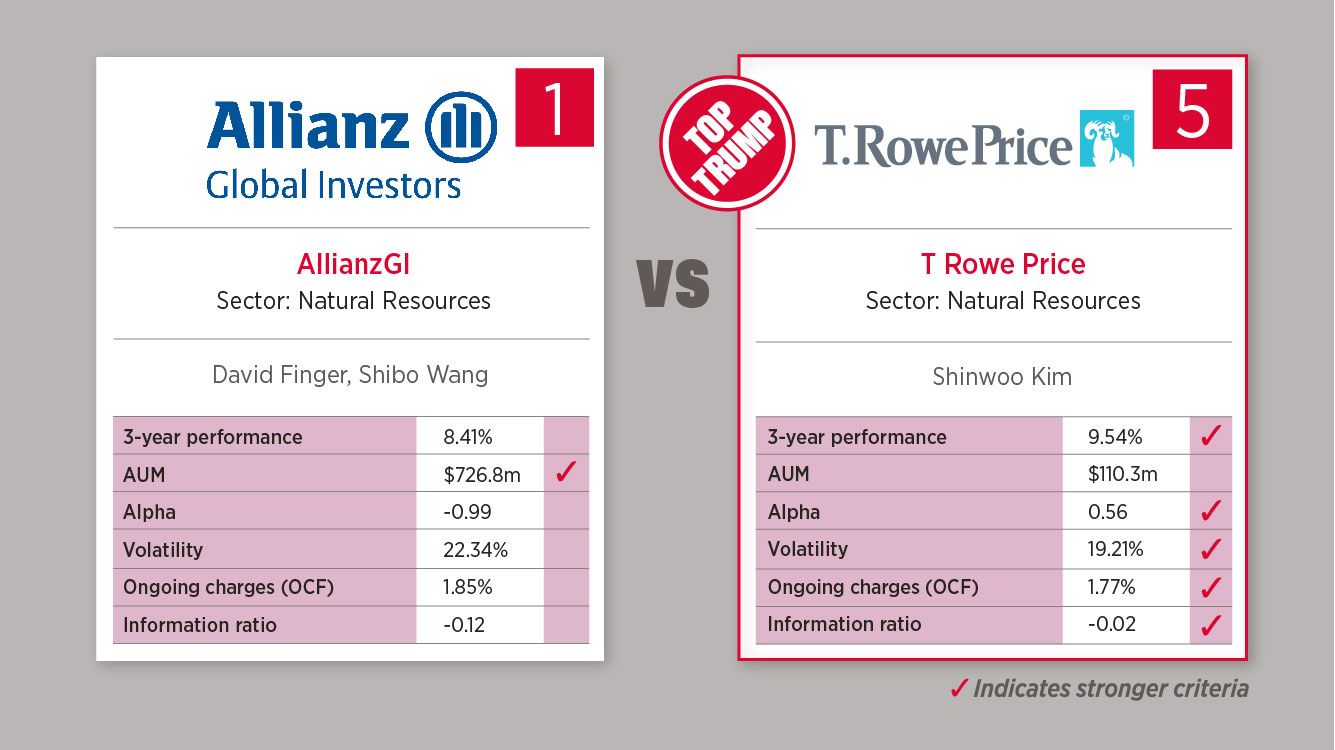

Based on the popular 80s card game, each week we select an asset class and use FE Fundinfo data to compare two funds based on their three-year performance, assets under management, alpha, volatility, ongoing charges and information ratio to decide who is the Top Trump.

This week, the Allianz Global Metals and Mining fund and the T Rowe Price Global Natural Resources Equity fund 5-1.

Allianz Global Metals and Mining fund

The fund invests in global equity markets, primarily in the natural resource segment. Its

investment objective is to attain capital growth over the long term.

Top 10 Holdings:

- Rio Tinto (5.17%)

- Fortescue Metals Group (5.09%)

- Anglo American (4.81%)

- Teck Resources (4.55%)

- Nippon Steel Corp (4.54%)

- Newmont Corp (4.37%)

- Nucor Corp (4.34%)

- Norsk Hydro (4.17%)

- BHP Group (3.84%)

- Rio Tinto (3.75%)

T Rowe Price Global Natural Resources Equity fund

The fund invests mainly in a widely diversified portfolio of shares of natural resources or commodities-related companies. The companies may be anywhere in the world, including emerging markets.

Top 10 Holdings:

- TotalEnergies (4.1%)

- ConocoPhillips (4.1%)

- ExxonMobil (3.7%)

- Shell (3.3%)

- Hess (3.2%)

- Cameco (3%)

- BP (2.9%)

- Schlumberger (2.8%)

- Diamondback Energy (2.6%)

- Chevron (2.4%)