three share classes in Singapore, which investors can buy using cash, their supplementary retirement scheme, or central provident fund savings.

Managed by Jay Luong and Manish Bhatia, the $119.64m fund has a management fee of 1.25% per annum.

The top three holding sectors are information technology (27.22%), financials (17.08%), and communication services (8.68%), according to the fund factsheet.

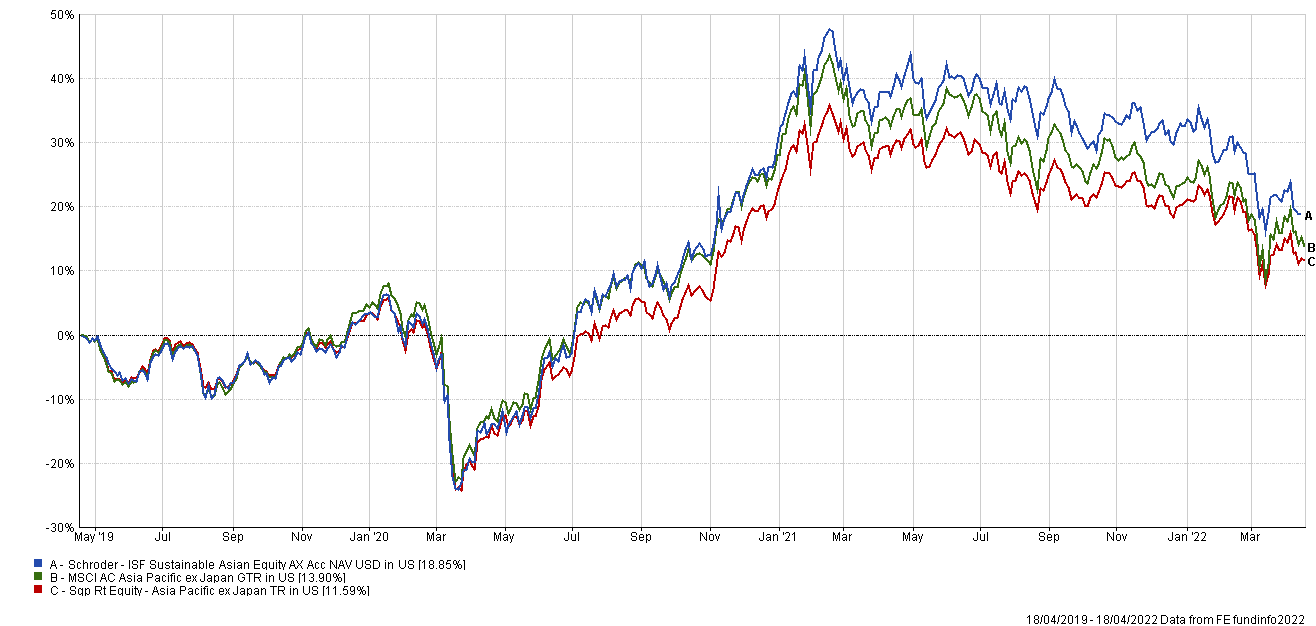

The fund posted a cumulative return of 18.85% over the last three years, compared with the Asia Pacific ex Japan sector return of 11.59% and the MSCI AC Asia Pacific ex Japan index average of 13.9%, according to FE fundinfo.

Schroder ISF Sustainable Asian Equity Fund vs sector average vs benchmark average

SchrodersLearn platform

Together with the launch of the sustainable fund, the asset manager also introduced the SchrodersLearn platform with UOB as the inaugural partner.

The platform will provide a series of investing “masterclasses” to the bank’s relationship managers covering a wide range of ESG-related topics.

First announced in October 2020, the platform is a part of Schroders’ ESG education hub, which gives training to its employees, clients, and partners to upskill their sustainability investing capabilities.

As at 31 December 2021, Schroders has AUM of $990.9bn, with offices across 37 locations.