Despite having the “best” long-term story within emerging markets (EM), Indian equity market valuations are “getting out of hand” after a blistering rally over the past few years.

This is according to Robeco’s Wim-Hein Pals, lead portfolio manager of the firm’s flagship $1.1bn Emerging Markets Equity fund.

As of the end of last month, the MSCI India index traded at a price-to-earnings (P/E) ratio of over 27x, almost double that of the wider MSCI Emerging Markets index.

In Pal’s view, this is a clear indication that India’s equity market valuations have become “outrageous”.

“India deserves to trade at a premium, but this is a bit out of hand. It is driven by all the domestic flows,” he told FSA in a recent interview.

Despite a richly valued equity market, Indian retail investors have been flocking to their local stock market on the back of strong performance.

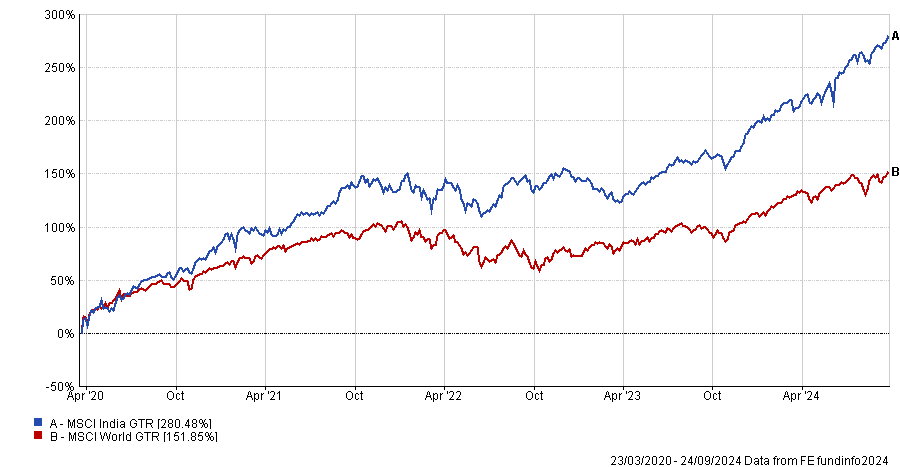

The MSCI India index is up 280.5% versus 151.9% from the MSCI World index since the global pandemic bottom in 2020.

Amid this rally however, Robeco’s EM strategy has been selling down its Indian equity exposure due to the rising frothiness in the market, Pals revealed.

“That’s a tactical move, given the valuations and given the short-term challenges on the macro front,” he said. “The country faces a fiscal deficit and there is a current account deficit, so there’s a constant pressure on the rupee.”

“Valuations are outrageous and earnings are not shooting the lights out,” he added. “There is some good earnings execution, but there’re also companies that are very disappointing.”

Longer term however, he thinks India might be the best emerging market story because of its favourable demographics and strong management teams with a focus on return on equity as opposed to acquiring market share at any cost.

Pals also emphasised the importance of using a top-down approach when equity investing in India and indeed in any emerging market region, because even if you’re right with a particular company, “if you’re wrong with the currency, you’re toast”.

Indeed, EM currencies have been particularly volatile in recent years. For example, Turkey and Indonesia, have experienced two wildly different outcomes. The Turkish lira has continued to depreciate massively due to runaway inflation, whereas the Indonesian rupiah has been fairly resilient in recent months.

No longer massively underweight China

Despite widespread bearishness from foreign investors towards China, Pals said his strategy started to increase its China allocation late last year.

He said he has shifted from “a huge underweight” in 2023 to now only slightly underweight Chinese equities relative to the wider MSCI EM index.

He said the fund took advantage of low valuations late last year to buy certain stocks in the consumer space, and the internet platforms.

“Some of them went to single digit P/Es, coming from 30 to 40 times earnings,” he said. “Some of them were trading at eight times earnings, which is remarkable from a value angle.”

“We’ve been sitting on our hands since Q1, but we’ve made a bit of money on the stock selection.”

Chinese e-commerce firm Alibaba Group is in the fund’s top-10, although at a smaller weight than the MSCI EM index. Unlike the benchmark, Tencent or Meituan do not feature in its top-10.

Commenting on the fate of internet platforms in China, Pals said: “Some of them we don’t think have a future, and will continue to burn money, and continue to lose market share.”

That being said, he believes the business for e-commerce platforms is still growing as a group, “but you need to be in the right platform to benefit”.

Despite recent Chinese stimulus measures inspiring hope for its local equity markets, Pals said evidence of improving consumer health is needed for him to go overweight the country.

“What is needed for us to go overweight is a convincing uptick in consumer spending,” he said. “But for now, the consumer is also sitting on their hands.”

Maximum overweight Korea

One country the fund manager is decidedly bullish on is South Korea, where the fund runs a maximum overweight, as set by its risk parameters, of close to 5%.

“Korea is one of the crowded underweights among EM investors,” he said. “We are maximum overweight due to some very strong companies that are listed in Seoul, but also due to their corporate value.”

“We are structural holders of Korea because of the Korea discount. Corporate governance has improved dramatically, and we think in a couple of years’ time, that the Korea discount will have disappeared.”

He also said that he expects to see significant earnings growth in certain sectors within the Korean economy, particularly in the IT sector, some consumer names, as well as the automobile sector.

More broadly, he is upbeat on the emerging markets as a whole, but particularly in Asia.

“In EM, earnings are going to grow 20% this year – which is double the earnings growth in the MSCI world,” he said. “That’s a key difference between this year and the prior.”

“EM has always been cheap, so the valuation has always been a positive factor, but earnings have been the challenge, and this year is the first year of many more to come that earnings are finally coming to fruition in the EM in general, and in Asia in particular.”